Rhino Resource Partners LP Announces Third Quarter 2017 Financial and Operating Results

November 8, 2017 - Rhino Resource Partners LP (OTCQB:RHNO) announced today its financial and operating results for the quarter ended September 30, 2017. For the quarter, the Partnership reported net income of $1.7 million and Adjusted EBITDA of $7.9 million, compared to a net loss of $3.8 million and Adjusted EBITDA of $5.6 million in the third quarter of 2016. Diluted net loss per common unit was zero for the quarter compared to diluted net loss per common unit of $0.41 for the third quarter of 2016. Total revenues for the quarter were $58.3 million, with coal sales generating $56.5 million of the total, compared to total revenues of $43.4 million and coal revenues of $41.0 million in the third quarter of 2016. (Refer to “Reconciliations of Adjusted EBITDA” included later in this release for reconciliations to the most directly comparable GAAP financial measures).

The Partnership continued the suspension of the cash distribution for its common units for the current quarter. No distributions will be paid for common or subordinated units for the quarter ended September 30, 2017.

Rick Boone, President and Chief Executive Officer of Rhino’s general partner, stated, “We are pleased to see continuing improvement in our financial results for 2017. For the third quarter and year to date 2017, Rhino’s financial performance has significantly improved over the same periods of 2016. The continued market strength and focused cost containment at the operations helped achieve these results. Our Adjusted EBITDA in the third quarter of 2017 improved by $1.0 million compared to the second quarter. We expect the continuing market improvement and cost containment will provide us with full-year 2017 financial results that will be our best in several years.

We continue to execute contracts for 2018 and beyond for our thermal coal and we are close to finalizing our 2018 annual met coal business. To date, we have sold over 60% of our expected 2018 production. We are very encouraged that through our met coal sales negotiations, we have developed relationships with international customers that we believe will lead to long-term met coal business and potential multi-year sales agreements.

Our debt remains at historically low levels with $9.9 million outstanding on our facility at September 30, 2017 while we have invested over $14.0 million in capital during the first three quarters of 2017 to expand our met coal production capabilities in our Central Appalachia operations and maintain our fleet of mining equipment at the other operations. We look to increase our met coal production even further in 2018 as we have begun development of a new surface mine in our Central Appalachia segment that will begin production in the first quarter of 2018.

Providing a safe workplace for our employees is a primary focus for Rhino. We remain steadfast in our commitment to safety and training that will result in a safe environment for our employees. We have increased our workforce and production in 2017 while achieving safety results that are improved over the same period in 2016.

We have executed a letter of intent with a third party lender to complete a new three year credit facility that will replace our expiring debt facility. We have received a letter from the lender stating that they are highly confident the new credit facility will be consummated and we believe the new facility will be finalized in the next 30 to 45 days. The new credit facility coupled with our sponsor, Royal Energy Resources, Inc. (OTCQB:ROYE) (“Royal”), as well as our strong financial partner, Yorktown Partners LLC, will provide us with financial stability and a solid foundation as we look to grow and capitalize on the robust coal markets. Our strong balance sheet and disciplined business practices coupled with the improved coal markets provide a combination for long-term growth and the capability to be a significant competitor in the world-wide coal markets.

We have booked a significant portion of our steam coal sales for 2018 and we expect to get firm commitments for our 2018 met coal production in the next few weeks. At our Central Appalachia operations, we have contracted for all of our 2018 projected steam coal production and we expect our 2018 met coal production of 800,000 tons will be booked shortly. Pennyrile recently booked sales for 400,000 tons per year for 2018 through 2020 with a major utility customer and we believe current negotiations with other customers will lead to Pennyrile being fully contracted for 2018 and beyond. At Castle Valley, we have booked sales for 300,000 tons per year for 2018 through 2020 with a major utility and we have executed another sales agreement that has this operation fully contracted for next year. In Northern Appalachia, we have agreed to a sales agreement with a local utility for our Hopedale operation for 200,000 tons for 2018 along with an export order for 90,000 tons for the first quarter of 2018 and we believe additional sales for Hopedale can be secured to add to this tonnage for next year.

The strong financial results we have generated during the first three quarters of 2017 shows the potential of Rhino to bring value to our unitholders and we are confident that the remainder of 2017 and the upcoming 2018 year will be positive for Rhino, its employees and all of our business partners.”

Coal Operations Update

Pennyrile

Pennyrile long-term sales contracts have committed sales of 1.3 million tons for full-year 2017 and 550,000 tons for 2018.

Sales volume for the current quarter was 316,000 tons, versus 305,000 in the prior year and 357,000 in the prior quarter. For the third quarter, coal revenues per ton decreased to $47.37 compared to $47.97 in the prior year.

Cost of operations per ton was $41.40 versus $43.99 in the prior year and $40.85 in the prior quarter. The decrease was primarily due to fixed operating costs being allocated to higher production and sales during the current period.

Central Appalachia

Coal revenues were $27.9 million, versus $10.4 million in the prior year and $25.6 million in the prior quarter. The increase in revenue was primarily due to the increase in demand for met and steam coal tons sold from this region. Coal revenues per ton in the quarter was $73.02 versus $57.91 in the prior year and $66.42 in the prior quarter. Metallurgical coal revenue per ton in the quarter was $92.93 versus $63.95 in the prior year and $83.45 in the prior quarter. Steam coal revenue in the quarter was $51.82 per ton versus $52.07 in the prior year and $51.11 in the prior quarter. Sales volume was 382,000 tons in the quarter versus 180,000 in the prior year and 386,000 tons in the prior quarter.

Cost of operations per ton in the quarter was $54.73 versus $49.29 in the prior year and $53.05 in the prior quarter. The increase in cost per ton period-over-period was due to higher maintenance costs to upgrade the equipment fleet to meet the demand for additional met coal production. In addition, cost items related to selling price of coal increased due to the increase in realization.

Central Appalachia sales are fully contracted through 2017 at current production levels.

Rhino Western

Coal revenues were $9.1 million, versus $7.2 million in the prior year and $8.8 million in the prior quarter. Coal revenues per ton in the quarter were $37.53 versus $39.00 in the prior year and $38.31 in the prior quarter. Coal revenues per ton decreased by $1.47 or 3.8% compared to the prior year.

Sales volume was 242,000 tons versus 185,000 tons in the prior year and 229,000 tons in the prior quarter. The increase in coal sales in the third quarter of 2017 was the result of an increase in tons sold from our Castle Valley mine.

Cost of operations per ton was $27.48 versus $28.82 in the prior year and $29.13 in the prior quarter. The decrease in the cost of operations per ton was due to allocating the fixed costs of the operation over additional tons.

Northern Appalachia

Sales volume was 115,000 tons, versus 149,000 tons in the prior year and 75,000 tons in the prior quarter. Sales were lower in the current quarter compared to the same period in 2016 due to decreased sales volumes from our Sands Hills and Hopedale operations as demand decreased for coal from this region during the comparative periods.

For the third quarter, coal revenues per ton decreased $18.93 to $39.81 which was primarily due to the larger mix of lower priced tons being sold from our Sands Hill complex compared to higher priced tons sold from our Hopedale complex.

Cost of operations was $6.6 million versus $7.8 million in the prior year and $5.4 million in the prior quarter. The decrease in the third quarter versus the same period in 2016 was due to decreased sales in this region in response to weak market demand.

Capital Expenditures

- Maintenance capital expenditures for the third quarter were approximately $3.4 million.

- Expansion capital expenditures for the third quarter were approximately $0.3 million.

Sales Commitments

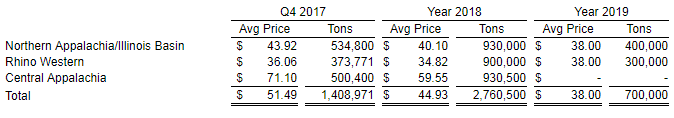

The table below displays Rhino’s committed coal sales for the periods indicated.

Evaluating Financial Results

Rhino management uses a variety of financial measurements to analyze the Partnership’s performance, including (1) Adjusted EBITDA, (2) coal revenues per ton and (3) cost of operations per ton.

Adjusted EBITDA. Adjusted EBITDA, a Non-GAAP measure, represents net income before deducting interest expense, income taxes and depreciation, depletion and amortization, while also excluding certain non-cash and/or non-recurring items. Adjusted EBITDA is used by management primarily as a measure of the operating performance of the Partnership’s segments. Adjusted EBITDA should not be considered an alternative to net income, income from operations, cash flows from operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP. Because not all companies calculate Adjusted EBITDA identically, the Partnership’s calculation may not be comparable to similarly titled measures of other companies. (Refer to “Reconciliations of Adjusted EBITDA” included later in this release for reconciliations of Adjusted EBITDA to the most directly comparable GAAP financial measures).

Coal Revenues Per Ton. Coal revenues per ton sold represents coal revenues divided by tons of coal sold. Coal revenues per ton is a key indicator of Rhino’s effectiveness in obtaining favorable prices for the Partnership’s product.

Cost of Operations Per Ton. Cost of operations per ton sold represents the cost of operations (exclusive of depreciation, depletion and amortization) divided by tons of coal sold. Rhino management uses this measurement as a key indicator of the efficiency of operations.

Overview of Financial Results

Results for the three months ended September 30, 2017 included:

- Adjusted EBITDA from continuing operations of $7.9 million and net income from continuing operations of $1.7 million compared to Adjusted EBITDA from continuing operations of $5.5 million and a net loss from continuing operations of $3.2 million in the third quarter of 2016. Adjusted EBITDA from continuing operations increased period to period due to an increase in net income during the three months ended September 30, 2017 compared to net loss generated for the three months ended September 30, 2016. Including net loss from discontinued operations of approximately $0.6 million, total net loss for the three months ended September 30, 2016 was $3.8 million while Adjusted EBITDA was $5.6 million. We did not incur a gain or loss from discontinued operations for the third quarter of 2017.

- Basic and diluted net income per common unit from continuing operations of $0.0 compared to basic and diluted net loss per common unit from continuing operations of $0.41 for the third quarter of 2016.

- Coal sales were 1.1 million tons, which was an increase of 28.8% compared to the third quarter of 2016, primarily due to increased sales from Central Appalachia operations.

- Total revenues and coal revenues of $58.3 million and $56.5 million, respectively, compared to $43.4 million and $41.0 million, respectively, for the same period of 2016.

- Coal revenues per ton of $53.58 compared to $50.09 for the third quarter of 2016, an increase of 7.0%.

- Cost of operations from continuing operations of $46.5 million compared to $35.2 million for the same period of 2016 as production was increased in the Central Appalachia region to meet the increased demand for met and steam coal during the third quarter of 2017.

- Cost of operations per ton from continuing operations of $44.08 compared to $43.07 for the third quarter of 2016, an increase of 2.4%.

Total coal revenues increased approximately 37.7% period-over-period primarily due to the increase in production in Central Appalachia resulting from increases in demand for met and steam coal from this region. Coal revenues per ton increased primarily due to a higher mix of met coal sold from Central Appalachia compared to the same period of 2016. Total cost of production increased by 31.8% during the third quarter of 2017 primarily due to an increase of $12.0 million in total cost of operations in Central Appalachia, which was also the result of increased production in Central Appalachia due to increased demand for met and steam coal from this region.

Results for the nine months ended September 30, 2017 included:

- Adjusted EBITDA from continuing operations of $19.6 million and net loss from continuing operations of $0.1 million compared to Adjusted EBITDA from continuing operations of $14.9 million and a net loss from continuing operations of $9.0 million in the first nine months of 2016. Adjusted EBITDA from continuing operations increased period to period due to lower net loss during the nine months ended September 30, 2017 compared to the same period in 2016. Including net loss from discontinued operations of approximately $117.9 million, total net loss for the nine months ended September 30, 2016 was $126.9 million while Adjusted EBITDA was $16.7 million. We did not incur a gain or loss from discontinued operations for the first nine months of 2017.

- Basic and diluted net loss per common unit from continuing operations of $0.29 compared to basic and diluted net loss per common unit from continuing operations of $1.45 for the first nine months of 2016.

- Coal sales were 3.1 million tons, which was an increase of 27.8% compared to the first nine months of 2016, primarily due to increased sales from Central Appalachia operations.

- Total revenues and coal revenues of $168.4 million and $163.0 million, respectively, compared to $124.4 million and $116.8 million, respectively, for the same period of 2016.

- Coal revenues per ton of $53.00 compared to $48.52 for the first nine months of 2016, an increase of 9.2%.

- Cost of operations from continuing operations of $138.1 million compared to $98.1 million for the same period of 2016 as production was increased in the Central Appalachia region to meet the increase demand for met and steam coal during the first nine months of 2017.

- Cost of operations per ton from continuing operations of $44.91 compared to $40.77 for the first nine months of 2016, an increase of 10.2%.

Total coal revenues increased approximately 39.5% period-over-period primarily due to the increase in production in Central Appalachia resulting from increases in demand for met and steam coal from this region. Coal revenues per ton increased primarily due to a higher mix of met coal sold from Central Appalachia compared to the same period of 2016. Total cost of production increased by 40.7% during the first nine months of 2017 primarily due to an increase of $37.9 million in total cost of operations in Central Appalachia. Total cost of operations and cost of operations per ton increased primarily due to higher mix of Central Appalachia tons which operate at a higher cost level. The cost of operations for the nine months ended September 30, 2016 was also impacted by a prior service cost benefit of $3.9 million resulting from the cancellation of the postretirement benefit plan at our Hopedale operation.

Segment Information

The Partnership produces and markets coal from surface and underground mines in Kentucky, West Virginia, Ohio and Utah. For the quarter ended September 30, 2017, the Partnership had four reportable business segments: Central Appalachia, Northern Appalachia, Rhino Western and Illinois Basin. Additionally, the Partnership has an Other category that includes its ancillary businesses.