Analysis: Weaker Yuan Unnerves China's Commodity Imports

August 8, 2019 - China's commodity importers are changing tack after this week's yuan devaluation sent shockwaves through global financial markets, with companies already reeling from the tariff dispute with the U.S. now deferring purchases as dollar-denominated trades become more expensive.

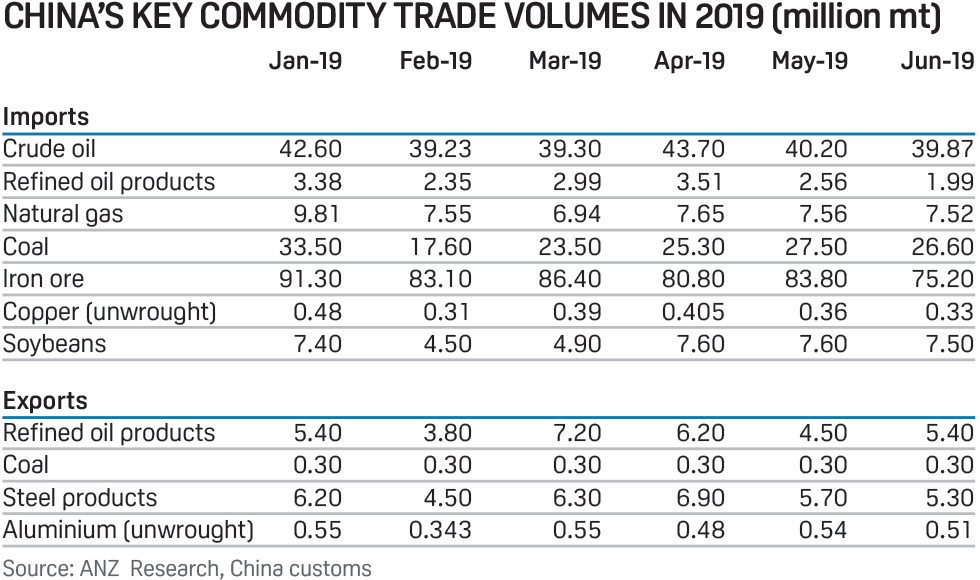

Crude oil, iron ore, coal, natural gas and agricultural products like soybeans --which rely heavily on Chinese demand -- have been impacted in various ways.

Some Shandong-based independent refineries have held back from buying crude cargoes for October and early November delivery after China allowed the yuan to breach the 7 per U.S. dollar level for the first time in 11 years on Monday, trading sources said.

"The drop in international crude prices has partly offset the yuan's depreciation, but refined product prices have also dropped, so refineries will still face forex losses," an independent refinery source in Shandong province said.

China surpassed the U.S. as the world's largest crude oil importer in 2017, according to the U.S. Energy Information Administration. The country imported 9.91 million b/d of crude oil in the first half of 2019, of which the independents accounted for about 23.2%, official data showed.

The currency depreciation could hit Chinese independent refiners much harder than their state-owned peers such as Sinopec and PetroChina, or large-scale private refineries like Zhejiang Petrochemical Co, as almost none of the small independents hedge their currency risk.

Chinese corporate and state-run companies, which are the main commodity importers, have far lower currency hedging volumes than the industry average.

This is likely to prove problematic as currency risks grow.

Nomura economists said on Tuesday they expected the yuan to depreciate further to 7.20 by the end of the third quarter and 7.40 by end 2019, with numerous negative risks.

"It is impossible for us to land seaborne cargoes with the yuan's depreciation, as cargoes are exposed to too much currency risk," a Chinese bulks importer said.

However, UBS analyst Giovanni Staunovo said the yuan weakness is one element of the equation and the Brent price in U.S. dollar terms has fallen more than the yuan in recent days; the oil price in yuan terms stands at a 6-month low, and Brent in U.S. dollar terms at a 7-month low.

Staunovo said he "wouldn't be surprised if current lower prices trigger some stronger Chinese imports going forward."

LNG, Soybeans and Coal

In the LNG market, record low prices and oversupply offset the weaker yuan.

Spot Asia LNG prices are at multi-year lows, with the S&P Global Platts JKM for September cargoes assessed at $4.175/MMBtu Tuesday, the lowest for the benchmark since April 21, 2016.

Higher import costs will also make domestic natural gas more competitive, as city gate gas is priced in yuan, traders said.

In China's soybean market, the world's largest, the yuan devaluation is poorly timed and adds to bearish fundamentals -- Chinese crushers are already paying a premium for Brazilian soybeans due to the trade dispute and demand is weak due to the African swine fever outbreak.

The weaker yuan will raise import costs for local crushers and lower their crushing margins, said Michael Every, head of Asia research at Rabobank in Hong Kong.

Soybean prices FOB Santos, Brazil, have averaged $363.42/mt in the past 12 months, compared with soybeans from New Orleans in the US, which have averaged $337.36/mt, Platts assessments show.

China's soybean imports in the 2019-20 marketing year (October-September) are now forecast at 80 million mt due to the swine fever, down from around 88 million-90 million mt/year imported in previous years.

In coal, the weaker yuan comes amid China's attempts to reign in imports and with softening demand at the end of peak summer season and slowing industrial activity.

"The yuan devaluation against the U.S. dollar will make coal imports more expensive for Chinese buyers, given seaborne prices are on a US-dollar basis," said Matthew Boyle, S&P Global Platts Analytics lead coal analyst.

China imported around 154 million mt of coal over January-June, including thermal and metallurgical coal, up 6.4% year on year, according to official data. It averaged 281 million mt of imports in 2018 and similar levels are expected for 2019.

Macro Risks

The yuan devaluation signals the U.S.-China trade dispute has entered a new level of escalation.

"Global markets have been gripped by risk aversion and this has been expressed by industrial commodities like oil, copper and iron ore declining, safe haven assets like gold or the Japanese yen being bid up and finally equities and bond yields retreating," said BNP Paribas analyst Harry Tchilinguirian.

There's now a greater chance that the U.S. will hike tariffs to 25% or that China will fully halt purchases of agricultural products and U.S. crude, without imposing tariffs.

Meanwhile, other entities in the firing line are commodity traders with a large China exposure, producers like Middle East oil exporters and resource giants like Australia, which rely on Chinese demand.

However, Alan Struth, director of global oil at Platts Analytics, noted the yuan hasn't weakened as much against other currencies and said the fall may not be as broad as portrayed -- suggesting its impact is likely to be less severe than many think.