Corsa Coal Provides Interim Update and Announces Second Quarter 2017 Reporting Date

July 19, 2017 - Corsa Coal Corp. (TSXV: CSO) has announced that it will issue its second quarter earnings release after the market close on Wednesday, August 16th.

Update on Second Quarter 2017 Sales Metrics

Metallurgical Coal Sales and Production Volume

Sales Volume

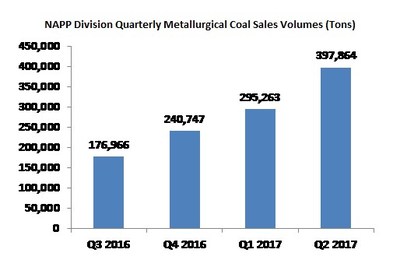

Corsa's metallurgical coal sales in second quarter 2017 were 397,864 tons, an increase of 35% from first quarter 2017 levels. This marks the fifth consecutive quarter of at least 20% sequential quarterly sales volume growth for Corsa. Year to date metallurgical coal sales volumes through June are up 180% from first half 2016 levels. A twelve month history of Corsa's metallurgical coal sales volumes is presented below.

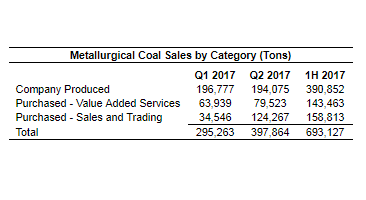

Corsa's metallurgical coal sales figure is comprised of three types of sales: (1) Selling coal that Corsa produces ("Company Produced"); (2) Selling coal that Corsa purchases and provides value added services (storing, washing, blending, loading) to make the coal saleable ("Valued Added Services"); and (3) Selling coal that Corsa purchases on a clean or finished basis from suppliers outside the Northern Appalachia region ("Sales and Trading"). In the first half of 2017, Corsa's sales were broken down into the following categories.

Over the second half of 2017, Corsa expects its Company Produced metallurgical tons to increase as compared to first half 2017 levels, as production from the Acosta mine and a surface mine ramps up. Additional metallurgical coal production is expected to come from Corsa's Cooper Ridge mine which is a part of the CAPP Division.

Update on the Acosta Mine

The Acosta mine successfully commenced production in early June, consistent with previous guidance. Early indications are positive from a geologic, equipment, and hiring standpoint. Production from Acosta will increase over the second half of 2017, as additional shifts are added and a second mining unit is added in the fall.

Metallurgical Coal Pricing

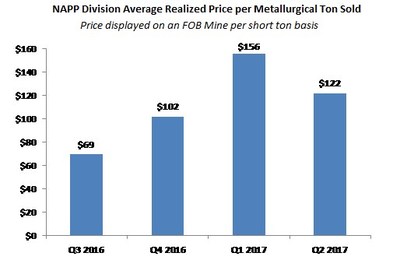

Corsa expects its second quarter 2017 average realized metallurgical coal price to be $122, on an FOB mine per short ton basis, which is the approximate equivalent of $167.00 to $170.00 on an FOBT delivered basis per metric ton (1). A twelve month history of Corsa's average realized metallurgical coal price is displayed below.

(1) Similar to most United States-based producers, Corsa reports sales and costs per ton on an FOB mine basis and denominated in short tons. Many international producers report prices and costs on a delivered-to-the port basis, thereby including freight costs between the mine and the port. Additionally, Corsa reports sales and costs per short ton, which is approximately 10% lower than a metric ton. For the purposes of this figure, we have used an illustrative freight rate of $30.00-$33.00 per short ton. Historically, freight rates rise and fall as market prices rise and fall. As a note, most published indices for metallurgical coal report prices on a delivered-to-the-port basis and denominated in metric tons.

Pricing Commentary

Metallurgical coal prices declined from record levels in April after the Australian export terminals returned to service after the impact of Cyclone Debbie. In July, prices reversed course and have risen by approximately 20%, as Chinese metallurgical coal miners have announced intentions to reduce output in response to seaborne prices breaching the $140/mt FOBT price level. We view this move as a reflection of the cost curve for producing metallurgical coal in China and as a significant marker for estimating a long range metallurgical coal price. Additional supply interruptions in Australia and the United States have occurred in July which pushed spot prices higher. These moves in aggregate continue to suggest that the global supply chain for metallurgical coal remains fragile and prone to disruption. On the demand side, the steel industry is enjoying profitable prices globally and production growth has been robust in the first half of 2017, with global crude steel production up 4.7% YTD through May. Multiple catalysts for continued strong steel pricing and production levels exist in the second half of 2017, including a strong economic outlook, the potential for increased infrastructure spending in the United States and China, the potential for steel import tariffs in the United States, and the potential for higher blast furnace utilization rates in the United States.

Committed and Priced Tonnage

As of today, 79% of Corsa's 2017 estimated metallurgical coal sales tons are committed and 63% of Corsa's 2017 estimated metallurgical coal sales tons are priced, as measured against the midpoint of 2017 full year metallurgical coal sales guidance (1.4 million tons).

NAPP Division Quarterly Metallurgical Coal Sales Volumes (Tons) (CNW Group/Corsa Coal Corp.)

NAPP Division Average Realized Price per Metallurgical Ton Sold (CNW Group/Corsa Coal Corp.)