Is Alliance Resource Partners LP a Buy?

By Maxx Chatsko

March 4, 2018 - It's not exactly a secret by now: The United States continues to rely less and less on coal for electricity production. Several factors, from stricter environmental regulations to cheap and abundant natural gas, have accelerated coal's decline. One number alone paints a pretty bleak picture of the future of this fossil fuel: American coal production declined 38% from 2008 to 2016.

But a funny thing happened in 2017: Coal production rose. In fact, the U.S. posted its largest year-over-year tonnage increase in coal production since 2001. What happened? While domestic consumption continued to slide, an export boom helped to lift production and prices -- a trend that could retain its momentum in the year ahead.

That could bode well for Alliance Resource Partners LP (NASDAQ:ARLP), which is a comfortably profitable coal miner boasting a dividend yield of nearly 11%. Does a resurgent American coal industry make the stock buy?

By the Numbers

The gloom and doom surrounding most discussions about coal may make you think that mining it is a money-losing waste of time. Not so for Alliance Resource Partners LP. The company boasts eye-popping margins and churns out a healthy level of distributable cash flow.

Following the trend in the domestic industry as a whole, the company has increased its focus on exports for both thermal coal (used to generate electricity) and metallurgical coal (used to manufacture iron and steel). In 2017, Alliance Resource Partners LP exported record volumes of product.

he business actually had a pretty solid year all around. Year-over-year production and sales volumes increased 6.7% and 4.7%, respectively. Debt levels decreased for the second consecutive year, and the amount of cash distributed to shareholders climbed higher.

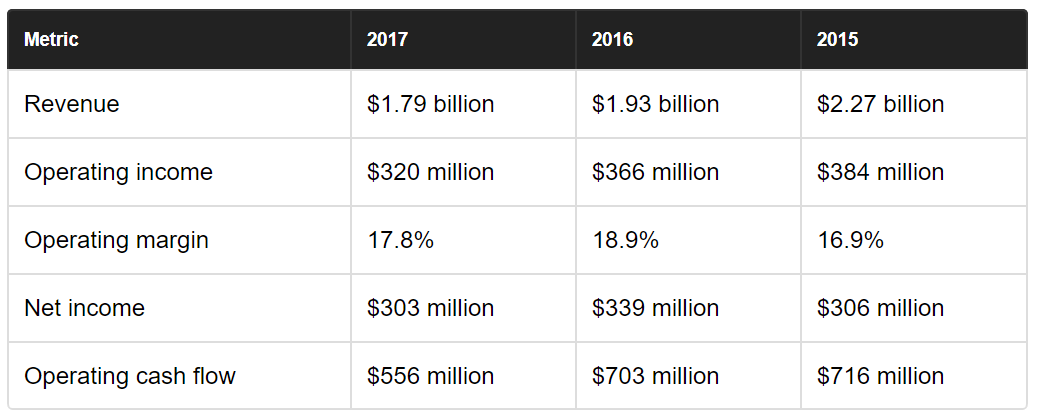

While there's no denying that Alliance Resource Partners LP has a healthy business in terms of profit and cash flow, it's also true that the business is dying, rather than growing or even plateauing. A quick glance at financial performance from the last three years clearly demonstrates that:

Data Source: Google Finance

As investors can see, looks are deceiving. The same can be said of the company's production growth.

Alliance Resource Partners LP increased coal production 6.7% in 2017 compared to the prior year, but that basically matches the 6.2% growth achieved for all domestic producers in that span. The company has guided for 3.7% to 6.3% production growth in 2018, again identical to industrywide ebbs and flows.

It's also worth considering the distribution of mining assets. Alliance Resource Partners LP sources 75% of its production from the Illinois Basin, 22% from the Northern Appalachian Basin, and the remaining 3% from the Central Appalachian Basin. The Illinois Basin was the only one of America's five major coal-producing regions to see selling prices fall over the course of 2017. Meanwhile, the Central Appalachian Basin saw selling prices increase nearly 30%.

In other words, the geographic distribution of the company's assets didn't do shareholders any favors.

Why You Might Pass on This Stock

Alliance Resource Partners LP runs a solidly profitable business -- it just happens to be deteriorating each and every year. While year-over-year production and sales growth will likely occur here and there, investors shouldn't mistake that for a sign that the American coal mining industry is rebounding.

The share of coal in the nation's electricity mix is at 30%, but it's steadily losing market share to natural gas and renewables. A lack of new coal-fired power generation units entering service, and the fact that many existing units are near the end of their lives, mean domestic coal demand will continue to plunge rapidly. Producers such as Alliance Resource Partners LP have found a lifeline by ramping up export volumes, but that promises to be a short-lived phenomenon. After all, other countries are turning to natural gas and renewables, too.

Therefore, while the stock may be enticing for its high dividend yield and may be worth owning for a short period of time, this is by no means in the running for becoming the poster child of long-term investing. If you do go yield chasing and buy Alliance Resource Partners LP, then be sure to keep tabs on trends in domestic and international coal demand.

CoalZoom.com - Your Foremost Source for Coal News