Illinois Basin Coal Production Rises 6.6% on Boost in Demand

By Taylor Kuykendall and Maham Furqan

August 13, 2017 - Top Illinois Basin coal producers have been increasing their production of coal for the past 12 months versus the year-ago period, though production slowed in the second quarter.

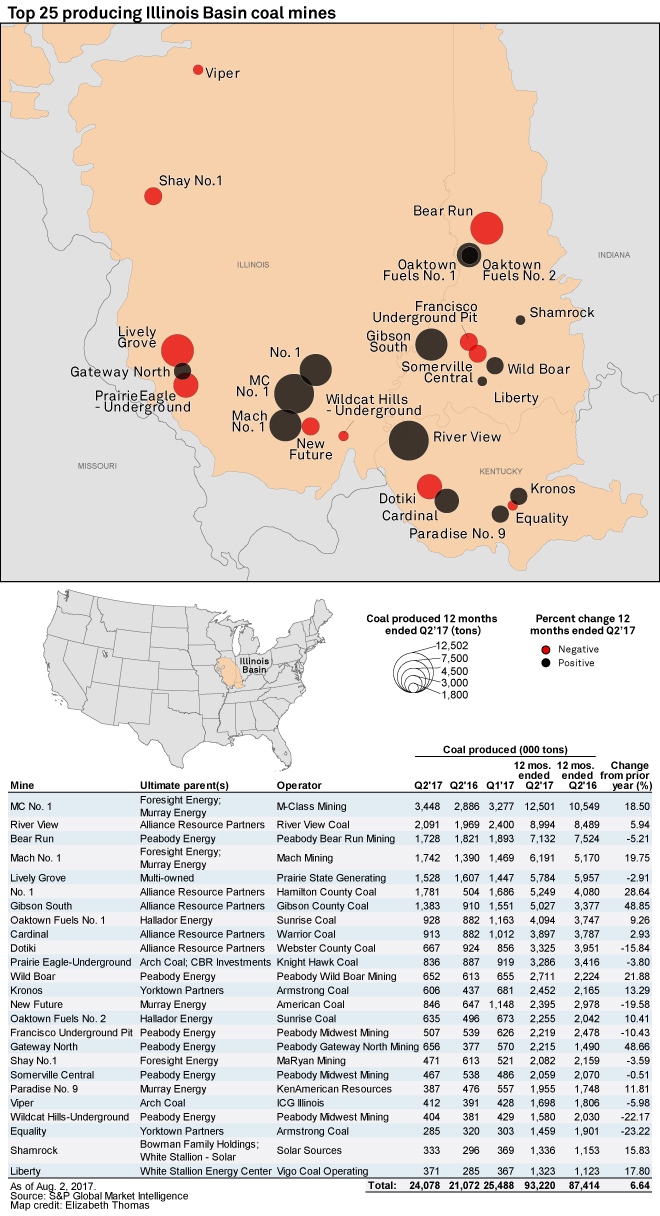

The 25 highest-producing coal mines in the region produced about 6.6% more coal in the yearlong period that ended in the second quarter of 2017. Production at those mines totaled 93.2 million tons in that period, up from 87.4 million tons in the comparable period.

Quarter to quarter, production declined from 25.5 million tons in the first quarter to about 24.1 million tons in the second quarter.

"The market is much healthier than it was a year ago," Hallador Energy Co. CEO and President Brent Bilsland said on an Aug. 9 earnings call. "There's — I'm not going to say there's a shortage, but the market is much stronger from a gas perspective, from an export perspective. The U.S. dollar has continued to fall and that continues to help improve the export market."

Hallador's Oaktown Fuels No. 1 and Oaktown Fuels No. 2 mines in the Illinois Basin both increased production over the recent 12-month period, by 9.3% and 10.4%, respectively.

The top-producing mine in the region, MC No. 1 owned by Foresight Energy LP and Murray Energy Corp., increased its production over the yearlong period by 18.5% to 12.5 million tons. Another Murray and Foresight operation, Mach No. 1, grew production by 19.8%. The Shay No. 1 mine reported a production decrease of 3.6%. Foresight is expected to report its earnings results Aug. 11.

Murray Energy's New Future mine cut production by 19.6% in the 12-month period while production at the company's Paradise No. 9 mine increased 11.8%.

Alliance Resource Partners LP, a top producer in the region with five of the top 25 Illinois Basin mines by production, boosted production at its River View, Gibson South, No. 1 and Cardinal mines. Alliance decreased production at its Dotiki mine by about 15.8% in the 12-month period that ended in the second quarter.

Alliance President and CEO Joe Craft said on a July 31 earnings call that Alliance plans to boost tonnage, at least in part by taking some business from contracts that are expiring at the end of 2017.

"I believe that the customers will be out in force in the next quarter and in the fourth quarter to fill substantially a lot of their open position," Craft said. "I believe the low-cost producer's going to be able to secure tonnage. I would hope that we could actually increase volume next year. ... We think there are some higher-cost producers that have supply in the market today on the basis of higher price legacy contracts."

Peabody Energy Corp. has six of the top 25 producing mines in the Illinois Basin, though they are mostly smaller by tonnage than Alliance's operations. Peabody's largest operation, the Bear Run mine, decreased coal production by 5.2% in the most recent 12-month period.