CONSOL Coal Resources LP’s Financial Results Comparing With CONSOL Energy Inc.

August 20, 2019 - We are comparing CONSOL Coal Resources LP (NYSE:CCR) and CONSOL Energy Inc. (NYSE:CEIX) on their profitability, analyst recommendations, institutional ownership, risk, dividends, earnings and valuation.

They both are Industrial Metals & Minerals companies, competing one another.

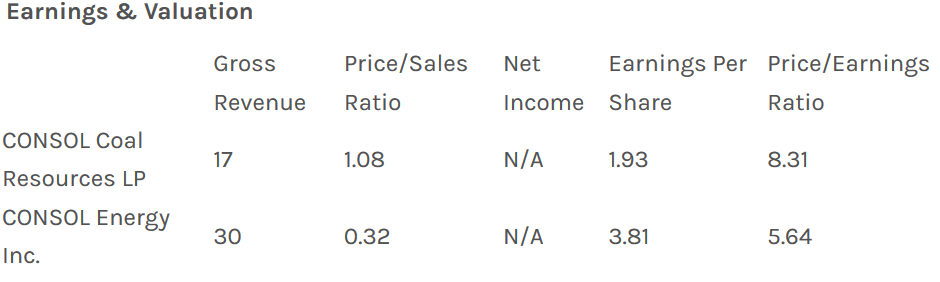

Table 1 shows the gross revenue, earnings per share (EPS) and valuation for CONSOL Coal Resources LP and CONSOL Energy Inc. CONSOL Energy Inc. has higher revenue and earnings than CONSOL Coal Resources LP. Currently more expensive of the two stocks is the business with a higher P/E ratio. CONSOL Coal Resources LP is thus presently the expensive of the two stocks because it has a higher P/E ratio.

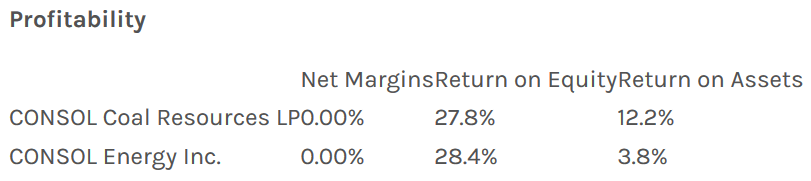

Table 2 provides CONSOL Coal Resources LP and CONSOL Energy Inc.’s return on assets, net margins and return on equity.

Liquidity

The Current Ratio of CONSOL Coal Resources LP is 0.6 while its Quick Ratio stands at 0.5. The Current Ratio of rival CONSOL Energy Inc. is 1 and its Quick Ratio is has 0.8. CONSOL Energy Inc. is better equipped to clear short and long-term obligations than CONSOL Coal Resources LP.

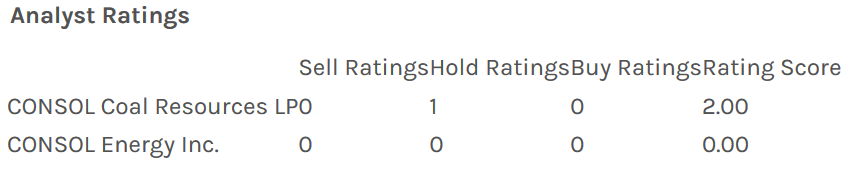

The next table highlights the given recommendations and ratings for CONSOL Coal Resources LP and CONSOL Energy Inc.

CONSOL Coal Resources LP’s upside potential currently stands at 20.66% and an $16 average price target.

Insider & Institutional Ownership

CONSOL Coal Resources LP and CONSOL Energy Inc. has shares owned by institutional investors as follows: 39.4% and 97.3%. About 32.8% of CONSOL Coal Resources LP’s share are owned by insiders. Insiders Competitively, owned 2% of CONSOL Energy Inc. shares.

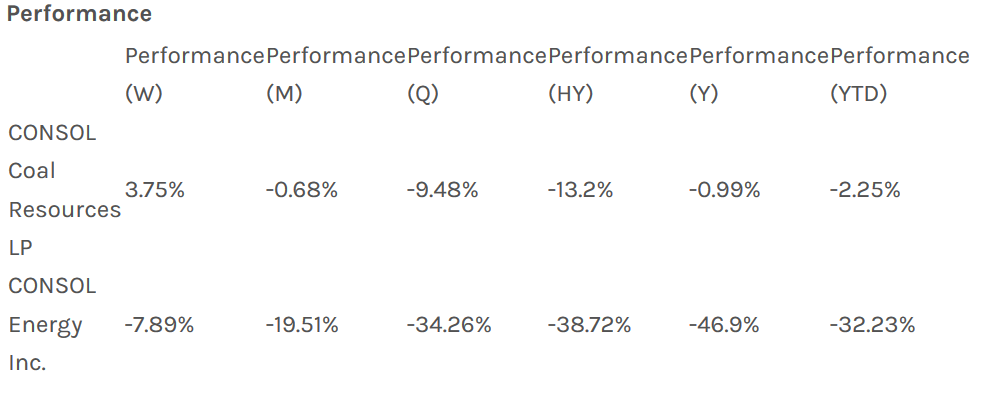

In this table we provide the Weekly, Monthly, Quarterly, Half Yearly, Yearly and YTD Performance of both pretenders.

For the past year CONSOL Coal Resources LP was less bearish than CONSOL Energy Inc.

CONSOL Energy Inc. produces and exports bituminous thermal and crossover metallurgical coal. The company owns and operates its mining operations in the Northern Appalachian Basin. Its flagship operation is the Pennsylvania Mining Complex, which has the capacity to produce approximately 28.5 million tons of coal per year and is comprised three underground mines, including Bailey, Enlow Fork, and Harvey. The company also owns and operates the CONSOL Marine Terminal, which is located in the port of Baltimore and has a throughput capacity of approximately 15 million tons per year. In addition, it controls approximately 1.6 billion tons of greenfield thermal and metallurgical coal reserves located in the coal-producing basins of the eastern United States. CONSOL Energy Inc. is headquartered in Canonsburg, Pennsylvania.