|

Signature Sponsor

October 27, 2017 - South Africa has a large energy-intensive coal mining industry. The country has limited proved reserves of oil and natural gas and uses its large coal deposits to meet most of its energy needs, particularly in the electricity sector.

South Africa has the world's tenth-largest amount of recoverable coal reserves and holds 75% of Africa's total coal reserves. Coal consumption in South Africa is expected to continue to increase as new coal-fired power stations are scheduled to come online to meet rising demand for electricity.

South African proved coal reserves were estimated at 11 billion short tons at the end of 2016, the 10th-largest in the world, according to the BP Statistical Review of World Energy 2017. South Africa’s coal reserves accounted for 75% of those in Africa and 1% of total world reserves.

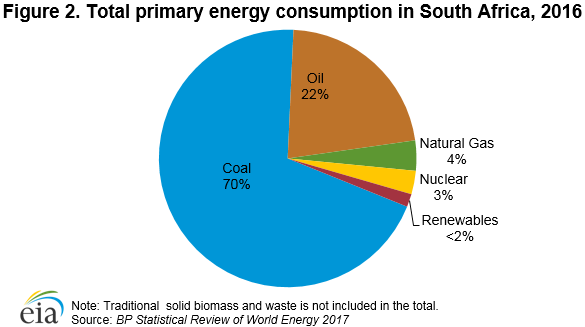

South Africa's economy is heavily dependent on coal, as it accounts for about 70% of the country’s total primary energy consumption (Figure 2). The electricity sector accounts for more than half of the coal consumed in South Africa, followed by Sasol’s petrochemical industries, metallurgical industries, and domestic heating and cooking, according to Eskom.

South Africa’s coal production and consumption levels have remained relatively stable over the past decade. In 2016, the country produced an estimated 277 million short tons (MMst) and consumed 191 MMst of coal (Figure 3). Most of the coal produced comes from the Witbank, Highveld, and Ermelo coal fields, which are located in the eastern part of the country near Swaziland. South Africa has the potential to increase coal production, particularly from the resource-rich Waterberg basin in the northeastern area of the country. One of the main bottlenecks to increasing coal exports is the lack of railway infrastructure used to transport coal from the inland mines to the ports. Transnet, South Africa’s railway operator, is investing billions of dollars to expand railway infrastructure over the next few years. Several railway projects are slated to be commissioned by 2021, which should facilitate transporting coal to export facilities and demand centers within South Africa. However, weaker global coal demand, lower international coal prices over the past few years, and some regulatory uncertainties have delayed investments in these mine projects.

Some of South Africa’s mining projects are allocated to domestic electricity generation versus coal exports. South Africa’s electricity consumption is increasing, and coal production will be needed to fuel new power plants that are currently under construction. Coal use—especially by Eskom and Sasol—is expected to rise over the next few years. Eskom is expanding its coal-fired electricity capacity to meet growing demand by bringing online coal-fired power plants—Medupi (4,764 megawatts (MW) and Kusile (4,800 MW)—in stages by 2022. Two units of the Medupi power plant and the first unit of the Kusile plant (collectively 2,388 MW of capacity) were operational by September 2017. However, coal consumption in the power sector is expected to face competition from natural gas and renewable energy in the next few years.

To read EIA's full analysis brief on South Africa’s energy sector, visit https://www.eia.gov/beta/international/analysis.cfm?iso=ZAF. |

|

.png)