US Power Generators Set for Another Big Year in Coal Plant Closures in 2020

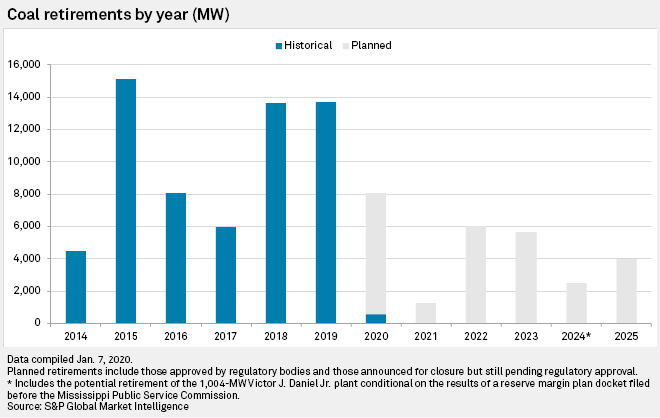

January 14, 2020 - U.S. coal consumption is likely to decline sharply again in 2020, though the current roster of planned and completed coal plant retirements suggests the year may not be quite as rough as the past two.

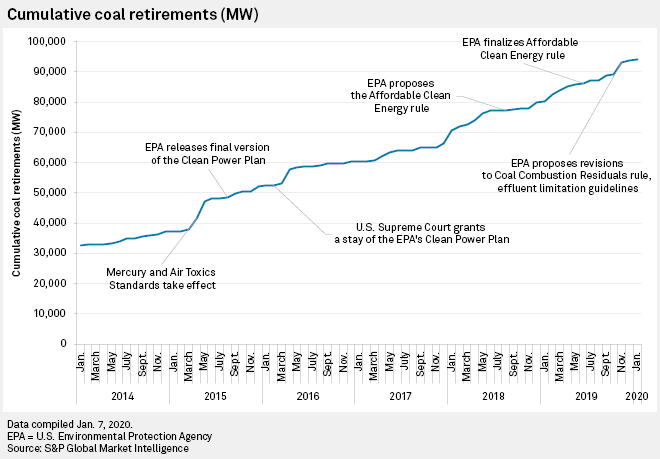

At 13,703 MW, 2019 marks the highest level of annual coal capacity retirements in the U.S. since 2015, a new S&P Global Market Intelligence analysis of federal data shows. The amount of coal capacity planned for retirement in 2020 is expected to exceed the amount retired in each of 2014, 2016 and 2017. Another retirement has already been announced.

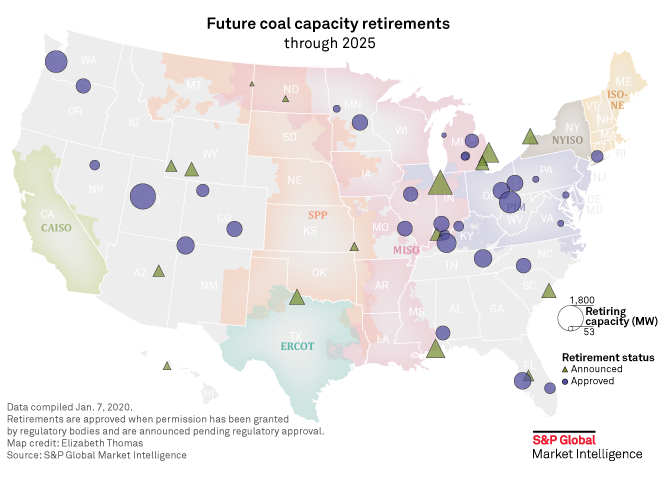

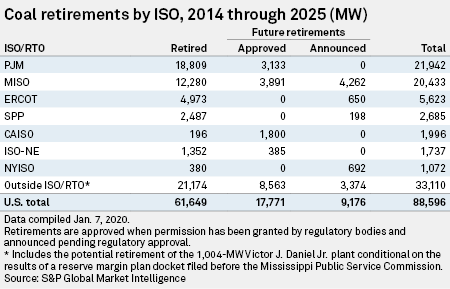

Tri-State Generation and Transmission Association Inc. said Jan. 9 that it was closing its 247-MW Escalante power plant in New Mexico by the end of 2020. Since 2014, U.S. power generators retired nearly 62,000 MW of coal-fired generation capacity, with another 26,947 MW of retirements teed up through 2025.

"I would say, overall, utilities seem pretty keen to retire coal … sooner rather than later," Scotia Capital (USA) Inc. analyst Andrew Weisel said in a Jan. 8 phone interview. "I think that a lot of companies, from an investor perspective, they are very focused on [environmental, social and governance]. So, there is a generic interest, not to mention it is what their customers want."

Morgan Stanley & Co. LLC forecast in a December 2019 report that about 70,000 MW to as much as 190,000 MW of coal-fired generation is "economically at risk" from the deployment of a "second wave of renewables" in the U.S. The research firm said these projections exclude about 24,000 MW of coal generation already set to shut down.

"[W]e believe that carbon-heavy utilities that have not historically led the pack in clean energy deployment will accelerate their earnings growth by pursuing a 'virtuous cycle': shutting down expensive coal plants and investing in cheap renewables," the analysts wrote.

U.S. domestic coal consumption for power is estimated to fall another 5% in 2020, said Matt Preston, Wood Mackenzie's research director of North America coal markets.

"Announced retirements are up as more utilities address climate change in their long term planning," Preston said. "Low-cost renewables and gas plus cooperative state commissions make the decision to retire coal units — especially those that need capital to comply with environmental regulations — an easy one."

Coal plant operators in the PJM Interconnection have retired more than 18,800 MW of coal capacity since 2014 with more than 3,100 MW of shuttered coal plants on the horizon.

The Midcontinent ISO will have shut down 20,433 MW of coal capacity between 2014 and 2025 based on completed, approved and announced retirements.

Meanwhile, coal plant operators in the Electric Reliability Council Of Texas Inc. have pulled the plug on 4,973 MW of capacity since 2014. American Electric Power Co. Inc.'s, or AEP's, plans to shut down the 650-MW Oklaunion coal plant in Texas this year is the only announced retirement in ERCOT through 2025, data shows.

While President Donald Trump vowed to bring back the coal industry and rolled out several policy initiatives supportive of the sector, utilities continue to retire coal plants at a more rapid rate than before he took office.

High levels of coal capacity retirements marked both 2018 and 2019, while 2015 remains the peak year for coal plant retirements so far. That year, the U.S. Environmental Protection Agency put mercury emissions standards into effect, and many utilities opted to retire older coal plants rather than retrofit new pollution controls.

Pressured by various stakeholders, many with environmental concerns associated with burning coal, power generators continue to instead turn to natural gas and renewable energy. Meanwhile, a glut of cheap natural gas and falling renewable energy prices are quickening the transition to lower-emission fuels. Power generators with plans to retire coal capacity say they are sticking to those plans despite more favorable policies coming out of the Trump administration.

Targeted advocacy from groups such as the Sierra Club and their Beyond Coal campaign also played a significant role in the U.S. coal sector's precipitous decline over the past several years. In a recent interview, Beyond Coal director Mary Anne Hitt highlighted the group's work to drive a shift away from coal.

"That includes holding coal plants accountable for their air and water pollution and forcing decisions by utilities to either clean up or retire those plants and also making smart economic arguments in front of regulators about the competitiveness of clean energy," Hitt said. "I think it's instrumental and it's also a sign of the role advocacy can play in some of the other sectors of our economy as we get serious about tackling climate change."

Beyond Coal recently celebrated the retirement of the 300th coal plant since 2010 with the announcement that an AEP subsidiary would shut down its 642.1-MW lignite-burning Dolet Hills plant by the end of 2026. The next day, two more coal plants were added to their list.

Several power suppliers retiring coal plants tout their decisions as financially beneficial. Power generator Vistra Energy Corp. recently noted that the retirement of four coal plants in Illinois improved its 2021 adjusted EBITDA forecast by an incremental $100 million as the company pivots focus from coal toward natural gas. Coal units operated by Vistra Energy in the PJM Interconnection are susceptible to retirements over the next 10 years, but those are "not meaningful contributors of EBITDA today," President and CEO Curtis Morgan said on a recent earnings call.

"Retirement of this generation is going to be needed anyway. Most of these coal plants we're talking about are going on 60-plus years old. They're becoming obsolete, and they're not economic," Morgan said in November 2019. "I think any business that is a capital-intensive business, whether it's airlines or chemicals or refining or whatever, have to replace their hardware at some point in time. The question is going to be, what kind of hardware are we going to replace it with? I think it's going to be renewables."

Coal consumption could also decline with utilities looking for ways to reduce coal consumption even if they do not retire all the plants in their fleet. PPL Corp. CEO William Spence suggested on a November 2019 call with investors that some of its larger, baseload coal stations could pair up with variable renewable energy generation. And an Xcel Energy Inc. subsidiary in Minnesota recently proposed operating some of its coal generation assets seasonally in a bid to lower overall costs and emissions.

Moody's Investors Service projected coal could make up as little as 11% of U.S. power generation by 2030 based on scheduled and likely coal retirements alone. Similarly, Morgan Stanley projected under a base-case scenario that coal-fired electricity will decline from 27% of the total U.S. power mix in 2018 to just 8% by 2030.

If lawmakers roll out policies to limit carbon dioxide emissions, coal plant retirements could even outpace analysts' current projections.

"The big dynamic, but this would likely require a Democrat Senate as well as a Democrat president, would be carbon pricing," Morgan Stanley analyst Stephen Byrd said in a December 2019 interview. "That was one thing, I guess it surprised me a little bit, but when we ran the numbers even at a price of say, $20 a ton, that would cause [almost] every coal plant in our model to screen uneconomic."

Still, many generators currently see a place for the remainder of their coal-fired generation.

"There's no question that at certain times of the year, the fossil generation fleet is what carries the day," AEP Chairman, President and CEO Nicholas Akins said in a November 2019 interview with S&P Global Market Intelligence. "If the wind's not blowing, there's the need for these types of resources. They will be there as more of an insurance policy."

Weisel, however, noted that "more and more companies, not all, are retiring coal plants sooner than expected and replacing them with renewables."

"I think most companies would be happy to replace all of their coal with renewables if they could maintain reliability," Weisel said. "My personal view is that until [battery] storage becomes more economic and more technologically reliable, there is not that much more wood to chop as far as coal plant retirements."

Weisel added that the pressure at the local level to keep coal plants operating is "very real" given the economic impact of a coal plant retirement. "So, there is definitely a lot of those factors beyond reliability," the analyst said.

"The key thing I would think about though is it used to be that a utility had to choose between being dirty and cheap or clean and expensive," Weisel added. "The overarching trend, of course, is that you have had such technological advancements in renewables that you can now be both clean and cheap."