Fossil Fuel Financing Falls in 2020 Amid COVID-19, Environmental Groups Find

By Jennifer Laidlaw

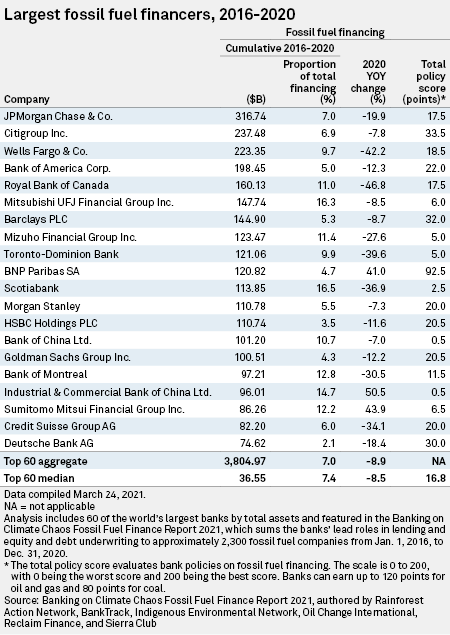

April 7, 2021 - Fossil fuel financing fell by 9% in 2020 as the COVID-19 pandemic halted demand and production, but overall bank funding of the fossil fuel industry in 2020 remained higher than in 2016, the year after the 2015 Paris agreement on climate change was signed, according to a new report from a group of environmental advocacy organizations.

In 2020, 60 of the world’s largest commercial and investment banks financed $750.73 billion to the fossil fuel industry, down from $823.68 billion in 2019, but above $709.23 billion in 2016.

Stranded Asset Concern

Investors and regulators have grown increasingly concerned about long-term climate risks, fearing that if industries like coal and gas become obsolete, financial institutions will be left with stranded assets. As a result, lenders have been adopting policies to phase out fossil fuel funding and to bring their lending into line with the Paris agreement, which aims to limit warming at the end of this century to well below 2 degrees C measured against preindustrial levels, with signatories agreeing to strive for a 1.5-degree C goal.

"The overall fossil fuel financing trend of the last five years is still heading definitively in the wrong direction, reinforcing the need for banks to establish policies that lock in the fossil fuel financing declines of 2020, lest they snap back to business-as-usual in 2021," the report said.

The sponsors of the report — the Rainforest Action Network, BankTrack, the Indigenous Environmental Network, Oil Change International, Reclaim Finance and the Sierra Club — advocate the complete elimination of funding for fossil fuel projects. The figures come from Bloomberg Finance, energy research consultancy Rystad Energy, and Urgewald, a German environmental nongovernmental organization.

U.S. companies ranked as the largest lenders to fossil fuel projects, with JPMorgan Chase & Co. providing the highest amount of funding between 2016 and 2020. But the bank's overall fossil fuel financing fell 20% from 2019 to 2020. In October 2020, JPMorgan announced plans to bring its financing into line with the goals of the Paris agreement, which aims to achieve net-zero emissions by 2050. The bank’s fossil fuel financing stood at $51.30 billion in 2020, down from $64.04 billion in 2019 and $63.73 billion in 2016.

'Skepticism'

Citigroup Inc. provided the second-highest amount of funding to fossil fuels over the five-year stretch. While its lending decreased to $48.39 billion in 2020 from $52.50 billion, it was still higher than the $42.64 billion provided in 2016. At the beginning of March, the bank committed to reach net-zero greenhouse gas emissions by 2050 and will publish an initial net-zero emissions plan within the next year.

Wells Fargo & Co. and Bank of America Corp. took third and fourth position, respectively. Wells Fargo also announced plans in March to reach net-zero emissions by 2050, while Bank of America in February outlined initial steps to achieve net-zero greenhouse gas emissions in its financing, operations and supply chain activities before 2050.

However, the environmental groups said that net-zero commitments are "inadequate" and should be "met with great skepticism unless they are accompanied by 2021 action on coal, oil, and gas."

Among European lenders, Barclays PLC was ranked as the biggest financer of fossil fuels, while France's BNP Paribas SA was the 10th-largest. The report noted that French peers Société Générale SA and Crédit Agricole SA had also increased their fossil fuel financing.

French banks are generally regarded as among the leading European lenders in tackling climate change, helped in part by France's policies on climate change. The country passed a law in 2015 designed to make the financial sector and publicly traded companies more accountable for sustainability. For example, France requires asset managers to report how they account for climate change when making investment decisions. Publicly traded companies must include climate change risks in their financial reporting.

The report also scored banks on their policies, and French banks had among the strongest — BNP Paribas for restricting unconventional oil and gas, and Crédit Agricole for phasing out coal financing. Italy's UniCredit SpA had the strongest fossil fuel polices overall, the report concluded. Unicredit plans to phase out coal sector financing totally by 2028.