.gif)

|

Signature Sponsor

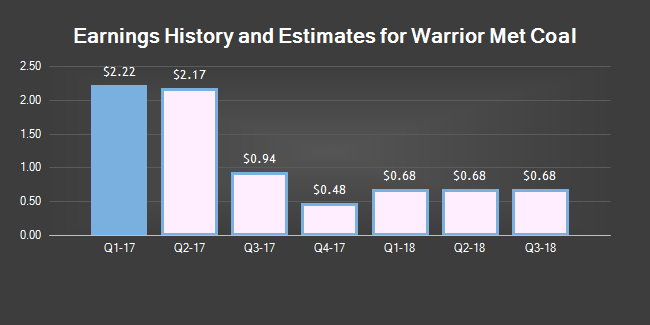

July 5, 2017 - Equities research analysts at FBR & Co reduced their Q4 2017 earnings estimates for Warrior Met Coal (NYSE:HCC) in a research note issued last Friday. FBR & Co analyst L. Pipes now expects that the company will earn $0.67 per share for the quarter, down from their previous estimate of $0.84. FBR & Co currently has a “Mkt Perform” rating and a $22.00 price target on the stock.

Warrior Met Coal last announced its quarterly earnings results on Thursday, May 18th. The company reported $2.22 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.98 by $0.24. Warrior Met Coal had a return on equity of 61.16% and a net margin of 42.65%. The business had revenue of $253.96 million during the quarter, compared to the consensus estimate of $363.34 million.

A number of other research analysts also recently issued reports on HCC. Citigroup Inc began coverage on Warrior Met Coal in a research note on Monday, May 15th. They issued a “neutral” rating and a $20.00 price objective for the company. Royal Bank of Canada began coverage on Warrior Met Coal in a research note on Monday, May 15th. They issued an “outperform” rating and a $25.00 price objective for the company. Morgan Stanley began coverage on Warrior Met Coal in a research note on Monday, May 15th. They issued an “overweight” rating and a $27.00 price objective for the company. Credit Suisse Group AG initiated coverage on Warrior Met Coal in a research note on Monday, May 8th. They issued an “outperform” rating and a $26.00 price objective for the company. Finally, Seaport Global Securities initiated coverage on Warrior Met Coal in a research report on Wednesday, May 10th. They set a “buy” rating and a $21.00 price target on the stock. One analyst has rated the stock with a hold rating and six have given a buy rating to the stock. The stock has an average rating of “Buy” and a consensus price target of $24.75.

Shares of Warrior Met Coal (NYSE:HCC) opened at 17.21 on Monday. The firm’s 50-day moving average price is $17.75 and its 200 day moving average price is $17.75. The firm has a market cap of $920.05 million and a P/E ratio of 7.64. Warrior Met Coal has a one year low of $16.63 and a one year high of $19.08.

The company also recently declared a special dividend, which will be paid on Tuesday, June 13th. Stockholders of record on Tuesday, May 30th will be given a dividend of $0.05 per share. The ex-dividend date is Thursday, May 25th.

In other news, Director Franklin Mutual Advisers Llc sold 2,718,359 shares of the company’s stock in a transaction on Thursday, April 13th. The stock was sold at an average price of $17.81, for a total transaction of $48,413,973.79. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Also, Director Alan H. Schumacher purchased 3,000 shares of the company’s stock in a transaction dated Wednesday, May 24th. The shares were purchased at an average cost of $17.99 per share, for a total transaction of $53,970.00. Following the transaction, the director now directly owns 3,000 shares in the company, valued at $53,970. The disclosure for this purchase can be found here.

Warrior Met Coal, Inc, formerly Warrior Met Coal, LLC, is a producer and exporter of metallurgical coal for the steel industry from underground mines located in Brookwood, Alabama, southwest of Birmingham and near Tuscaloosa. These underground coalmines are 1,400 to 2,100 feet underground. Its operations serve markets in the United States, Europe, Asia and South America via barge and rail access to the Port of Mobile.

|

|