Natural Gas Jumps on Expectations of Above-Average Cold, With Supplies at Decade Low

By Patti Domm

October 16, 2018 - Natural gas prices jumped Monday on report of below-average cold weather expected across the U.S. at a time when gas supplies are at decade lows.

Natural gas futures for November rose 2.6 percent, to $3.242 per million British thermal units.

"The updated model from over the weekend showed an early-season cold snap for the bulk of the country, which is the last thing consumers needed to have happen," said John Kilduff of Again Capital.

Natural gas hit a high of $3.37 per mBtu a week ago Tuesday on a cold weather report, but that concern faded and a new 11-day to 15-day forecast shows a blast of cold across the U.S., particularly in the South and in the Midwest.

"It's a different pattern," said Jacob Meisel, Bespoke Weather Services chief weather analyst. "You're seeing more risk that cold air masses get trapped across the East. Before, it looked like we'd get warm Pacific air into the East."

Meisel said this year's weather pattern has been unusual, and it coincides with extremely low supply.

"My early thoughts are for a warmer November into December and then some colder risk in January but primarily February," he said. "In October, we're actually looking at a top-five cooling demand days and a top-five heating demand. We started with near-record heat, and we flipped to cold. You always expect to get several weeks of low energy demand, and that's not happening."

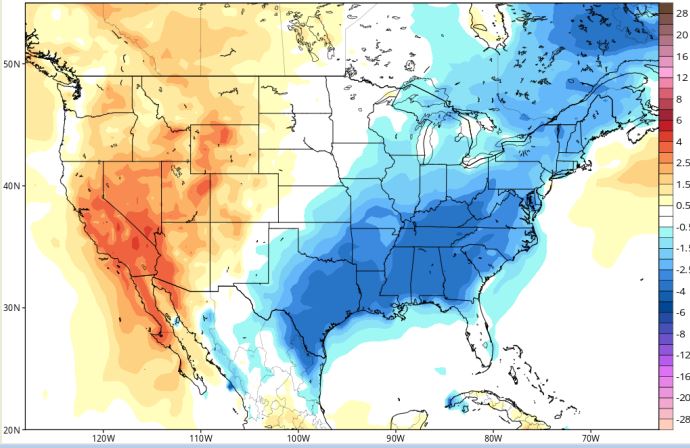

Average difference from normal temperatures Oct. 26-31

Source: Tropical Tidbits/Bespoke Weather Services

Meisel said with a maximum cold winter, prices for natural gas could jump above $4, but that seems unlikely. "With natural gas storage levels so low, prices are sensitive to cold this early in the season," said Meisel. "Prices have remained relatively low on record production but these low prices have encouraged far more power burns for electricity. ... This was compounded by the fact we've seen a record number of gas-weighted degree days between April and September.

The amount of natural gas in storage is below the five-year historical range. At 2,956 billion cubic feet, as of Oct. 5, it was slightly higher than the week before but still well below the five-year average.

"Natural gas supplies are 17 percent below last year and the five-year average levels. Put in real numbers, that's 600 billion cubic feet below. It means we're starting off the winter with a big hole in our supply," said Kilduff.

Analysts say one of the issues is that October lacked a period of comfortable weather where consumers did not need heat or air conditioning so demand has been high even though gas production was strong.

"You're going to get overnight temperatures falling into the 40s and some places into the 30s. Denver already had 20s. Besides the idea that storage levels are really low, we've gone from running air conditioning to turning on heaters," said Gene McGillian, manager market research at Tradition Energy.

McGillian said natural gas could easily run back up to last winter's $3.66 per mBtu high from January, but serious cold weather would send it higher.

"It's pretty clear we're going into the heating season with more than a 10-year low in storage," he said. "We think the winter risk is showing up. ... It's also driven by the forecast from NOAA for November and December being above average temperatures."

Kilduff said if there is a polar vortex this year, with extreme cold through the winter, prices could double or even go much higher.