Critical Review: Westmoreland Coal and Alliance Holdings GP, L.P.

By Rob Logan

September 20, 2017 - Alliance Holdings GP, L.P. (NASDAQ: AHGP) and Westmoreland Coal (NASDAQ:WLB) are both small-cap oils/energy companies, but which is the superior investment? We will contrast the two businesses based on the strength of their earnings, valuation, institutional ownership, risk, profitability, dividends and analyst recommendations.

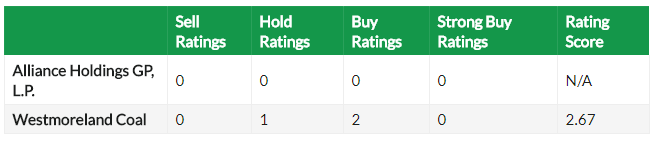

Analyst Ratings

This is a breakdown of recent recommendations for Alliance Holdings GP, L.P. and Westmoreland Coal, as reported by MarketBeat.com.

Westmoreland Coal has a consensus target price of $10.67, indicating a potential upside of 324.97%. Given Westmoreland Coal’s higher possible upside, analysts plainly believe Westmoreland Coal is more favorable than Alliance Holdings GP, L.P.

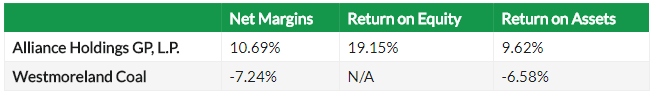

Profitability

This table compares Alliance Holdings GP, L.P. and Westmoreland Coal’s net margins, return on equity and return on assets.

Insider and Institutional Ownership

21.4% of Alliance Holdings GP, L.P. shares are held by institutional investors. Comparatively, 78.2% of Westmoreland Coal shares are held by institutional investors. 1.4% of Westmoreland Coal shares are held by insiders. Strong institutional ownership is an indication that large money managers, endowments and hedge funds believe a company is poised for long-term growth.

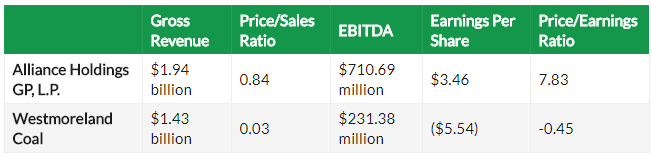

Valuation & Earnings

This table compares Alliance Holdings GP, L.P. and Westmoreland Coal’s top-line revenue, earnings per share (EPS) and valuation.

Alliance Holdings GP, L.P. has higher revenue and earnings than Westmoreland Coal. Westmoreland Coal is trading at a lower price-to-earnings ratio than Alliance Holdings GP, L.P., indicating that it is currently the more affordable of the two stocks.

Volatility & Risk

Alliance Holdings GP, L.P. has a beta of 0.53, indicating that its stock price is 47% less volatile than the S&P 500. Comparatively, Westmoreland Coal has a beta of 0.92, indicating that its stock price is 8% less volatile than the S&P 500.

Dividends

Alliance Holdings GP, L.P. pays an annual dividend of $2.92 per share and has a dividend yield of 10.8%. Westmoreland Coal does not pay a dividend. Alliance Holdings GP, L.P. pays out 84.4% of its earnings in the form of a dividend, suggesting it may not have sufficient earnings to cover its dividend payment in the future.

Summary

Alliance Holdings GP, L.P. beats Westmoreland Coal on 8 of the 14 factors compared between the two stocks.

Alliance Holdings GP, L.P. Company Profile

Alliance Holdings GP, L.P. (AHGP) is a limited partnership company. The Company owns directly and indirectly the members’ interest in Alliance Resource Management GP, LLC (MGP), the managing general partner of Alliance Resource Partners, L.P. (ARLP). The Company’s segments include Illinois Basin, Appalachia, and Other and Corporate. The Illinois Basin segment consists of mining complexes, including Webster County Coal’s Dotiki mining complex; Gibson County Coal’s mining complex, which includes the Gibson North mine and Gibson South mine; Warrior’s mining complex; River View’s mining complex and the Hamilton mining complex. The Appalachia segment consists of various operating segments, including the Mettiki mining complex, the Tunnel Ridge mining complex and the MC Mining mining complex. The Mettiki mining complex includes Mettiki Coal (WV)’s Mountain View mine and Mettiki Coal’s preparation plant. Other and Corporate segment includes marketing and administrative activities.

Westmoreland Coal Company Profile

Westmoreland Coal Company is an energy company. The Company operates through six segments: Coal-U.S., Coal-Canada, Coal-(WMLP), Power, Heritage and Corporate. The Coal-U.S. segment includes the operations of coal mines located in Montana, North Dakota, Ohio, Texas and New Mexico. The Coal-Canada segment includes the operations of coal mines located in Alberta and Saskatchewan. The Coal-WMLP segment includes the operations of Westmoreland Resource Partners, LP, a coal master limited partnership. The Power segment includes its Roanoke Valley Power Facility (ROVA) operations located in North Carolina. The Heritage segment includes the benefits it provides to former mining operation employees, as well as other administrative costs associated with providing those benefits and cost containment efforts. It produces and sells thermal coal primarily to investment grade utility customers under cost-protected contracts, as well as to industrial customers and barbeque briquettes manufacturers.