UK Coal Plant Surges Back Into the Money for Winter

By Henry Evans

September 10, 2018 - Near ten-year highs on winter NBP natural gas prices have pushed coal plant back into contention to take a significant share of the UK’s generation mix over the coming winter.

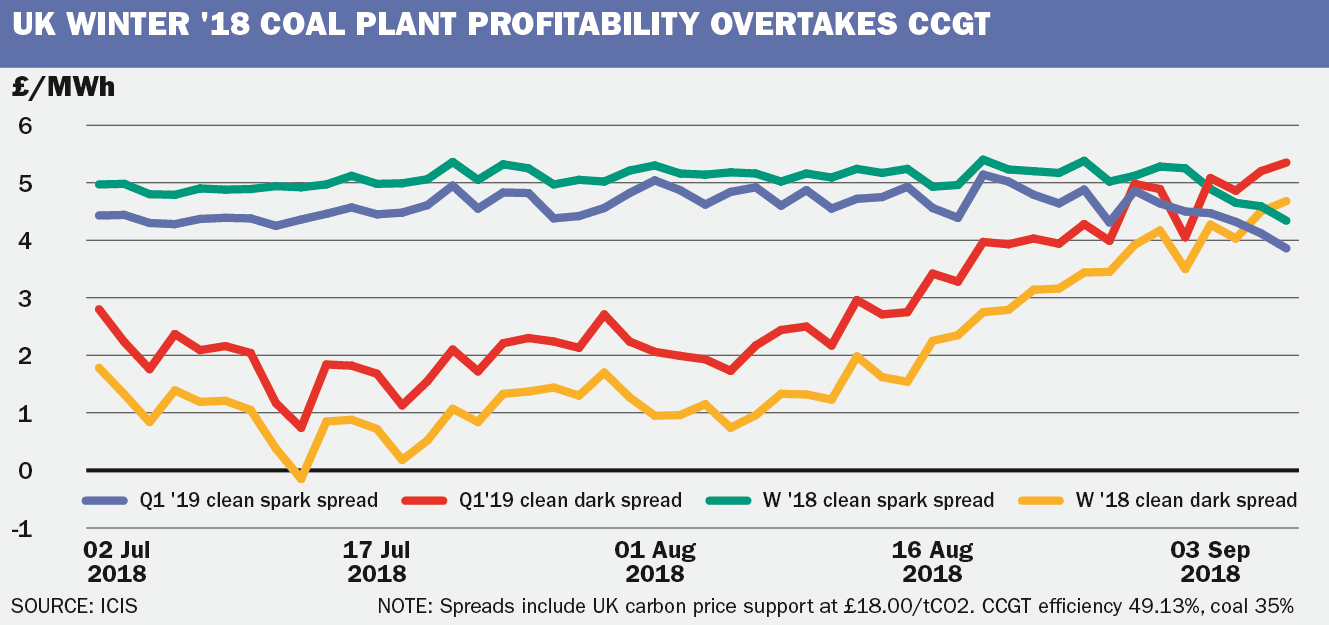

A recent surge in the value of the Winter ’18 clean dark spread – the notional profit margin for coal plants including emissions costs – has pushed it above the corresponding clean spark.

It raises the possibility that the remaining 11GW of coal capacity in the UK will play a more prominent role in the margins of the market than recent years. This in turn could increase the correlation between European coal prices – already trading at five-year highs – and power products.

Bullishness across wider commodities and concerns over winter supply have put near-curve NBP prices on a constant upward trajectory over the summer. Power products, which are typically correlated to gas prices, have followed suit and kept winter clean spark spreads relatively stable since July.

However, the premium on the power curve has stretched the value of the clean dark spread since mid-August. The increased prominence of coal in the generation mix has already been evident since late August.

“The Q1’19 clean dark spreads highlight the bullish outlook for the start of the new year,” head of trading at energy consultancy Monarch Partnership Serge Mazodila said. “This is based on the potential for significant gas storage depletion as the continent looks to enter the cooler trading period with below seasonal normal levels.”

Low nuclear availability in October and the potential for high exports of gas to the European mainland ahead of withdrawal season could also mean coal plants are economic to run from the start of October, according to another trader at a supplier.

Last Winter

Clean dark spreads were previously wider than spark spreads on a consistent basis ahead of the Winter ’15 expiry. Since then, coal plants have had minimal involvement in the generation mix, occasionally ramping up at times of tightness in Britain’s gas market.

Last year, the Winter ’17 clean spark spread expired at a £6.56/MWh premium to the corresponding dark spread, which was negative during much of last summer’s trading.

The economics for coal plant barely improved once winter started as the Q1 ’18 clean spark spread was valued £5.37/MWh above the dark spread on expiry at the end of 2017.

Over the course of last winter, coal plants provided 10% of the UK’s total electricity generation. This equates to an average of 3.6GW of capacity employed across the period.

With dark spreads currently valued as they are, it suggests coal plants will play a more prominent role in the market this winter.