Two Charts That Show China's Importance to the Global Coal Industry

By David Scutt

July 14, 2017 - China remains a global force when it comes to coal consumption, burning more than all other countries combined over the past five years.

Just have a look at this chart from the National Australia Bank (NAB) showing the rapid increase in consumption levels since the year 2000, assisting China's rise to becoming a global industrial superpower.

.jpg)

While China still burns more coal than all other nations combined, it's consumption levels have started to drift lower in recent years, coinciding with renewed efforts from policymakers to improve air quality, along with increased use of renewable energy such as wind and solar.

It's that trend that has caught the attention of Gerard Burg, senior Asia economist at the NAB, who suggests that whatever declines faster in the period ahead -- consumption or production -- will have a lasting impact on seaborne coal markets.

"The decline of both Chinese domestic consumption and production could have a significant and uncertain impact on global coal markets, depending on which falls faster," he says.

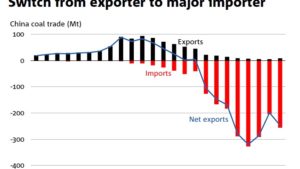

"In the past fifteen years, China has gone from being a major coal exporter to a major importer, fundamentally altering global markets."

He points out a remarkable statistic to underline this point, noting that while imports accounted for just 7% of Chinese coal consumption in 2016, they accounted for almost 19% of global trade.

Nearly a fifth of the total traded market, fueled in part by a reduction in Chinese production from close to 4 billion tonnes to 3.4 billion tonnes in 2016.

This chart shows China's shift from being a net coal exporter to importer over the past two decades.

Given its share of global traded demand, whatever happens next will impact seaborne markets and prices, says Burg.

"China’s outsized impact on global coal trade means considerable uncertainty for commodity markets as relatively small changes in the domestic mix could have large scale impact on seaborne demand and prices," he says.

As the world's largest coal exporter, any shifts would clearly impact Australia.

The Chinese government is aiming to reduce coal power generation to 58% of the nation's energy mix by the year 2020, down from 62% in 2016.

However, the government is forecasting that total energy consumption could rise by around 3% a year over that period, something that Berg says would lead to a modest increase in absolute coal use.