Coal Finance: Polish Banks Call For More State Support to Aid Transition

By Beata Fojcik

November 4, 2021 - Poland's biggest lenders warned that green financing will require further regulatory support and economic incentives if the country is to be successful in its plans to reduce its dependence on coal.

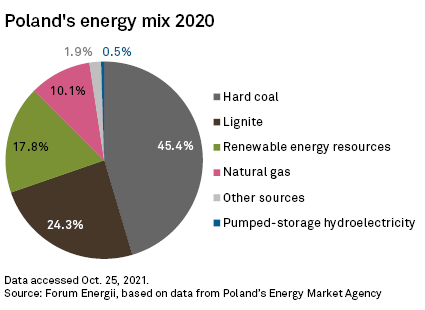

Poland was responsible for 96% of total EU hard coal production and 43% of total EU hard coal consumption in 2020, according to Eurostat. It is also one of the top consumers of lignite, widely considered the most polluting form of coal, and home to Be?chatów Cogen Plant, Europe's largest and most polluting power plant.

The implementation of Poland's 2040 energy policy, which lays out the country's plans for green transformation, is estimated to cost 1.6 trillion zlotys, or about 80 billion zlotys on average per year, a burden that will partly be funded by banks, Leszek Skiba, CEO of Polish lender Bank Polska Kasa Opieki SA, told S&P Global Market Intelligence.

"The effort related to the energy transformation is unprecedented," Skiba said. "This is due to both the wide range of planned activities and high-level ambitions."

The value of loans provided to Polish companies involved in dirty, mainly coal-related investments amounted to the equivalent of roughly 36 billion zlotys between October 2018 and October 2020, according to figures provided by Polish pro-climate organization Rozwój Tak-Odkrywki Nie.

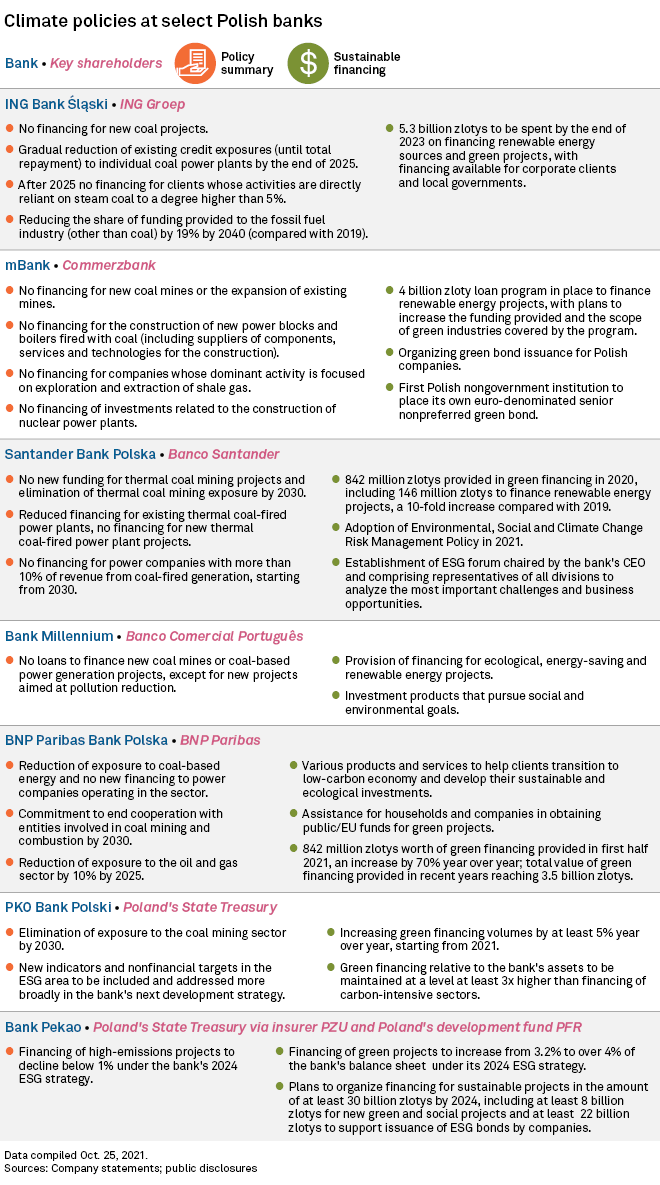

Poland's biggest banks told Market Intelligence they have been working on phasing out their exposures to coal and other high-emissions industries. In the case of Polska Kasa Opieki, better known as Bank Pekao, high-emissions financing amounts to 1.3% of its balance sheet.

Carbon assets at ING Groep NV subsidiary ING Bank Slaski SA constitute less than 1% of its loan book, while Commerzbank AG unit mBank SA's corporate exposure to industries related to coal and other fossil fuels is 1.5%, the respective lenders said. The exposure of Banco Comercial Português SA unit Bank Millennium SA to the coal mining and coal-based energy industry accounted for 0.6% of its total portfolio in 2020, according to information available on the lender's website.

Banks will not only serve as one of the main sources for financing the green transformation but also act as intermediaries in the distribution of EU funds allocated for this purpose, said Micha? Mi?owski, environmental, social and governance specialist at mBank. The bank foresees a rapid development of ESG investment products and anticipates that they will be a driving force behind the growth of its AUM in the coming years.

Big Polish banks already have strategies in place under which they no longer offer new loans to the coal mining sector and coal-fired power stations. Many of them also have targets in place to completely eliminate coal sector exposure.

Regional green finance hub

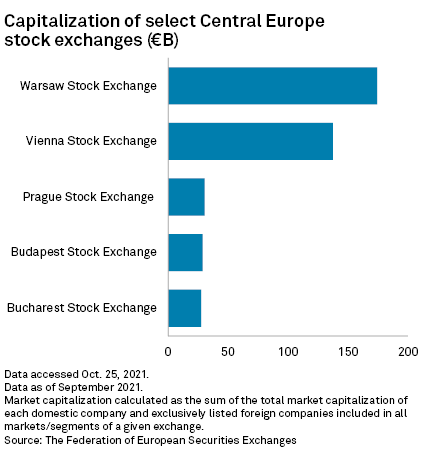

Poland has the potential to become a regional green finance hub if the right conditions are in place, Katarzyna ?redzi?ska, manager for sustainability consulting in central Europe, and Aleksander ?aszek, manager for sustainability and economics, at Deloitte told Market Intelligence. "Poland's capital market is highly developed compared to other markets in the region, and the Polish stock exchange is far ahead of others in terms of capitalization, liquidity or the number of IPOs," they noted.

However, while Polish banks say they are keen to finance the green transition, they want the Polish state to address a number of issues that could hamper the process. The lenders call, among other things, for the exclusion of green assets from the country's bank assets tax and for the reduction of capital requirements on such assets.

"There is no strategy for the transformation of individual economic sectors, no strategy to develop green financing, no certification and data collection/monitoring systems, and finally … no clear political support for the idea of green transformation of the Polish economy," a spokesperson for Santander Bank Polska SA, Banco Santander SA's Polish unit, told Market Intelligence. "Polish banks know and are convinced of their important role in the process of economic changes and want to actively support it, but without changes in public policy it will be much more difficult."

BNP Paribas SA's Polish unit BNP Paribas Bank Polska SA would like the banking sector to be included in drafting public programs and policies so that private and banking funds could be used more effectively at a later stage.

ING Bank ?l?ski believes Polish authorities should provide various kinds of top-down support systems in the initial phase of the transformation, as this would lower funding risks for the banking sector. "However, it is important to intelligently control these types of instruments so that the sector can be profitable also without state aid in the later stages of the development," said Micha? Szalast-Dao Quy, relationship manager in the lender's energy department.

The banks also pointed to the uncertainty regarding the future regulatory status of certain technologies or energy sources, for example, gas or nuclear. Gas could be an important source of energy for Poland and other central and Eastern European countries as they move away from coal. The European Commission published the first set of green taxonomy criteria in April, but the question of whether and how to include natural gas in the taxonomy will be addressed in a separate proposal later this year, with countries such as Poland seeking for gas to be recognized as a transition fuel.

"The current regulatory situation regarding nonfinancial reporting at EU level is very uncertain, final arrangements are pending regarding the definition of sustainable/green assets, and data availability is limited. Clarifications at the national level would help reduce this uncertainty," mBank's Mi?owski noted.

Some Polish banks and market participants are also concerned about the lack of green initiatives to back. "There are fewer green projects in Poland that the country's banking sector could finance, and finding reliable and well-thought-out projects is a challenge. Entities that attract such initiatives from the market will be able to build their advantages in the future. They will also become leaders that other institutions will follow," the Deloitte analysts noted.

This opinion is echoed by Skiba. "It is worth emphasizing … that domestic financial institutions are well prepared to finance the transformation," the Pekao CEO said. "There will be no shortage of funds for this purpose. Restrictions are rather on the side of investors, and thus the supply of green projects."

As of Nov. 3, US$1 was equivalent to 3.97 Polish zlotys.