.gif)

|

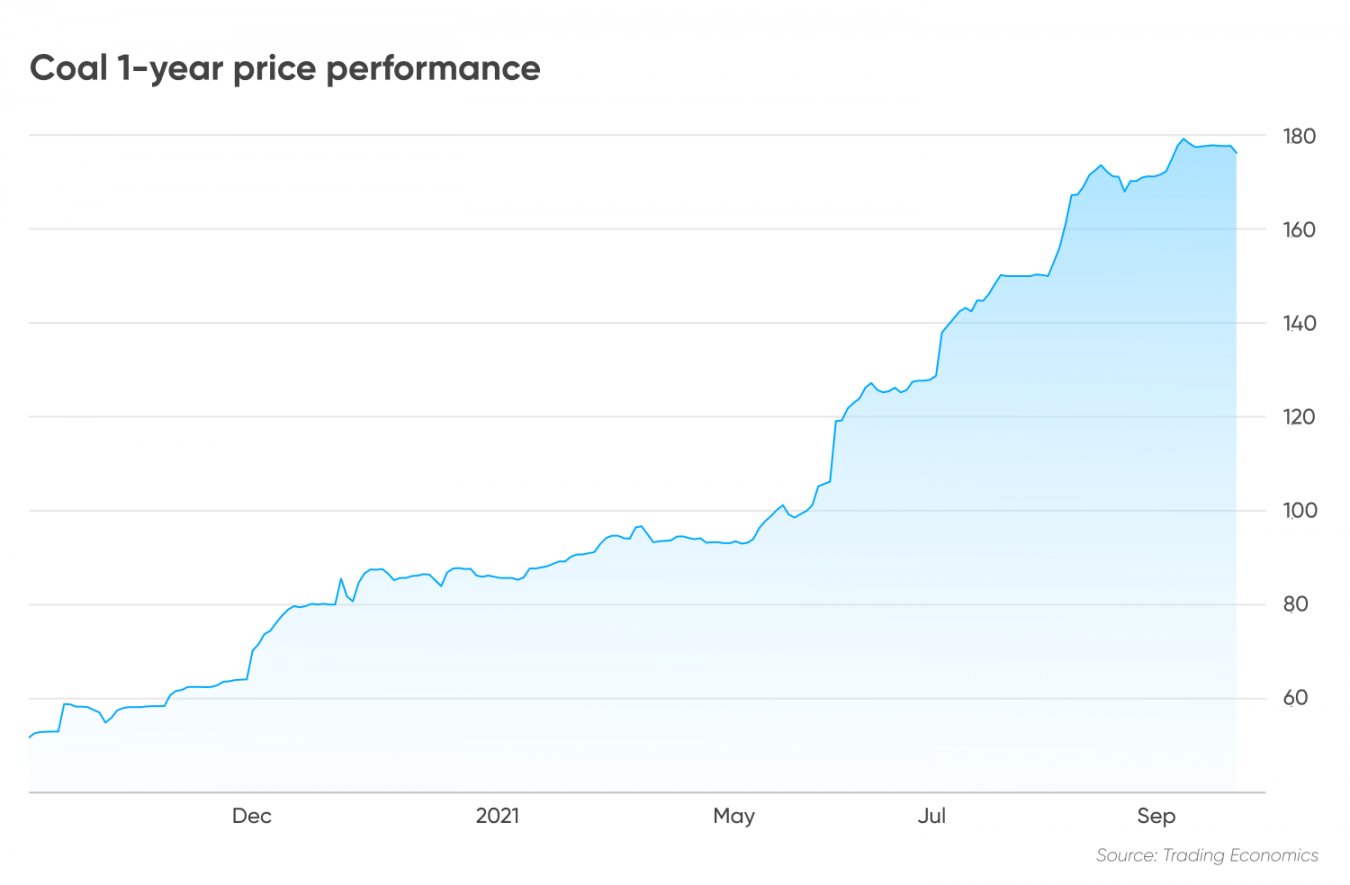

Signature Sponsor

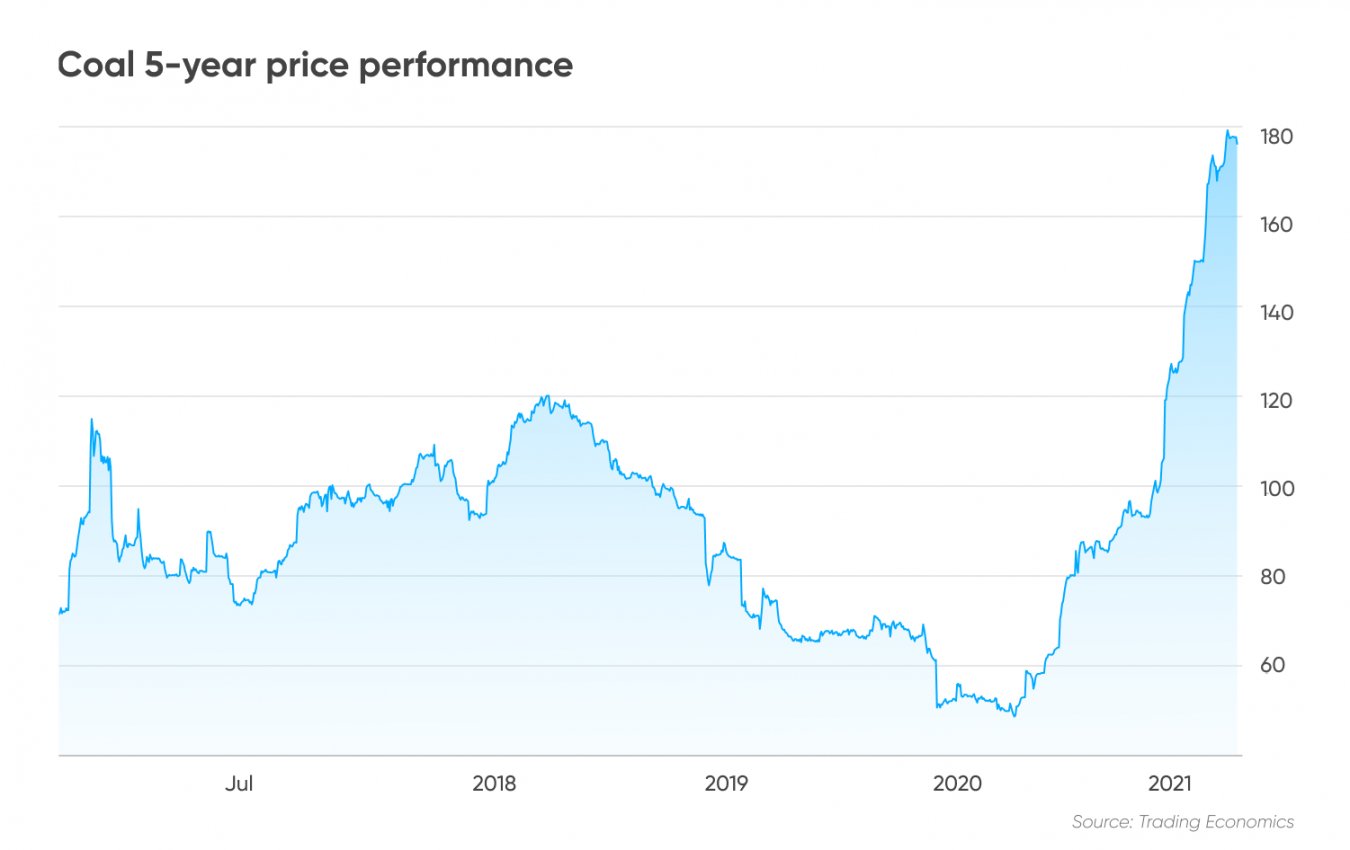

September 18, 2021 - A combination of surging coal demand – particularly from China, supply constraints in major producers, and tight natural gas supply have resulted in multi-year highs for thermal coal prices. As a result, Newcastle coal price index, the benchmark for Asia, hit an all-time high of $179 per tonne in September, according to economic data provider Trading Economics, nearly triple the price at the end of 2020. The surge in coal demand and prices came amid calls for decarbonisation which foresees coal demise in the long term. But coal prices rally enough to make Keith Pitt, Australia's minister for resources and water, confidently say that "coal's impending death reports are greatly exaggerated." The article will discuss an overview of the thermal coal market, coal price analysis, and coal mining industry outlook.

Thermal coal market overviewThermal coal's demand slumped last year when COVID-19 wreaked havoc across the world. Global coal demand fell by 4% in 2020, the biggest drop since World War II as COVID-19 restrictions led to lower electricity use and the resulting economic downturn, according to the International Energy Agency in Global Energy Review 2021. Preferential use of renewable energy in many markets and lower natural gas prices saw users switching away from coal last year, IEA noted. With demand muted, thermal coal prices took a nosedive to as low as $48 a tonne last year.

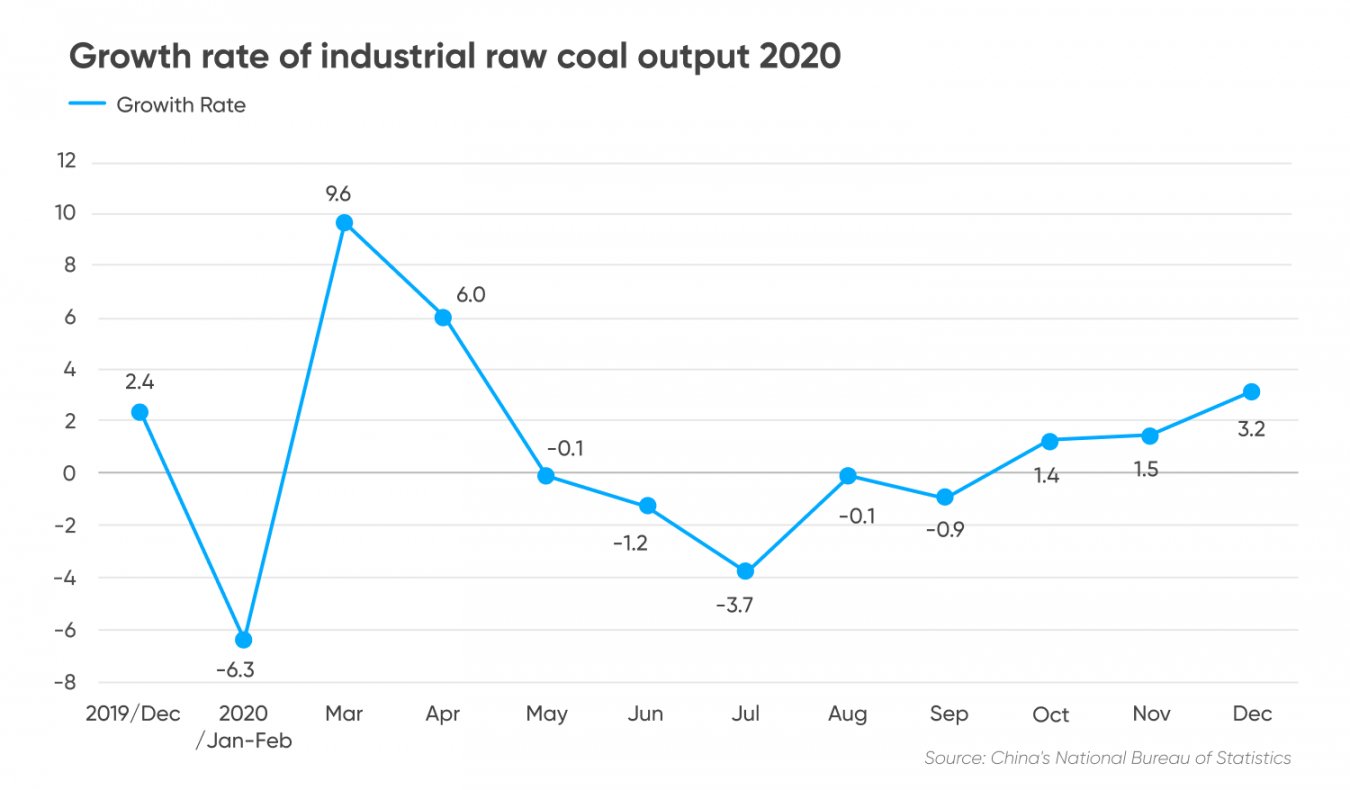

Coal showed signs of life in the last quarter of 2020. A colder winter swept through northeast Asia, raising electricity demand for heating at key Asian coal buyers – Japan, South Korea, and China. Particularly for China, demand did not come only for winter heating but also for its industries which started to recover as the country's economy rebounded after controlling the coronavirus pandemic. But Chinese coal miners could not catch up with the rising demand, partly due to stricter mine safety inspections. In November 2020, China launched year-long safety inspections on coal mines to prevent accidents, Reuters reported. The policy had the effect of curbing the country's domestic coal output. In addition, the country had imposed restrictions on imports of Australian coal due to a trade spat between the two countries. This forced Chinese buyers to find alternative suppliers. In December 2020, China imported 39.08m tonnes, a 43% increase from 27.32m in the previous month, according to data from China's National Bureau of Statistics. In 2020, China imported 304 million tonnes of coal, rising 1.5% from the previous, data showed.

Coal mining industry outlook: supply constraintsWhile demand from Asia started to climb, key producers Indonesia and Australia, which supply more than half of global coal exports, struggled to increase their output. Heavy rains brought by the La Nina weather phenomenon had slowed mining in Indonesia, the world's largest exporter of power-station coal, and delayed shipments from Australia. Torrential rain often floods coal mines in Indonesia's central coal-producing provinces of East Kalimantan and South Kalimantan. Wet weather also hampered deliveries as many Indonesian miners ship coal to transhipment vessels on open seas. Why thermal coal prices in Asia hit new highsSupply constraints and surging demand have continued well into 2021, creating a boost for power-station coal in Asia. Bloomberg reported that in March, heavy rains and strong winds hampered production and shipments in Australia's key coal producers Hunters Valley and Port of Newcastle. In Indonesia, prolonged wet weather has deterred miners from increasing production. At the same time, China's economy was expanding, rising power demand to fuel its industrial activity. As a result, the world's second-largest economy still grew 7.9% year-on-year in the second quarter of this year, despite significantly slowing from 18.3% expansion in the first quarter. This summer, heatwaves also swept through several countries. Extreme hot spells increased electricity demand for air-conditioning. Dry weather can also reduce hydropower capacity, which prompts utilities to switch to fossil fuels. "The short version is that demand has returned, but supply has not," said Dale Hazelton, research director at energy research and consultancy firm, Wood Mackenzie, to Capital.com.

Hazelton said that renewables have also been underperforming in many areas due to weather and drought, prompting a switch to coal. These have sent coal prices to hit multi-year high since March. In September, Indonesia raised its monthly coal benchmark price or Harga Batubara Acuan (HBA) to $150.03 a tonne, a 30% increase from July's price. Newcastle coal prices have steadied at $177 a metric tonne after hitting an all-time high of $179 a tonne this month, according to Trading Economics. Coal market forecast: IEA outlookCoal demand is forecast to stay robust until the end of 2021 as more coal-consuming countries, particularly in Asia, are set to reopen their economy. IEA forecasts recovering economic activity in 2021 to reverse 2020's decline in coal demand. Global increase by 4.5%, above 2019 levels, with a 4.5% increase pushing global coal demand above 2019 levels. According to this IEA, the rapid increase in coal-fired generation in Asia will account for three-quarters of the rebound in 2021. China's coal demand is forecast to rise by 4% this year, according to IEA. Chinese coal power fleet represents around one-third of global coal consumption, the agency noted. "The future of both Chinese and global coal demand depends on the Chinese electricity system," IEA said.

India's coal consumption is seen rising by 9%, after dropping to the lowest in many years in April 2020 due to the 2019 economic slowdown and followed by COVID-19 lockdowns, the agency estimated. China and India were the two largest coal importers in the world in 2020, according to IEA. "The problem is economic recovery is uneven. Key consumers, China and India, have their economy rebounded fast. But the economy in producing countries has been slow to recover," said Ahmad Zuhdi, an industrial analyst at Indonesian state-owned lender Bank Mandiri's Office of Chief Economic in Jakarta.

"The demand is there, but supply is chaotic," he added. Zuhdi added miners are still facing challenges this year to increase production, ranging from a shortage of vessels, mobility restrictions related to COVID-19, and problems in ordering heavy equipment. Coal market news: tight supply to persistRising demand amid supply crunch has bitten. Earlier this month, Reuters reported that India urged utilities to import more coal as coal-fired power generation surged in the world's third-largest economy, after it eased COVID-19 restrictions. Some utilities were reportedly on the verge of running out of fuel. With the resulting surge in prices, tight supplies have prompted China to reopen 67 million tonnes of open-pit mines in the Inner Mongolia region. Beijing has also approved new production capacities and requested miners to increase output as the country wanted to secure supply for the winter. Hazelton of WoodMac estimated the coal supply and demand balance to stay tight through 2023. "One possibility is if China can significantly increase domestic supply at a lower cost than imports," said Hazelton. "No other regions seem likely to significantly increase coal production to the amount that would be needed to rebalance the market," he added.

WoodMac forecast Australian thermal exports are forecast to be flat this year compared to 2020 and only slight growth next year of 3-5%. Indonesian exports are set to be up 8-10% year-over-year, but the growth rate will slow in 2022 to 1-3%. Coal price forecast 2021: short-term outlookAnalysts were bullish on coal prices for the remainder of the year due to supply constraints. WoodMac forecasts prices to stay strong through the winter. "The supply issues have continued throughout the year. While supply will improve towards the end of the year, winter demand will offset the gains," said Hazelton.

Fitch Ratings forecast Newcastle coal with 6,000 kcal/kg will average $115 a metric tonne this year, nearly double from $60 a metric tonne. But prices will retreat to $87. The rating agency said Beijing's measures to ramp up domestic coal output and seasonally weaker demand in September and October should help moderate prices from the current high levels. Bank Mandiri's Office of Chief Economist forecast Newcastle coal prices to average $112.7 a metric tonne this year. "Demand will remain high until the end of the year. India is set to normalise. Coal consumption in Japan and South Korea is also relatively high. Moreover, coal is still the cheapest fuel to support base load in power plants," said Zuhdi.

Energy transition clouds long-term coal price predictionThe coal prices rally, however, may only last for a couple of years. Analysts were of the view that coal prices may retreat after 2023 on push to reduce carbon emission. Key coal buyers have set their targets to achieve net zero-emission. China will strive to peak carbon dioxide emissions before 2030 and achieve carbon neutrality before 2060. The country also plans to limit coal-fired generation and address coal consumption more strictly. Japan and Taiwan have set a target to achieve carbon neutrality by 2050. "Many countries are not ready right now to phase out coal, but coal supply will be increasingly limited in the next two years because of growth in renewables investment," said Zuhdi.

Wood Mackenzie forecast in July that global imports of seaborne thermal coal are projected to be about 600 million tons a year by 2050, down 37% from this year's level. "By the second half of the 2040s, China's imports are projected to be about 50 million tons a year, roughly a quarter of this year's level," wrote Ed Cook, Wood Mackenzie's Vice-Chair Americas in July. Fitch Ratings has maintained its forecast for Newcastle coal price at $64 a tonne in 2024 and $63 a tonne in long-term. "We anticipate that pressures to reduce coal power generation in many key markets consuming Australian coal will eventually lessen coal demand and help normalise the seaborne prices," it added. Coal mining stocks to watchThe recent coal price rally can bode well for the coal mining stocks performance. At Capital.com you can follow and track various coal producers, including China Coal Energy Company Limited, Yanzhou Coal Mining Company Limited and China Resources Power Holdings Company Limited in real time and consider trading their shares with contracts for difference. CFDs enable you to try to profit from both positive and negative price fluctuations. If you expect the share price to rise, you can open a long position. If you think it will fall, you can go short. Note that CFDs are leveraged products and you can use leverage to open significantly larger positions with a smaller amount of initial capital. Be aware that while leverage can maximise gains, it can also increase your losses if the asset’s price moves against you. Make sure you understand how CFDs work before you start. And never invest money you cannot afford to lose. Learn more about CFDs with our comprehensive guide. |

|