Comparing Arch Coal, Inc. Class A & Peabody Energy Corporation

August 7, 2017 - Arch Coal, Inc. Class A (NASDAQ: ARCH) and Peabody Energy Corporation (NYSE:BTU) are both oils/energy companies, but which is the better investment? We will contrast the two businesses based on the strength of their valuation, profitabiliy, risk, analyst recommendations, institutional ownership, dividends and earnings.

Analyst Recommendations

This is a breakdown of recent ratings and recommmendations for Arch Coal, Inc. Class A and Peabody Energy Corporation, as provided by MarketBeat.

Arch Coal, Inc. Class A presently has a consensus target price of $94.20, indicating a potential upside of 24.59%. Peabody Energy Corporation has a consensus target price of $35.57, indicating a potential upside of 26.05%. Given Peabody Energy Corporation’s higher probable upside, analysts plainly believe Peabody Energy Corporation is more favorable than Arch Coal, Inc. Class A.

Institutional and Insider Ownership

0.1% of Peabody Energy Corporation shares are owned by institutional investors. 1.3% of Peabody Energy Corporation shares are owned by insiders. Strong institutional ownership is an indication that endowments, large money managers and hedge funds believe a company is poised for long-term growth.

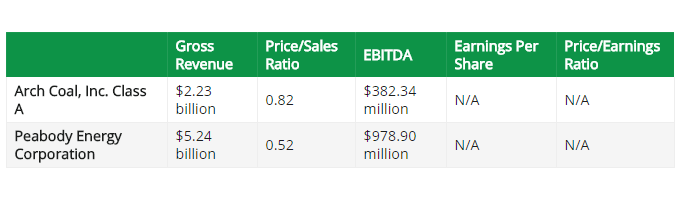

Valuation and Earnings

This table compares Arch Coal, Inc. Class A and Peabody Energy Corporation’s revenue, earnings per share (EPS) and valuation.

Peabody Energy Corporation has higher revenue and earnings than Arch Coal, Inc. Class A.

Profitability

This table compares Arch Coal, Inc. Class A and Peabody Energy Corporation’s net margins, return on equity and return on assets.

Summary

Peabody Energy Corporation beats Arch Coal, Inc. Class A on 5 of the 8 factors compared between the two stocks.

Arch Coal, Inc. Class A Company Profile

Arch Coal, Inc. is a coal producer. The Company is engaged in the production of thermal and metallurgical coal from surface and underground mines located throughout the United States, for sale to utility, industrial and steel producers both in the United States and around the world. The Company operates mining complexes in West Virginia, Kentucky, Maryland, Virginia, Illinois, Wyoming and Colorado. The Company’s segments include the Powder River Basin and Appalachia. The Powder River Basin segment includes operations in Wyoming. The Appalachia segment includes operations in West Virginia, Kentucky, Maryland and Virginia. The Company also sells coal from operations in Colorado and Illinois. Powder River Basin consists of Black Thunder and Coal Creek mines. The Company’s mines in Appalachia include Coal-Mac, Lone Mountain, Mountain Laurel, Beckley, Vindex, Sentinel and Leer. The Company operates, or contracts out the operation of approximately 10 active mines in the United States.

Peabody Energy Corporation Company Profile

Peabody Energy Corporation logoPeabody Energy Corporation is a coal company. The Company’s segments include Powder River Basin Mining, Midwestern U.S. Mining, Western U.S. Mining, Australian Metallurgical Mining, Australian Thermal Mining, Trading and Brokerage, and Corporate and Other. Its Powder River Basin Mining operations consist of its mines in Wyoming. Midwestern U.S. Mining operations reflect the Company’s Illinois and Indiana mining operations. Western U.S. Mining operations reflect the aggregation of the New Mexico, Arizona and Colorado mining operations. Australian Metallurgical Mining operations consist of mines in Queensland and New South Wales, Australia. Australian Thermal Mining operations consist of mines in New South Wales, Australia. Its Trading and Brokerage segment engages in the direct and brokered trading of coal and freight-related contracts through the trading and business offices. Its Corporate and Other includes selling and administrative expenses, and corporate hedging activities.