The Role of Coal in the Energy Supply of the EU-28

By Hans-Wilhelm Schiffer, Executive Chair, World Energy Resources, World Energy Council

April 2, 2017 - The European Union (EU-28) is one of the largest economies in the world, with a gross domestic product (GDP) of €14,635 billion in 2015. It has 508 million inhabitants, or 7% of the world´s population. Coal has played, and still plays, an important role in covering the energy needs of the EU-28. This article reflects on the role of coal within Europe in the past, at present, and in the future.

Structure of the EU Energy Supply

In 2015 the total primary energy consumption of the EU-28 was 2332 million tonnes of coal equivalent (Mtce). That ranks the EU as the third largest energy market worldwide—after China and the U.S. Table 1 gives the total primary energy consumption of the EU by energy sources in comparison with the global average energy mix.

TABLE 1. Primary energy consumption mix globally and in the EU-28 in 2015.

Source: BP Statistical Review of World Energy June 2016

A significant difference is the lower share of coal in primary energy consumption. In contrast, there is a higher contribution of nuclear energy in comparison to the global average. The share of non-hydro renewables, particularly wind and solar, in total primary consumption exceeds the global average by a factor of three.

The energy production within the EU-28 by energy sources in 2015 was:

- Other renewables: 194 Mtce

The share of production (including nuclear energy) in the total primary energy consumption was 45%. The energy import dependence of the EU was 55% accordingly.

Globally, the EU-28 has become the largest energy importer. The EU´s energy import was one-fourth the total worldwide trade in oil, gas, and coal. In contrast, the EU´s share in global primary energy consumption was only 12.4% in 2015. The import dependence in the case of oil and gas is particularly high, 88% and 70%, respectively. The share of imports in total coal consumption was 45%.

The import dependence of the EU´s energy supply has increased over the last decade. The main reasons for this were the halving of EU oil and gas production and a decline in the production of coal by 17%. The trend of increasing import dependence would have been even stronger were it not for a doubling in the consumption of renewables.

The lack of diversification in the supply sources for oil and gas are concerning from an energy security point of view. Russia is the largest supplier of oil and gas imports. Four EU member-states procure their entire supply of natural gas exclusively from Russia: Estonia, Latvia, Lithuania, and Finland. The countries of Central and Eastern Europe, such as Poland, Czech Republic, Slovakia, and Hungary, cover between 50 and nearly 100% of their annual gas consumption via imports from Russia. Because some of the region´s gas comes via Ukraine, it risks transit disruptions due to Ukraine´s situation as well as Russia-related risks. This high dependence on a single supply source makes some EU countries susceptible to supply disruptions. Ten years after Russia cut off gas supplies to Ukraine and Europe in the winters of 2006 and 2009, and in the midst of the 2014 Ukraine crisis, concerns about a potential politically motivated disruption of gas supplies from Russia, and especially those that pass through Ukraine, triggered a discussion on creating an Energy Union to counter this threat.

In fact, Russia is also the most important single supplier of coal. However, the supply options for coal are numerous, and thanks to the existing infrastructure, even the loss of the largest supplier could be offset with deliveries from other sources—unlike the situation for gas.

The EU Regulatory Framework and its Effects on the Energy Mix

At the beginning of 2015, the EU Commission presented plans for a European Energy Union based on the strategic framework of the Commission and featuring five closely connected dimensions: energy supply security, solidarity, and trust; single energy market; energy efficiency; reduction of CO2 emissions from economic activities; research, innovation, and competitiveness. The Energy Union has the following specific objectives:

- Energy dependency is to be reduced and investors are to be given planning security by the EU´s efforts to develop new sources, especially natural gas sources. Coal as a domestic energy source found in abundance in Europe is not mentioned specifically. The European Council wants to improve “the utilization of domestic sources”, however, and coal is one of these sources.

- A strategy for the import of more liquefied natural gas (LNG) and for increasing energy efficiency is to be prepared with the aim of making the energy system “fit for a society low in carbon”.

The prosperity and security of the EU depend on a stable and adequate supply of energy. Consequently, the Commission has developed a strategy for a secure European energy supply that fosters resilience against energy supply disruptions in the short term and reduces dependency on certain fuels, energy suppliers, and supply channels in the long term.

The energy mix of EU countries differs markedly, due not only to differing resources but also to the wide variety of national energy policies adopted over the years.

Thus, power generation in France is based on nuclear energy. In contrast, Germany has decided to phase out nuclear energy by the end of 2022. As a result of political support in Germany, the share of renewables in total power generation reached 29.0% in 2015. This represents a fivefold increase since 2000. Hydropower has the highest share in power generation in Austria and in Sweden. Wind energy has a strong position in Denmark. In the Netherlands, gas is the most important energy source for power generation. Coal dominates power generation in Poland with a share of more than 80%. Of the UK´s electricity generation in 2015, coal accounted for 22.6 %—a decrease of 7.1 percentage points on 2014 due to plant closures and conversions. In 2015, the British Secretary for Energy and Climate Change proposed a consultation on the closure of all coal-fired power plants without CCS by 2025. A week later, the UK government cancelled its £1 billion funding of the flagship White Rose CCS project.

Coal Supply in 2015

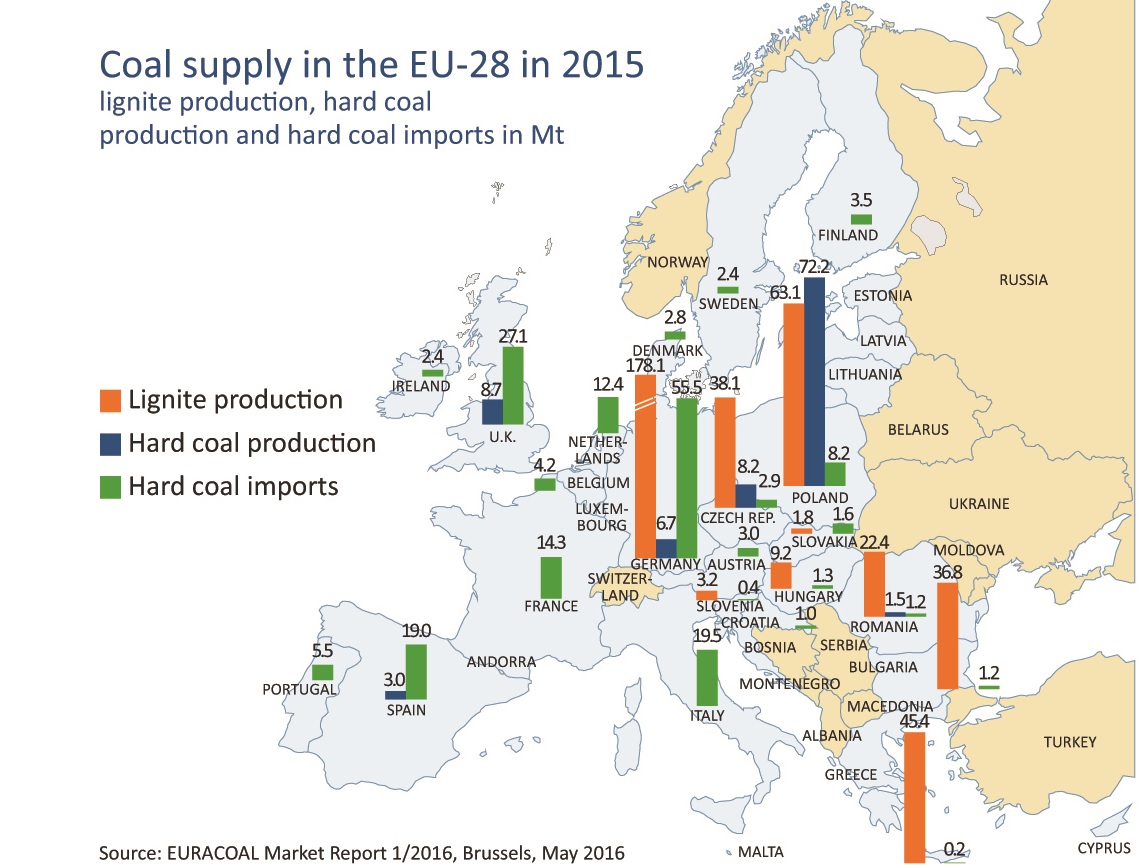

Figure 1 shows the total coal supply breakdown in 2015 for Europe. The total production of hard coal in the EU-28 was 100.3 Mt in 2015. Poland was the most important producer with 72.2 Mt, followed by the United Kingdom with 8.7 Mt, Czech Republic with 8.2 Mt, Germany with 6.7 Mt, Spain with 3.0 Mt, and Romania with 1.5 Mt. The total brown coal production in the EU-28 was 398.1 Mt in 2015. Germany is the most important producer of brown coal within the EU. The production of brown coal, classified as lignite, was 178.1 Mt in 2015. Other major producers of brown coal in the EU are Poland (63.1 Mt), Greece (45.4 Mt), the Czech Republic (38.1 Mt), Bulgaria (36.8 Mt), Romania (22.4 Mt), Hungary (9.2 Mt), Slovenia (3.2 Mt), and Slovakia (1.8 Mt).

FIGURE 1. Coal supply in the EU-28 in 2015.

The coal supply of the EU-28 was supplemented by 191.6 Mt of hard coal imports (including anthracite) in 2015. In 2015, the most important such importers were Germany (55.5 Mt), the United Kingdom (27.1 Mt), Italy (19.5 Mt), Spain (19.0 Mt), France (14.3 Mt), the Netherlands (12.4 Mt), and Poland (8.2 Mt).

Domestic production and consumption of coal has declined in the EU over the past two decades. However, domestic production of hard coal and lignite represent a significant share in total coal supply, 55% in 2015—after conversion of the different categories of coal into energy quantities using standardized heating values.

Imported coal can also be classified as secure in supply as the import sources are well diversified. Global coal reserves remain plentiful and are found around the world. On an energy basis, proven reserves of coal, essentially an inventory of what is currently economic to produce, are much greater than those of oil and gas combined, and are sufficient to supply more than 100 years of production at 2015 levels.

Role of Coal in the Energy Supply Market

The power and heat sector dominates coal demand in the EU, accounting for more than 75% of the total coal demand. Another 10% is used in blast furnaces and coke ovens for iron and steel production. Other industries, such as cement making, accounts for 9% of coal use, the residential sector for 3%, and commercial and other services for 1%. Coal demand has been declining slowly in all sectors.

Despite being the main source of coal demand, coal’s share in power generation in the EU-28 has decreased substantially since 2000, from roughly 32% in 2000 to 25% in 2015. Although the German nuclear phase-out temporarily led to some increases in coal’s contribution after 2011, the share of coal in total electricity generation was 42% in 2015 compared to 50% in 2000.

The share of coal in total power generation varies from country to country. The highest share of coal in power generation exists in Poland with more than 80%. In Germany, the Czech Republic, Greece, and Bulgaria coal is the most important fuel for power generation with shares between 40 and 50%. Indigenous lignite plays a major role in these countries. Coal covers 10–30% of power generation in the UK, Spain, Denmark, the Netherlands, Romania, Portugal, Hungary, Ireland, and Slovenia. Coal continues to make a major contribution to energy security in approximately half of the member countries.

Impacts of Coal on Key EU Climate and Energy Policies

In recent years, sustainability—notably, mitigating climate change—has been the key driver for EU energy policies. However, concerns about energy security and industrial competitiveness have become more pressing in recent years.

Coal is one of the main pillars for power generation. “But the European Union does not have a specific coal policy, even though its policy affects coal use, including the European Union Emissions Trading Scheme (EU-ETS), air pollution directives and renewable energy targets. There is still substantial competitive indigenous coal production in the European Union and well diversified secure international coal supply at low (hard) coal prices; this fuel has clear security benefits. A continued contribution from coal in a low-carbon economy is however compromised by its high CO2 intensity. Considerable improvements in power plant efficiency and the use of carbon capture and storage (CCS) technologies will therefore be required.”

Over the last decade, the EU has embarked on three major actions in energy and climate policy: (1) the progressive liberalization of the internal energy market package, the so-called “Third Package”; (2) ambitious climate and energy targets and policy measures as part of the so-called “2020 Climate and Energy Package”; and (3) a new “2030 Climate and Energy Policy Framework” that prepared the EU position for international climate negotiations in 2015.

At their October 2014 European Council meeting, leaders from EU member-states reached an agreement on their ambitions for the 2030 Climate and Energy Policy Framework together with key conclusions on EU energy security:

- A binding EU target of a domestic reduction in greenhouse gas emissions of at least 40% by 2030 compared with 1990—with reductions in the emissions-trading sector amounting to 43% and in non-ETS sectors to 30% by 2030 compared with 2005.

- An EU-wide target of at least 27% for the share of renewable energy consumed in the EU in 2030.

- An indicative target at EU level of at least 27% for improving energy efficiency in 2030 compared with projections of future energy consumption based on current criteria.

Energy security is also part of the 2030 Climate and Energy Policy Framework. In this context, the European Council recognized that the EU´s energy security can be increased by exploiting indigenous resources, as well as using safe and sustainable low-carbon technologies.

The EU-ETS remains the central instrument for reaching cost-effective emission reductions. In 2015, the EU-ETS was strengthened with the introduction of a market stability reserve and a steeper annual reduction in the number of ETS emission allowances issued: The 1.7% linear annual reduction will be raised to 2.2% from 2021.

Perspectives for Coal in the EU

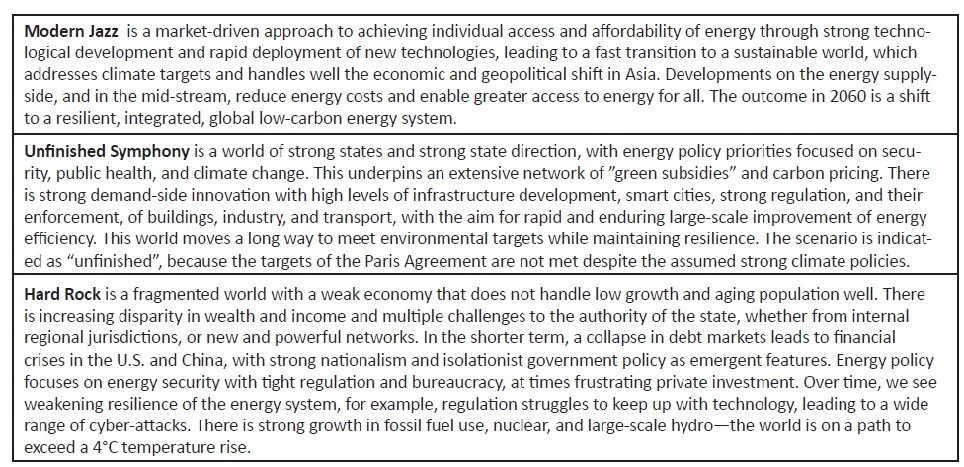

The World Energy Council (WEC) has prepared a study, World Energy Scenarios 2060. Presented at the World Energy Congress in October 2016, the paper comprises three scenarios. These scenarios, which are characterized in Table 2, are designed to help a range of stakeholders address the energy trilemma of achieving environmental sustainability, energy security, and energy equity.

TABLE 2. WEC: Three scenarios and key attributes.

Source: World Energy Council. World Energy Scenarios 2060. London, October 2016

The three developed scenario stories are exploratory, not normative; they follow a bottom-up approach. They raise the following questions: Where do we stand today, and what are plausible ways that could lead us into the future? This is in contrast to other scenarios that work with a top-down approach, or roadmaps that ask how one gets from A to a defined target B.

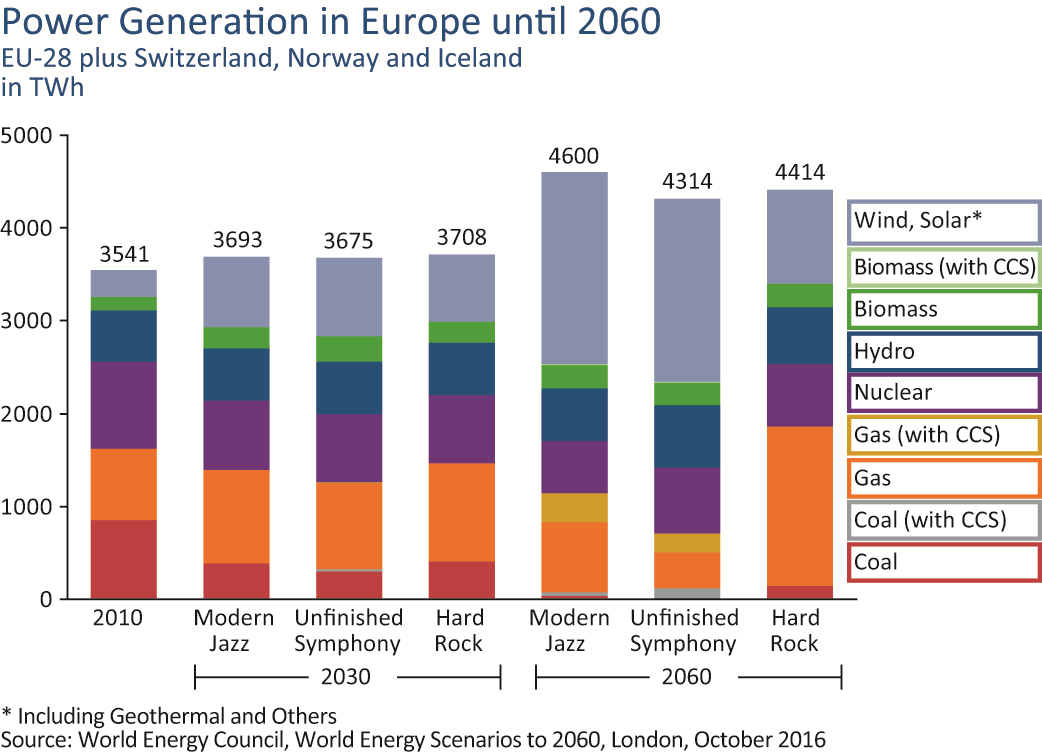

The quantitative results are presented at the global level and by different world regions. For the EU-31 region (EU-28 plus Switzerland, Norway, and Iceland), a strong reduction in coal consumption is expected, in particular in the Unfinished Symphony scenario (see Figure 2). The share of coal in total primary energy supply will be 5% or even less in 2060.

FIGURE 2. WEC´s scenario results for Europe.

Coal’s share in EU´s electricity generation will diminish to approximately 2% in Modern Jazz and to 3% in Unfinished Symphony and in Hard Rock by 2060. Carbon capture and storage (CCS) is seen as a technology that will be implemented after 2030, in particular in the Unfinished Symphony scenario. In this scenario, 81% of electricity generated by coal within the EU-31 will use CCS by 2050, and this share is expected to grow to 95% in 2060.

The share of fossil fuels in the EU´s total power generation will be reduced to approximately 42% in Hard Rock, to 25% in Modern Jazz, and to only 16% in Unfinished Symphony by 2060. Renewable energies will contribute approximately 43% of the total electricity generation in 2060 in the Hard Rock scenario, 63% in Modern Jazz, and 67% in Unfinished Symphony. The remaining share will be covered by nuclear energy.

Conclusions

The use of coal in the EU has clear energy security benefits, given the low international coal prices and well-diversified supplies as well as EU indigenous production potential in lignite. The deployment of clean coal technologies, equipped with CCS, should be a priority to reduce CO2 emissions alongside the expansion of renewable energies and increasing energy efficiency. Furthermore, the total discounted mitigation costs for the long-term achievement of the 450 ppm CO2 eq. target would be 138% higher globally if CCS was not used. Thus, policy backing and a corresponding legal framework for the implementation of CCS in power generation (on the basis of coal, gas, and biomass) and in industry are necessary in order to secure investments that lead to a cost-efficient reduction of greenhouse gas emissions. Taking such a sensible framework into account, a stronger role for coal than anticipated in the WEC scenarios would be compatible also with the ambitious climate targets of the European Union.