Tier 1-2 Coal Price Spread Pushing Mills to Diversify

February 12, 2019 - Interest in second- and third-tier coking coal products is picking up, as persisting wider price spreads between top-tier grades and other brands encourage some steelmakers globally to further diversify their supply sources.

"There is increasing curiosity about what can be done as an alternative to Australia," a European trader said, adding that he does not see an urgency of demand but that rather it is a case of end users keeping their eyes open for what can be done to limit reliance on high-cost top-tier grades. A European steelmaker agreed that it would be logical for mills to keep pushing to adjust blends to keep input costs down, particularly in light of how coking coal price spreads have been developing and with the current surge in iron ore costs exacerbating concerns about margins in the near term.

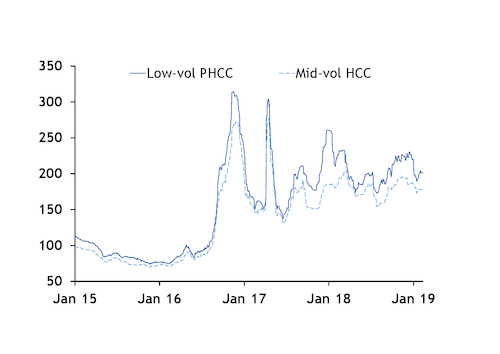

The spread between fob Australia prices for tier-one premium hard low-volatile coking coal and tier-two mid-volatile coking coal averaged $22.67/t in the past 12 months, according to Argus assessments. This is down slightly from an average spread of $25.94/t in the year to 12 February 2018, but still up significantly from $15.82/t in the year to 12 February 2017 and $7.07/t in the 12 months prior to that (see chart).

There is such a wide range of specifications in the tier-two and tier-three bands that many steelmakers are keen to identify which brands might fit their requirements and help them cut raw material costs, the European trader noted. Some mills have been continually working on measures to make their facilities more flexible ever since the supply shockwaves of 2016-17, potentially meaning they now have a bit more scope to adjust blends — albeit no one is anticipating a steep drop in consumption of tier-one Australian coals.

Russian coking coal — which is sometimes ruled out owing to its weaker caking properties compared with other origins — is potentially poised for an uptick in usage, with market participants noting a recent flurry of enquiries. That said, one mill noted that European end users are usually wary of becoming too reliant on Russian material owing to political risk.

The EU imported 621,118t of Russian coking coal in November, down on the year by 23pc, according to the latest Eurostat data. That said, January-November imports of Russian material were up by 14pc year on year at 6.23mn t.

Any uptick in Europe's intake of Russian coking coal is unlikely to be reflected in spot sales, with counterparties more likely to lock tonnes into term contracts, typically pricing at a discount to fob Australia benchmarks.

The drive to diversify and reduce reliance on Australian coking coal is nothing new. In 2017 Europe's coking coal imports leant increasingly towards the US, as mills moved to reduce exposure to Australian price volatility after Cyclone Debbie caused severe disruptions in March-April. But the push to diversify further is now being driven by additional considerations and more lasting price spreads.

Australian supply risks are once again in the spotlight, with Queensland vessel queues lengthening once again as a result of heavy rainfall in early February. Weather conditions were so severe that the 50mn t/yr Abbot Point coal terminal has been forced to close for several days this month.

US coking coal producers have seized the opportunity in the past two years, promoting the diverse applications and blending properties of their high-volatile grades and ramping up exports globally.

A growing push into the Chinese market was only cut short last year by trade defence measures which US exporters now hope might be softened. Indian mills now typically view US low-volatile material as the preferred alternative to Australian hard coking coal. The Argus weekly fob Hampton Roads assessment for low-volatile coking coal is now at $185/t fob, while fob Australia premium hard low-volatile coking coal held at $201/t over the past week.

While US high-volatile types A and B (HVA and HVB) are well-established in seaborne trade, a market participant noted growing activity with US high-volatile type C (HVC) and semi-soft coals, with small clips trading frequently.

"They are versatile crossover coals, sometimes referenced as PCI, or as HVB by some Indian buyers although that's not quite accurate," a sell-side market participant said, adding that the typical specifications for these US grades are similar but slightly better than Hunter Valley semi-soft.

The ramp-up of Canada's coking coal production and export capacity is also being closely monitored by Asian market participants, keen to assess where those additional tonnes will fit into the seaborne market.

Mining firm CST Canada — which has been restarting assets previously owned by Grande Cache Coal — told Argus that while it is primarily focused on sales to Asia, it has also been receiving enquiries from European and South American mills looking for new options.

CST's premium low-volatile coking coal has typical ash content of 9.5pc, dry sulphur at 0.55pc, volatile matter (VM) dry of 18pc plus or minus 1pp, and CSR at 62-66pc. This compares with Australian premium hard low-volatile coking coal, with ash at up to 10.5pc, dry sulphur at up to 0.6pc, VM at up to 25pc and CSR at a minimum of 67, based on Argus assessment specifications.