What's Behind the Metrallugical Coal Price Plunge - And What Lies Ahead?

October 16, 2019 - There has been an uneasy tension around hard coking coal (HCC) prices for some time. Few would argue that US$200/t prices for seaborne HCCs were sustainable. But at the same time, the market had become accustomed to sky-high prices, kept artificially strong while China focused on restructuring its steel and coal sectors.

When prices plunged in July and August 2019, reaching around US$130/t, it was either unnerving or long overdue, depending on your point of view. In either case, the current situation is a gaping disparity between domestic Chinese and international prices – with market participants left wondering if this is a long-term correction, or a short sharp shock.

So how did this come about? There are four key reasons for the HCC price fall.

1. Chinese port restrictions

China has intervened in the import trade throughout 2019, slowing customs clearances and restricting seaborne coal imports at several ports. In July a ban on trader cargoes was imposed at Caofeidien and Jintang – two ports that accounted for 35% of China’s metallurgical coal imports in H1 2019.

The intervention increased the risk associated with using imported coal. This deterred Chinese buyers, with the disincentive manifesting in lower prices rather than lower imports.

It has also created uncertainty for buyers and traders alike. With little clarity on the future of port restrictions, and the fear of greater controls to come, some traders are offloading cargoes at reduced prices.

2. Seasonal demand slowdown

The northern hemisphere summer is typically a slow period for steel demand and production. This is particularly true in southern China, where construction activity falls. This year several factors put additional pressure on demand.

Pollution control measures, usually a late-year phenomenon, meant that non-compliant mills in Tangshan had 50% production limits during July and 30% in August.

In the EU, steel sector weakness this summer saw ArcelorMittal approve deeper-than-usual production cuts. Performance across Europe was hit by the British Steel bankruptcy and the forced closure at Taranto due to pollution concerns.

And in India, the standout import performer of 2018, an advancing monsoon amplified other challenges. A period of weak economic activity and low infrastructure spending prompted a slowdown in steel demand. And new emissions rules have decimated auto demand. Stimulus has been put in place, including a reduction in corporation tax, but it will take time to take effect. Meanwhile, coking coal stocks at India’s mills and ports are high, reducing the need for imports.

3. Improved supply availability

Production performance has not been universally positive, but considerable improvement in some key areas had an impact.

Australia’s supply performance improved markedly in Q2. As we reported in our short-term outlook for July, BHP, Anglo and South 32 all reported production increases. Glencore’s H1 2019 production report also showed higher coking coal production, partly due to the reopening of the Wollombi deposit. Australian exports spiked by 1.6 Mt in June as throughput at DBCT in particular grew month-on-month. Port data suggests that July has not reached June’s highs, but dry weather is helping keep open-cut mine production strong.

Meanwhile, Russian coal sales have grown and diversified in recent months. This is partly due to higher mine production. However, weak European demand has also had an impact, while EU sales deteriorated further after the Russian government moved to restrict sales to Ukraine. In 2018 Russia exported 8 Mt to its neighbour, while June exports fell to near zero. The result has been an influx of Russian coals into other markets, especially India.

4. Economic reality: unusual turbulence for the global steel sector

As the US-China trade dispute rumbles on, tariffs have brought artificial cost increases. This has directly affected demand for steel-intensive goods and depressed sentiment. The devaluation of the yuan also increased the cost of imports into China, reducing the US$ price at which importing coal is competitive.

In addition, the tightly balanced iron ore market has had an effect. Iron ore prices remain historically high due to the tragic dam collapse in Brazil. The delivered cost of raw materials has also been affected by recovering freight rates. The assault on steel profitability has cut demand for raw materials and forced mills to focus on cost savings.

Is the link between Chinese domestic and international spot prices now broken?

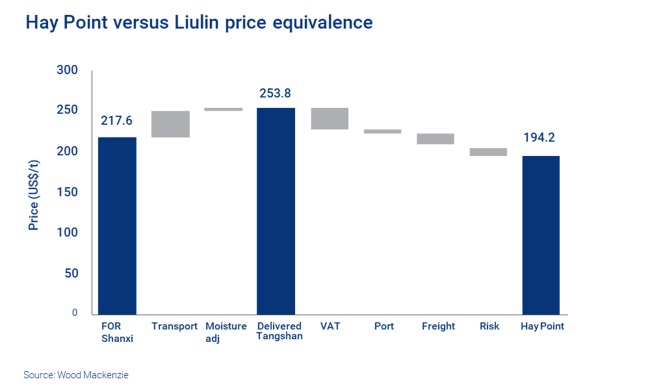

Between August 2018 and July 2019 seaborne hard coking coal prices were held in a narrow range between US$220 and US$180/t. These high prices were supported by Chinese spot buyers prepared to pay prices equivalent to Chinese domestic coals. Seaborne coal purchases typically involve more risk, around timing and cashflow, so Chinese buyers typically require an extra incentive beyond the usual net-back pricing discounts.

Using an RMB100/t incentive, we estimate current contract prices for benchmark low sulphur premium HCCs in China are equivalent to about US$195/t FOB Hay Point equivalent.

This simple comparison suggests that the link between Chinese domestic and international spot prices is currently broken. Seaborne spot prices ex-Australia have eclipsed the US$140/t mark, indicating a massive additional discount of almost 30%.

This is partly due to the extra demurrage costs incurred due to extended customs clearance times. But a greater penalty is applied to compensate for the risk that shipments will not be cleared at all. Many Chinese buyers are avoiding seaborne imports, irrespective of cost.

Government intervention is the most effective way to sever seaborne and Chinese prices. And without that link, ascribing value to seaborne coals may come down to production costs. That poses a challenge, as production cost support sits at a vast discount to current Chinese pricing.

Where is the Price Support?

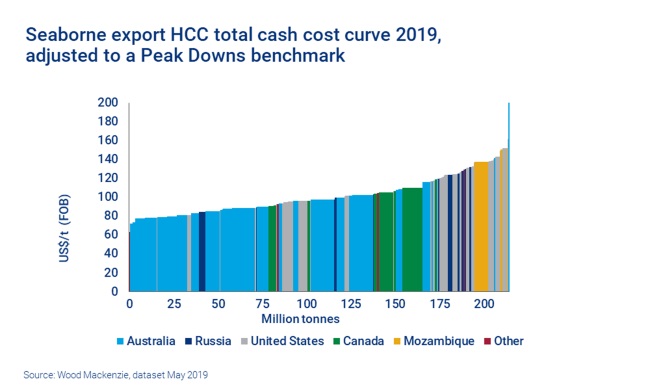

Traditionally, market analysts have used the 90th percentile of the global seaborne cost curve to identify a sustainable floor price. Based on our view of supply costs, this price support level sits at just above US$130/t.

With spot prices already close to this level, one interpretation of the curve is that further sustained price falls are unlikely. And, in fact a rebound is already evident in early October. Even at current levels, prices should eventually yield a supply response, or at least a concerted operational response to lower costs. High cost US mines, and those in Mozambique, will already be incurring operating losses and will need to make tough decisions if prices stay low. Such a supply response is a common mechanism that results in rising prices.

But further short term price falls can’t be ruled out completely. We estimate BHP’s marginal cash cost at around US$110/t. Given the company’s importance in setting prices, the spot price floor in this current downturn will likely depend on the supply and demand balance of BHP’s coking coal products into China.

A Look Ahead

Negative forces, not least the possibility of stricter intervention in China, will continue to put pressure on prices in the near term. However, now that the Chinese Golden Week holiday is over we expect activity to pick up. Fears around import quotas should eventually subside as we head toward November, because traders into China will start to rely on 2020 quotas given the long lead times to get coal delivered into the country and cleared by customs.

We expect that as risks around imports ameliorate, seaborne prices can start to rise again – back toward equivalent Chinese domestic prices.