.gif)

|

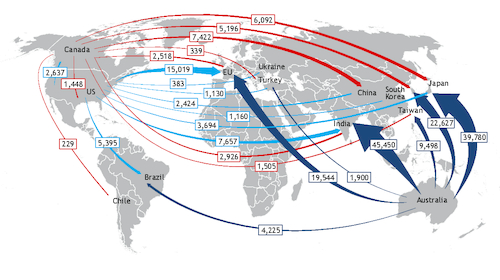

Signature Sponsor

By Brendan Kjellberg-Motton March 22, 2023 - Significantly higher shipments to India and the EU and higher output lifted US coking coal exports in 2022, offsetting a sharp fall in exports to China. US exports totalled 42.1mn t in 2022, trade data show, 3.2pc higher than a year earlier, while US coking coal output increased by around 3pc, according to Argus estimates. Russia's invasion of Ukraine in February 2022 and subsequent sanctions imposed on the import of Russian coal triggered a sharp increase in European buying from the US. US shipments to the EU increased by 42.2pc to 15.02mn t in 2022. Shipments to India increased by 136.7pc to 7.66mn t, as the country's steel output rose by 5.5pc to 124.7mn t. Shipments to China fell by 76.6pc to 2.42mn t in 2022. Buyers were largely out of the market for US tonnes at the start of the year as mills consumed an estimated 6mn t of stranded Australian coking coal cargoes cleared by customs from October 2021 onwards, and demand for US material remained subdued for the rest of the year as Mongolian and Russian imports covered the bulk of Chinese import requirements. Chinese imports from Russia almost doubled in 2022 to 21mn t. US shipments to Japan rose by 21.8pc in 2022 to 3.69mn t, largely driven by a period of strong precautionary buying at the start of the Russia-Ukraine war, and by robust demand towards the end of the year as Japanese buyers increasingly turned away from Russian coal. US coking coal output increased by approximately 3pc to 65-70mn short tons (st) in 2022, according to a survey of mines, accounting for the bulk of US production. A period of then-record high prices towards the end of 2021 boosted mining firms' ability to invest in new capacity, while a period of even higher pricing following the start of the war in Ukraine provided further incentive to maximise production. Argus' daily fob Australia assessment for premium low-volatile coking coal peaked at $663.80/t on 14 March 2022 while high-volatile A reached a high of $510/t fob Hampton Roads on 17 March last year. A large proportion of US business is priced with linkages to the Australian index. Major producer Arch's production of high-volatile A coking coal increased by 25.2pc to 6.3mn st in 2022, Mine Safety and Health Administration (MSHA) data show, as the company continues to ramp up its Leer South mine towards its planned 4mn t/yr capacity. Ramaco increased its production by 20.7pc to 2.68mn st last year after it brought new mines into operation at its Berwind and Knox Creek complexes. Full-year output at Warrior's Blue Creek 7 mine inched lower by 0.79pc to 47.9mn st, as the company maintained stable production despite the ongoing strike at its operations. But union the United Mine Workers of America has since instructed its members to return to work at Warrior's mines on 2 March, and with Arch and Ramaco still to add more capacity, it is likely that US output will increase again in 2023. Coronado's production of low-volatile coking coal at its Buchanan mine fell by 11.1pc in 2022 to 4.31mn st, because of disruptions to production in the second quarter. Blackhawk's production of high-volatile coking coal increased by 7.24pc to 6.22mn t, as the potential for crossover sales into the thermal market at high price levels incentivised higher output at high-volatile mines. Canadian exports totalled 28.06mn t in 2022, an increase of 6.75pc, boosted by higher shipments to Japan, South Korea and India. Shipments to Japan and South Korea increased by 14.5pc and 14.8pc, respectively, to 6.09mn st and 5.2mn t, while shipments to India increased by 44.8pc to 2.93mn t. These increases offset a fall of 19.3pc in shipments to China, to 7.4mn t.

Key coking coal exports 2022 '000t

|

|