US Coking Coal Supply Response Remains Constrained

By Brendan Kjellberg-Motton

November 6, 2021 - The financial, infrastructural and labour market environment around North American coking coal continues to limit the industry's ability to keep pace with demand, which is forecast to remain strong in 2022.

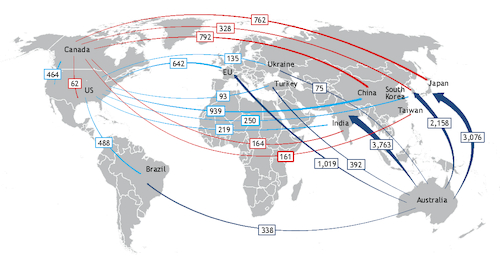

US third-quarter exports recovered by 11.74pc compared with a year earlier to 10.33mn t, driven by a sharp rise in Chinese demand following China's informal ban on Australian coals in October 2020. Shipments to most traditional buyers in Europe and Latin America, despite the significant recovery of steel production in those regions over the same period, fell as US suppliers sought to take advantage of historically high spot prices in China. US shipments to the EU fell by 21.4pc year on year to 2.05mn t in the third quarter, while shipments to Brazil fell by 33.3pc to 1.14mn t.

US exports to China totalled 3.48mn t in the third quarter, an increase of 51pc compared with the previous quarter, but fell below 1mn t for the first time in three months in September, to 939,405t. Shipments to most other destinations rose on a monthly basis in September as the increase of Australian prices to record levels made shipments to destinations outside of China more attractive.

But US exports fell by 17pc compared with the third quarter of 2019. This decline was largely supply-led, with US coking coal output falling by roughly 15pc over the same period, as indicated by a survey of Mine Safety and Health Administration (MSHA) data constituting the bulk of US coking coal production. Mining firms reduced production sharply last year in response to Covid-19, and the return of supply so far has not kept pace with the recovery and growth of demand. The impact of the Covid-19 pandemic triggered a labour shortage in the coal mining and transport industries, and an effort among global banks to support the decarbonisation of the steel sector has constrained new capital availability for coal producers. "We do not anticipate these conditions changing any time soon," said US mining firm Ramaco Resources this week. "Nor do we sense that there will be any near-term supply response sufficient to balance demand for the foreseeable future."

Mining companies will continue to raise output where possible and will gain some ground on demand, with global steel demand forecast to grow by 4.5pc on the year in 2021 to 1.85bn t. Ramaco plans to raise its annual coking coal production capacity by 50pc to 3mn short tons (st) by the second quarter of 2022, while Arch expects to reach full production levels of 4mn t/yr at its $400mn Leer South mine by early 2022. Alpha expects to ship 14-15mn st in 2022, compared with a projected 13-14mn st this year. Warrior expects that without a resolution to the ongoing strike, its production and sales volume over a 12-month period could be 5.5mn-6.5mn st, compared with the annualised rate of 4.4mn st in the third quarter. This increase could possibly include restarting Mine 4, the company said. With a resolution to the strike, the firm expects that it could ramp up to a run rate of approximately 7.5mn st/yr within 3-4 months.

But the increased production will be slower than in previous years and held back by ongoing disruptions on Appalachian rail networks. Federal Reserve chairman Jerome Powell on 22 October warned that US supply chain woes could extend well into next year. Thermal coal shipments through US ports rose by 84.1pc in the third quarter to 9.33mn t, adding to the pressure on rail and port operators.

In Canada, wildfire damage to rail systems serving major producer Teck limited the country's third-quarter exports to 6.17mn t, 2.21pc higher than a year earlier but 12.2pc lower than in the second quarter.

Key coking coal exports in Sep '000t