Does King Coal Have Nine Lives?

By Bob Kohut

June 23, 2019 - On June 20, australianmining.com.au reported that a subsidiary of ASX listed coal miner Yancoal Limited (YAL), Moolarben Coal Operations, has received approval from the NSW government to expand its coal production at a JV project in NSW. This was the second announcement in the past month where the coal miners received a seal of approval from an Australian state government despite significant public objections.

On June 13 abc.net.au and multiple other news outlets were reporting another controversial coal mining approval when the Queensland state government approved the Adani Carmichael coal mine.

This news and other developments in the global coal sector might have come as a surprise to some investors who stopped listening once the first pronouncement of the death of King Coal. Yet despite the rock bottom prices natural gas in the US reached, the falling price of solar energy, and the expert pronouncements heralding the declining fortunes in the once mighty sector, the King simply refuses to die, and is flourishing once again after a near death experience earlier this decade.

How retail investors view the wildly confusing information about the current state and outlook for coal depends to a large extent on the investor’s investment strategy. Market jargon has christened “investors” as those who believe in the “buy and hold” approach where the “hold” period can range from the accepted minimum of five years to “forever,” the favorite holding period of renowned “buy and hold” investor Warren Buffett. For many investors espousing that philosophy, King Coal is at best on life support.

Within this broad group of “investors” there are those who adopt a “passive” approach, relying on experts to manage their investing dollars in mutual or exchange traded funds. Others simply buy into funds that mirror the movements of a given market.

Then there are “active” investors who have the time and temperament to make and manage their own stock purchases.

The other broad group could be characterized as “active traders” where the hold period could be as short as a single trading day. There are sub-groups here as well but regardless of investing strategy all seek the same goal – profit. The critical difference is the time frame in which the investor is willing to wait to get that profit.

Almost seventy five years ago Benjamin Graham, considered to be the father of investing, commented on the strategic choice faced by retail investors that “temperament and personal situation may well be the determining factors.” The advice holds true today. Both active trading and active investing require substantial commitment of time required to cut through the confusing cacophony of contradictory information and adequately research potential stock purchases.

Coal provides a stellar example. Today’s financial news is awash in contradictory conclusions on the state of the sector. On the one hand, you have industry proponents flooding internet and other outlets with claims of increased capital expenditures on existing coal mines and development of new mines as well as tales of significant increases in spending in existing and new coal-fired electricity generation plants.

There are multiple sources with quotes like the following from the Sydney Morning Herald:

• The global pace of new construction of power stations is slowing while retirement of aging plants is accelerating, placing the world on track for “peak coal” capacity within a couple of years.

The article cites research from Global Energy Monitor and Greenpeace – no friends of the coal industry – showing that coal-fired plants declined in pre-construction activity, starts, and completions for the third year in a row and down 84% since 2015.

In addition, the retirement of coal-fired plants in the UK, the European Union, and the US were at a “record pace.” In the US the Trump administration is backing the coal sector, with the most recent development being the elimination of Obama-era regulations favoring renewable energy sources, with the new regulations allowing older coal-fired plants to continue.

Industry advocates touting the demand for affordable electricity in China and the rest of Asia rarely cite the US experience. When the fracking revolution began to yield massive amounts of natural gas embedded in shale rock, the price made natural gas far more affordable than coal. The result? Between 2012 and 2016 more than 50 US coal companies filed for bankruptcy, with that country’s largest producer, Peabody Energy, topping the list. As of May of this year, another of the biggest coal producers in the U.S. – Cloud Peak Energy – filed for bankruptcy.

For buy-and-hold investors the long-term outlook for coal makes coal stocks unpalatable.

However, for active traders and some risk-tolerant active investors, there are market forces in the coal sector that make some blue-chip coal stocks worthy targets.

First, the demand for both thermal coal used for generating electricity and coking coal for the production of steel remains solid in China and much of Asia. The Chinese appear caught between the stated goal of dramatically reducing the use of coal to clean their polluted air and the massive need for affordable electricity generation.

India apparently will not add any new coal-fired electrical plants, but existing plants remain and the need for steel there and throughout Asia remains.

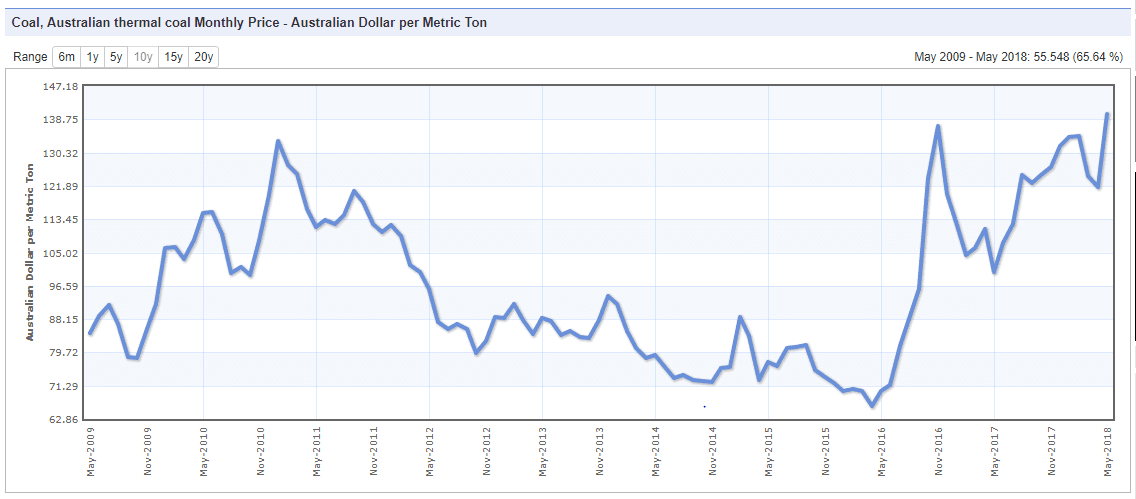

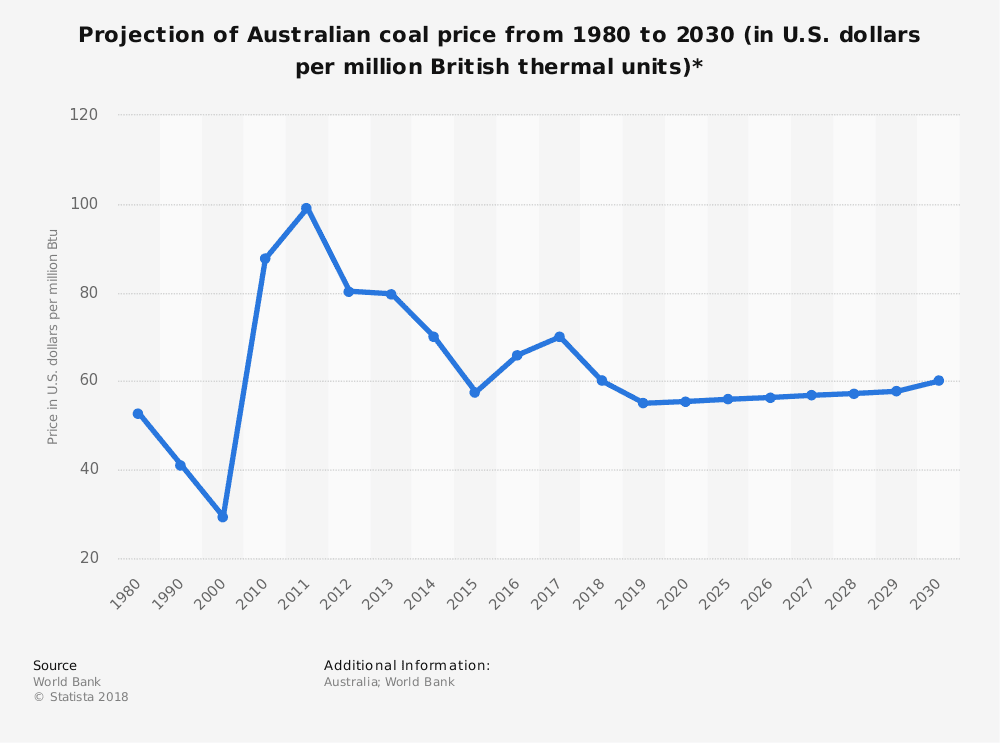

In one way, coal is in an ideal position for active traders. The price appears stable given the fact there is still demand with no new supply on the horizon coupled with declining investment for new mines and new coal-fired generating facilities and more retirements in existing facilities.

Prices for coking coal are expected to continue to rise in 2019 before beginning a gradual decline in 2020, with the decline in prices for thermal coal expected to accelerate in 2022.

The situation for thermal coal is more problematic due to the multiple alternative options for generating electricity – natural gas, solar, wind, and others.

Coking coal has fewer alternatives to compete with in the production of steel. Electric Arc Furnaces can produce steel with a minimal amount of coking coal, but only 30% of global steel production uses this method. Other alternatives would require more capital investment than the industry might be willing to make.

Finally, coal remains our second largest export and the government at both the state and federal level have already shown support for the coal industry. BNEF (Bloomberg New Energy Finance) is out with its 2019 New Energy Outlook (NEO), proclaiming coal-fired generators are “on their way out, with the only question not if but when.”

The report dramatically stated coal will “almost completely disappear from the Australian electricity system by 2050 if governments do not attempt to keep plants online through subsidies.”

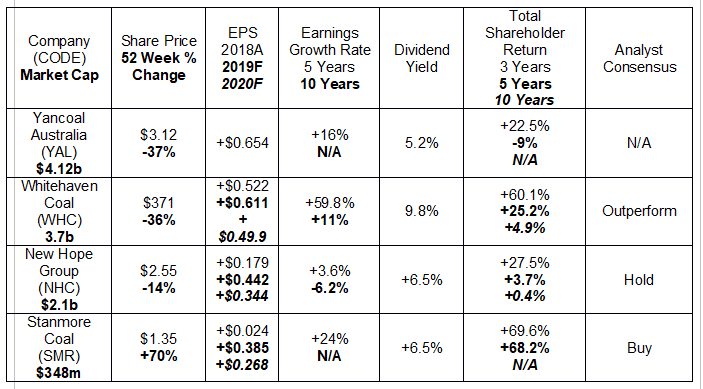

The following lists five of the largest ASX coal mining stocks by market cap. There are junior miners and companies still in exploration and development stages for at best investors with meteorically high-risk tolerance and at worst the maddest of mad dog punters.

Note that all these stocks show declines in forecasted earnings per share between FY 2019 and FY 2020.

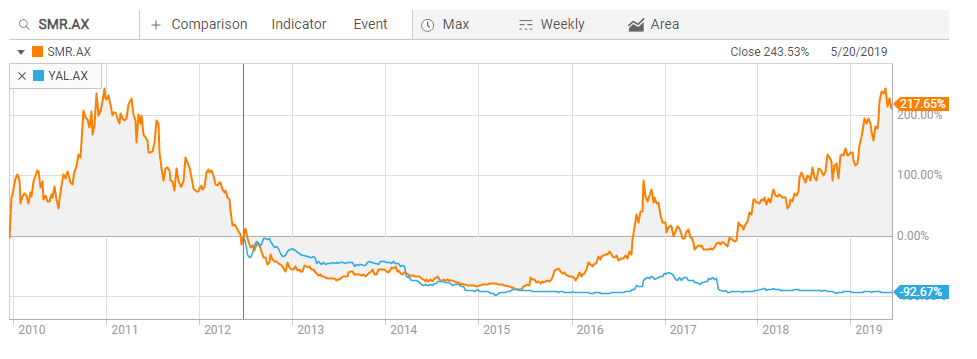

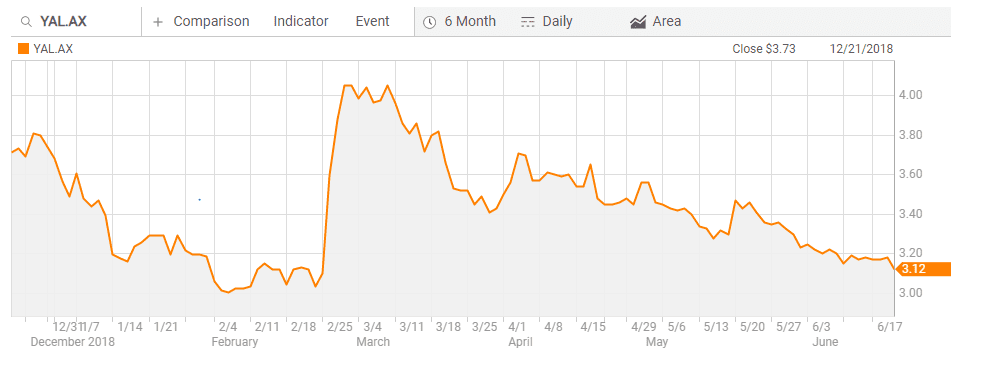

Stanmore Coal (SMR) appears as top choice here, although much of its share price appreciation may be due to a takeover offer the company initially rejected, and continues to reject, as too low. Stanmore listed in 2010 and got off to a hot start before the declining fortunes of coal drove the share price down hard. Following a ten year low posted in early 2016 the price of coal and Stanmore stock have gone up. Stanmore’s performance is vastly superior to another recent ASX listing – Yancoal Australia (YAL). From the Reuters website:

Stanmore has seven projects operating in the Bowen and Surat Basins in Queensland, with five producing coking coal. The company posted record financial results in its Half Year 2019 Financial Report. With the tailwinds of high coking coal prices at their back, the company’s revenues increased 79% over the previous corresponding period (pcp) while profit was up 165%.

Stanmore’s performance is even more surprising given the Chinese government’s suspicious delaying tactics at its ports for Australian coal imports while its domestic demand is slowing, and the US trade war is hurting.

Yancoal Australia’s controlling shareholder is Yanzhou Coal Mining Company Limited (62.26%) from the People’s Republic of China. The company has eleven mining sites across Queensland, New South Wales, and Western Australia, with five wholly owned and operated; five managed; and one joint venture.

The company has recently dual listed on the Hong Kong stock exchange and reported record financial results for the Full Year 2018 – with revenues increasing 77% and profit up 272%. Investors loved it.

Whitehaven Coal (WHC) is Australia’s largest independently owned producer of both metallurgical (coking) and thermal coal. The company operates six mines in northwest NSW. Whitehaven is one of the few pure play coal miners to have increased both revenue and net profit in each of the last three years, with revenues up 94%. Net profit increased to $525 million in FY 2018 from $20.5 million in FY 2016 – an increase of more than 2500%.

New Hope Group (NHC) presents itself as a diversified energy company but the bulk of its operation are in thermal coal with one project in metallurgical coal. The company owns a port facility for coal export at the Port of Brisbane and rehabilitates and manages land around its mining sites for agricultural use, mostly grazing.

After years of back and forth with the state government, New Hope appears to be close to final approval of an expansion at its New Acland coal mine.

The company’s Half Year 2019 results were the best in its history, with revenues up 21% over the Half Year 2018 and net profit up 33%