Will 2018 Be Alliance Resource Partners, L.P.'s Best Year Yet?

By Reuben Gregg Brewer

January 20, 2018 - The units of coal miner Alliance Resource Partners, L.P. (NASDAQ:ARLP) fell 12% in 2017, which might make you believe it was a pretty bad year for the partnership. But the partnership actually made notable progress in many ways, including a return to distribution growth. While 2018 probably won't be Alliance Resource Partners' best year yet, here's what to watch to see if the coal miner can turn it into a solid one.

Coal Prices Rule the Day

At its core, Alliance is a commodity producer of thermal coal. It operates largely out of the Illinois Coal Basin, which has been gaining share from competing regions for years and is expected to perform relatively well in the future. But that doesn't change the fact that demand for thermal coal, which is used to make electricity, will be the driving force of the partnership's top- and bottom-line results. A big price move in either direction could turn the year into a great one or a horrible one.

That said, U.S. coal miners have been facing severe headwinds for years from low natural gas prices and a push toward cleaner fuels. That's led utilities, the most important customer for thermal coal producers, to build natural gas power plants and mothball older, less efficient coal plants. So demand for thermal coal is unlikely to return to previous peaks. In other words, don't look for a huge price spike. Alliance is going to have to execute on the basics in a tough market if it wants keep its business humming in 2018.

Managing Quite Well, Thank You

The basics, however, are things that Alliance has proven quite good at handling. For example, at the end of the third quarter the coal miner had roughly 23.1 million tons of coal under contract for 2018. It should sell around 38 million tons in 2017, so it looks like nearly two-thirds of its 2018 coal sales are already on the books. That's a good start, noting that the industry has shifted away from signing long-term contracts. Watch the fourth quarter numbers here for further improvement. The core goal will be to sell as much coal this year as Alliance sold last year, anything beyond that is a big win.

Meanwhile, keep an eye on expenses. Alliance has been able to reduce its mining costs by shifting production to its lowest cost properties. That allowed the miner to reduce operating expenses by 5.4% through the first three quarters of 2017. I don't expect a repeat here in 2018, because the easy gains are likely to have already been made. However, just holding the line on costs will be a solid outcome. Alliance will deserve some notable kudos if it manages to keep costs heading lower.

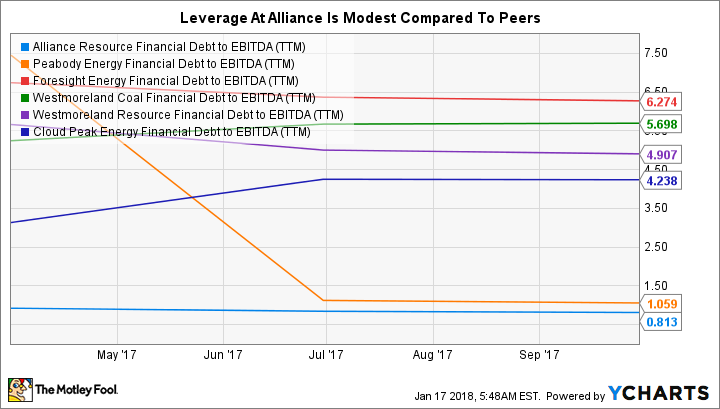

ARLP Financial Debt to EBITDA (TTM) Data by YCharts

Then there's the partnership's foundation, which is backed by a solid balance sheet. Long-term debt made up around 25% of the Alliance's capital structure at the end of the third quarter. That's a reasonable number for any company. Interest expense was roughly 6.5% of EBITDA. That's in stark contrast to competitors, which have needed a trip through bankruptcy court to shore up their finances. Watch Alliance's balance sheet to make sure it remains rock solid in 2018, which would be another notch it management's belt as far as I'm concerned.

The distribution will be another key indicator of success. Alliance's nearly 10% distribution yield is quite attractive -- until you note that it's a coal miner, which makes it look risky. But the partnership increased the distribution twice in 2017, and indicated that it would likely be increasing it again in the future. That's not what you'd expect from a struggling company. Every distribution increase should be seen as a statement of continued success, with management suggesting investors can expect regular quarterly hikes in 2018.

Not the Best Year, but Possibly Pretty Good

So 2018 isn't likely to be the best year yet for coal miner Alliance Resource Partners unless there's a massive thermal coal rally. I don't expect that, but that doesn't mean it will be a bad year. In fact, Alliance has been performing very well despite all of the headwinds it has been facing. Assuming it can continue to execute as well in the future, 2018 could still be a pretty good year. To figure out how the year is going, watch the miner's coal sales, cost containment efforts, balance sheet, and distribution trends.