CONSOL Energy Announces Results for the Second Quarter 2018

August 2, 2018 - CONSOL Energy Inc. (NYSE: CEIX) today reported financial and operating results for the quarter ended June 30, 2018.

Second Quarter 2018 Highlights

Highlights of the CEIX second quarter 20181 results include:

- Net income and cash flow from operations of $52.7 million and $162.5 million, respectively;

- Total dilutive earnings per share of $1.58;

- Adjusted EBITDA2 of $136.3 million - raised full year guidance by 11%3;

- Organic free cash flow net to CEIX shareholders2 of $122.6 million;

- Reduced outstanding debt and equity by $22.8 million and $2.0 million, respectively;

- Total net leverage ratio2 reduced to 1.6x compared to 2.4x at the end of the fourth quarter of 2017;

- Record quarter for coal production and sales volume;

- Secured new commitment in the domestic metallurgical coal market.

Management Comments

"Strong domestic and international demand for our product coupled with outstanding performance at the Pennsylvania Mining Complex (PAMC) allowed us to deliver a record sales and production quarter," said Jimmy Brock, Chief Executive Officer of CONSOL Energy Inc. "This year is shaping up to be a very strong first year for CEIX as a public company as we continue to exceed the expectations that we laid out at the time we went public. While strong coal prices powered our first quarter results, record production and cost performance drove the solid second quarter results. Our second quarter sales volume of 7.8 million tons represented an annualized run rate of more than 28.5 million tons, the highest in the 35+ year history of the PAMC. This was made possible due to the tireless efforts of our employees, well-synchronized logistics with our customers and transportation providers, modest initial benefits from our debottlenecking projects and strong demand for our product. I am also very pleased with the improving safety performance at the PAMC, which resulted in a 9% reduction in employee safety incidents in the first half of 2018 compared to the year-ago period. We continue to target further improvements on the safety front with our goal of zero life altering incidents."

"The demand outlook for the second half of 2018 remains robust with low coal stockpiles domestically, attractive BTU value of our coal relative to other fuels globally and our ability to capture market share. This confidence in demand and in our execution capabilities allows us to increase our 2018 guidance for the second consecutive quarter. Consistent with our previously stated goals, we have reduced the total net leverage ratio for CEIX to 1.6x, a level we feel very comfortable with, which gives us more flexibility to pursue shareholder friendly actions."

Pennsylvania Mining Complex (PAMC) Review and Outlook

PAMC Sales and Marketing

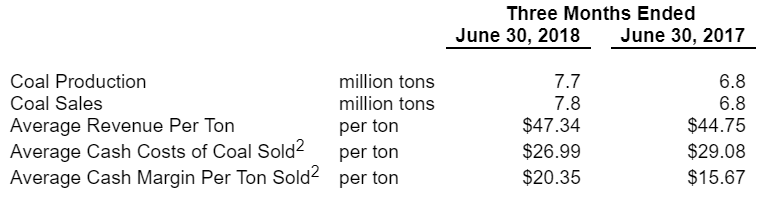

CEIX had a record sales quarter in which it sold 7.8 million tons of coal during the second quarter of 2018 at an average revenue per ton of $47.34 compared to 6.8 million tons at an average revenue per ton of $44.75 in the year-ago period. The average revenue per ton benefited from stronger pricing on our export sales and our domestic netback contracts. Our logistics team did an excellent job synchronizing shipments with our logistics partners at the rails and ports to move record volumes through the system.

On the domestic front, customer inventories remain low. According to the Energy Information Administration (EIA), inventories at domestic utilities stood at approximately 128 million tons at the end of May, down by approximately 21% from the same period a year ago. Furthermore, inventories at several of our key customers' Northern Appalachian (NAPP) rail-served power plants continue to average around 20 days. As mines, plants and railroads return from their annual maintenance shutdown period and with summer weather now upon us, CEIX expects demand to remain strong. We believe low inventories at domestic utilities coupled with continued strong international pull for our product should bode well as we enter the fall contracting season. CEIX is 74% contracted for 2019 and 32% contracted for 2020, assuming a 27 million ton annual run rate. We believe, as global coal demand is expected to continue to grow over the next several years, global supply will be challenged to keep pace due to several years of underinvestment and the lead time required to bring new brownfield or greenfield production online. A major competitive advantage of the PAMC is production sustainability based on its diversified longwalls, capital invested and long-life reserves. We will continue to benefit both domestically and abroad where many coal mines face normal depletion impacts and a lack of investment.

New Market Developments

During the second quarter, CEIX entered into a coal supply contract with a domestic coke producer, representing its first multi-shipment deal in the domestic metallurgical coal market since 2013. As previously disclosed, the sulfur levels at the PAMC have begun to decline. The lower sulfur, coupled with high fluidity and low cost, makes our product a better fit in the domestic metallurgical market and improves its competitiveness in the international crossover metallurgical markets as well. In the long term, we believe that this domestic market development will allow us to maximize our revenue potential and expand into the domestic metallurgical coal market. Our other five addressable markets where we are currently present include - export thermal, export industrial, export metallurgical, domestic thermal, and domestic industrial.

CEIX was also successful in expanding its sales portfolio by entering into an 18-month agreement with a domestic utility customer in the Midwest. This customer fits well with our domestic strategy of targeting top-performing power plants that are well-positioned to compete with natural gas and grow market share as other coal-fired plants retire.

During the quarter, we successfully completed a contract to remarket PAMC coal to new end-users in China, Europe and Africa. We continue to pursue coal sales in other potential international markets, including Turkey. While there continues to be uncertainty around the relaxation of sulfur restrictions for imported coal in Turkey, we believe the PAMC is well positioned, due to its product quality and cost structure, to enter the Turkish market should the opportunity arise.

Operations Summary

CEIX achieved strong second quarter production of 7.7 million tons, which compares to 6.8 million tons in the second quarter of 2017. During the quarter, we benefited from increased production at all three of our mines at the PAMC. Enlow Fork finished off the F27 panel, which was geologically very challenging, and has now transitioned to F28, which we believe will provide some operational relief as we improve our ability to manage these conditions. Our team continues to look forward to mid-2019, when the F side wall at the Enlow Fork mine will move to a different district, which we believe will provide much better mining conditions. Productivity at the PAMC, as measured by tons per employee-hour, improved 14% during the second quarter compared to the year-ago period and reached a level not seen since the first quarter of 2004.

CEIX shipped 7.8 million tons of coal during the second quarter, compared to 6.8 million tons in the year-ago quarter. The improvement in coal sales volume was driven by strong production and continued robust demand from our customers. Total coal revenue for the second quarter came in at $370.7 million and improved by $67.0 million compared to the year-ago quarter, primarily driven by $2.59 per ton higher revenue and 1.0 million more tons of coal sold. Our average revenue per ton increased to $47.34 from $44.75 in the year-ago quarter, as pricing improved on our export and domestic netback contracts.

The Company's total costs during the second quarter were $359.5 million compared to $290.2 million in the year-ago quarter, driven largely by a $28.0 million increase in total costs and expenses at the PAMC due to higher production volume, a $23.2 million increase in non-production depreciation, depletion and amortization and a $17.6 million increase in interest expense. Average cash cost of coal sold per ton2 was $26.99 compared to $29.08 in the year-ago quarter. This improvement was largely driven by a $1.02 per ton reduction in lease/rental expense and a $0.58 per ton improvement from labor productivity as discussed earlier. Average cash margin per ton sold2 for the second quarter of 2018 expanded by $4.68, or 30%, to $20.35 per ton compared to the year-ago period, driven by higher average revenue per ton and lower average cash cost of coal sold per ton.

Other costs increased by $12.0 million compared to the year-ago quarter, due to an increase in discretionary employee benefit expense and demurrage charges.

CONSOL Marine Terminal Review

For the second quarter of 2018, throughput volumes out of the CONSOL Marine Terminal were 3.5 million tons compared to 3.6 million tons in the year-ago period. For the second quarter, terminal revenue and terminal operating costs were $16.7 million and $6.0 million, respectively, compared to $14.9 million and $4.5 million, respectively, in the year-ago period. We expect the terminal to benefit from the recently-executed export contract, which provides a firm and attractive revenue stream for the next two years.

Debt Reduction and Share Repurchases

Taking advantage of the strong organic free cash flow net to CEIX shareholders2 generated during the quarter, CEIX repurchased approximately $22.8 million of various tranches of debt (Term Loan A-$11.3 million, Term Loan B-$1.0 million and second lien notes-$10.5 million) at an effective average coupon rate of 8.7%. We also took advantage of the volatility in our stock price to repurchase 47 thousand shares at an average price of $42.47 per share. Year-to-date, CEIX has effectively repurchased $48.8 million or approximately 5.4% of our outstanding debt that carried an effective average coupon rate of 8.5% and approximately 91 thousand shares of common stock at an average price of $36.05 per share. As of June 30, 2018, CEIX had $284.5 million of cash and cash equivalents and restricted cash.

2018 Guidance and Outlook

Based on our strong year-to-date results, robust coal demand and production expectations, we are improving several items of our financial and operating performance guidance for 2018.

- Coal Sales Volumes (100% PAMC) - 26.4-27.4 million tons

- Coal average revenue per ton sold - $47.75-$48.75

- Terminal throughput volume - 12-15 million tons

- Cash cost of coal sold per ton3 - $28.50-$29.50

- Adjusted EBITDA3 (incl. 100% PAMC) - $425-$465 million

- Effective tax rate - 8-12%

- Capital expenditures (incl. 100% PAMC) - $125-$145 million

CONSOL Energy Inc. (NYSE: CEIX) is a Canonsburg, Pennsylvania-based producer and exporter of high-Btu bituminous thermal and crossover metallurgical coal. It owns and operates some of the most productive longwall mining operations in the Northern Appalachian Basin. Our flagship operation is the Pennsylvania Mining Complex, which has the capacity to produce approximately 28.5 million tons of coal per year and is comprised of 3 large-scale underground mines: Bailey, Enlow Fork, and Harvey. The company also owns and operates the CONSOL Marine Terminal, which is located in the port of Baltimore and has a throughput capacity of approximately 15 million tons per year. In addition to the ~736 million reserve tons associated with the Pennsylvania Mining Complex, the company also controls approximately 1.6 billion tons of greenfield thermal and metallurgical coal reserves located in the major coal-producing basins of the eastern United States.

CoalZoom.com - Your Foremost Source for Coal News