Analyzing Alliance Resource Partners, L.P. and Alliance Holdings GP, L.P.

September 4, 2017 - Alliance Resource Partners, L.P. (NASDAQ: ARLP) and Alliance Holdings GP, L.P. (NASDAQ:AHGP) are both oils/energy companies, but which is the better business? We will contrast the two companies based on the strength of their analyst recommendations, earnings, risk, valuation, profitability, institutional ownership and dividends.

Risk and Volatility

Alliance Resource Partners, L.P. has a beta of 0.69, suggesting that its share price is 31% less volatile than the S&P 500. Comparatively, Alliance Holdings GP, L.P. has a beta of 0.53, suggesting that its share price is 47% less volatile than the S&P 500.

Earnings & Valuation

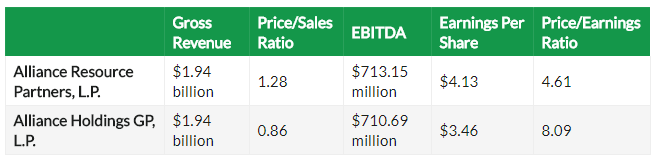

This table compares Alliance Resource Partners, L.P. and Alliance Holdings GP, L.P.’s revenue, earnings per share and valuation.

Alliance Resource Partners, L.P. is trading at a lower price-to-earnings ratio than Alliance Holdings GP, L.P., indicating that it is currently the more affordable of the two stocks.

Insider and Institutional Ownership

16.1% of Alliance Resource Partners, L.P. shares are owned by institutional investors. Comparatively, 21.4% of Alliance Holdings GP, L.P. shares are owned by institutional investors. 44.0% of Alliance Resource Partners, L.P. shares are owned by company insiders. Strong institutional ownership is an indication that large money managers, hedge funds and endowments believe a stock will outperform the market over the long term.

Analyst Ratings

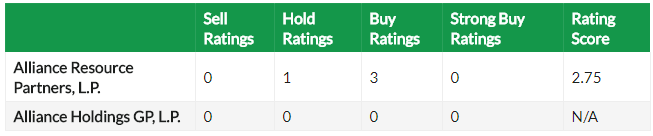

This is a summary of recent recommendations and price targets for Alliance Resource Partners, L.P. and Alliance Holdings GP, L.P., as reported by MarketBeat.com.

Alliance Resource Partners, L.P. currently has a consensus price target of $27.75, indicating a potential upside of 45.67%. Given Alliance Resource Partners, L.P.’s higher possible upside, equities research analysts plainly believe Alliance Resource Partners, L.P. is more favorable than Alliance Holdings GP, L.P..

Dividends

Alliance Resource Partners, L.P. pays an annual dividend of $2.00 per share and has a dividend yield of 10.5%. Alliance Holdings GP, L.P. pays an annual dividend of $2.92 per share and has a dividend yield of 10.4%. Alliance Resource Partners, L.P. pays out 48.4% of its earnings in the form of a dividend. Alliance Holdings GP, L.P. pays out 84.4% of its earnings in the form of a dividend, suggesting it may not have sufficient earnings to cover its dividend payment in the future. Alliance Resource Partners, L.P. is clearly the better dividend stock, given its higher yield and lower payout ratio.

Profitability

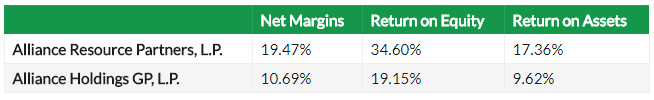

This table compares Alliance Resource Partners, L.P. and Alliance Holdings GP, L.P.’s net margins, return on equity and return on assets.

Summary

Alliance Resource Partners, L.P. beats Alliance Holdings GP, L.P. on 12 of the 14 factors compared between the two stocks.

Alliance Resource Partners, L.P. is a producer and marketer of coal primarily to the United States utilities and industrial users. The Company operates through segments, including Illinois Basin, Appalachia, and Other and Corporate. The Illinois Basin segment consists of various operating segments, including Webster County Coal, LLC’s Dotiki mining complex, Gibson County Coal, LLC’s mining complex, which includes the Gibson North mine and Gibson South mine, Hopkins County Coal, LLC’s mining complex, which includes the Elk Creek mine, the Pleasant View surface mineable reserves and the Fies property, White County Coal, LLC’s, Pattiki mining complex, Warrior Coal, LLC’s mining complex, Sebree Mining, LLC’s mining complex, which includes the Onton mine and River View Coal, LLC mining complex. The Appalachia segment consists of multiple operating segments, including the Mettiki mining complex, the Tunnel Ridge mining complex and the MC Mining mining complex.

Alliance Holdings GP, L.P. (AHGP) is a limited partnership company. The Company owns directly and indirectly the members’ interest in Alliance Resource Management GP, LLC (MGP), the managing general partner of Alliance Resource Partners, L.P. (ARLP). The Company’s segments include Illinois Basin, Appalachia, and Other and Corporate. The Illinois Basin segment consists of mining complexes, including Webster County Coal’s Dotiki mining complex; Gibson County Coal’s mining complex, which includes the Gibson North mine and Gibson South mine; Warrior’s mining complex; River View’s mining complex and the Hamilton mining complex. The Appalachia segment consists of various operating segments, including the Mettiki mining complex, the Tunnel Ridge mining complex and the MC Mining mining complex. The Mettiki mining complex includes Mettiki Coal (WV)’s Mountain View mine and Mettiki Coal’s preparation plant. Other and Corporate segment includes marketing and administrative activities.