Rhino Resource Partners LP Announces Fourth Quarter 2017 Financial and Operating Results

March 14, 2018 - Rhino Resource Partners LP (OTCQB:RHNO) announced today its financial and operating results for the quarter ended December 31, 2017. For the quarter, the Partnership reported net loss of $18.7 million and Adjusted EBITDA of $6.7 million, compared to a net loss of $3.8 million and Adjusted EBITDA of $4.6 million in the fourth quarter of 2016. Approximately $22.6 million of asset impairment charges impacted the net loss for the quarter ended December 31, 2017. Diluted net loss per common unit was $1.45 for the quarter compared to diluted net loss per common unit of $0.41 for the fourth quarter of 2016. Total revenues for the quarter were $55.8 million, with coal sales generating $55.4 million of the total, compared to total revenues of $44.4 million and coal revenues of $43.8 million in the fourth quarter of 2016.

The Partnership continued the suspension of the cash distribution for its common units for the current quarter. No distributions will be paid for common or subordinated units for the quarter ended December 31, 2017.

Rick Boone, President and Chief Executive Officer of Rhino’s general partner, stated, “In the fourth quarter of 2017, as in prior quarters during 2017, we continued to deliver strong financial results. In the fourth quarter of 2017 our revenue and Adjusted EBITDA both improved year over year. Our sales volume increased by 18% year over year or approximately one million tons in 2017 when compared to 2016. We now have contracted sales in place for 2018 that will exceed the levels we reached in 2017. With significant sales in place for 2018 and our constant focus on cost containment, we believe Rhino will continue to provide strong financial results in 2018.

Our 2018 contracted sales have been completed for our thermal coal and we have a small amount of met coal volumes to place over the coming months in 2018. To date, we have contracted over 90% of our expected 2018 production. We continue to expand our export business through direct relationships with international customers and through the use of coal brokers. We believe that sales to the international markets provide the best growth opportunities for us to continue to expand our business.

The recent completion of our new three year financing agreement provides us the financial stability and flexibility to continue to grow Rhino. We look forward to working with Colbeck, our new financing partner, to increase the value of our Partnership for our unitholders. Our new financing partner, Colbeck, coupled with the continued support of our sponsor, Royal Energy Resources, Inc. (OTCQB:ROYE), as well as our financial partner Yorktown Partners LLC, positions us to be a strong, long-term competitor in the world-wide coal markets.

Our commitment to providing a safe workplace for our employees continues to be a primary focus. We increased our workforce and production in 2017 while achieving safety results that are improved over the same period in 2016. Our “all incident rate” improved over 20% in 2017 compared to 2016 and we had similar improvements in other MSHA safety metrics.

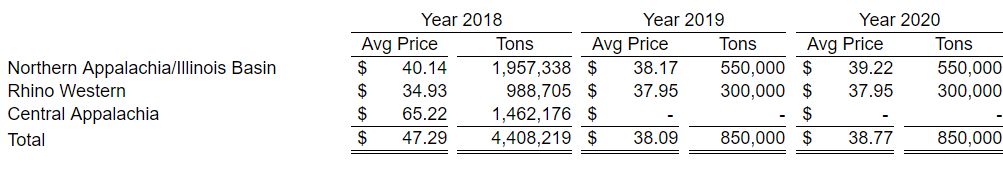

At our Central Appalachia operations, we have contracted for all of our 2018 projected steam coal production and we have a small amount of 2018 met coal tons remaining to be booked. We continue to develop relationships with international customers that could lead to multi-year met coal sales agreements and we have been negotiating with domestic utility and industrial customers for steam coal sales for 2019 and 2020. Our production at Pennyrile and Castle Valley are completely sold out for 2018. Pennyrile recently completed contracts with multiple utility customers for 2019 through 2020 and we are responding to multiple utility solicitations for two and three year sales contracts that could increase Pennyrile’s contracted sales positions for future periods. At Castle Valley, we have booked sales for 300,000 tons per year for 2018 through 2020 with a major utility. In Northern Appalachia, we have agreed to a sales agreement with a local utility for our Hopedale operation for 200,000 tons for 2018 along with export orders for the remainder of 2018 that have this operation completely sold for this year.

The strong financial results we have generated for full-year 2017 show the potential of Rhino to bring value to our unitholders and we are confident the upcoming 2018 year will be positive for Rhino, its employees and all of our business partners.”

Coal Operations Update

Pennyrile

Pennyrile long-term sales contracts have committed sales of 1.4 million tons for full-year 2018 and 550,000 tons for 2019 and 2020.

Sales volume for the current quarter was 325,000 tons, versus 286,000 in the prior year and 316,000 in the prior quarter. For the fourth quarter, coal revenues per ton decreased to $45.18 compared to $47.57 in the prior year and $47.37 in the prior quarter.

Cost of operations per ton was $39.39 versus $40.14 in the prior year and $41.40 in the prior quarter. The decrease was primarily due to fixed operating costs being allocated to higher production and sales during the current period.

Central Appalachia

Coal revenues were $25.1 million, versus $16.0 million in the prior year and $27.9 million in the prior quarter. The increase in revenue year over year was primarily due to the increase in demand for met and steam coal tons sold from this region. Coal revenues per ton in the quarter were $67.60 versus $60.14 in the prior year and $73.02 in the prior quarter. Metallurgical coal revenue per ton in the quarter was $85.83 versus $63.97 in the prior year and $92.93 in the prior quarter. Steam coal revenue in the quarter was $53.45 per ton versus $50.98 in the prior year and $51.82 in the prior quarter. Sales volume was 371,000 tons in the quarter versus 266,000 in the prior year and 382,000 tons in the prior quarter.

Cost of operations per ton in the quarter was $50.85 versus $48.77 in the prior year and $54.73 in the prior quarter. The increase in cost per ton year over year was due to higher maintenance costs to upgrade the equipment fleet to meet the demand for additional met coal production.

Rhino Western

Coal revenues were $10.3 million versus $9.5 million in the prior year and $9.1 million in the prior quarter. Coal revenues per ton in the quarter were $36.49 versus $38.61 in the prior year and $37.53 in the prior quarter. Coal revenues per ton decreased by $2.12 or 5.5% compared to the prior year.

Sales volume was 282,000 tons versus 247,000 tons in the prior year and 242,000 tons in the prior quarter. The increase in coal sales in the fourth quarter of 2017 was the result of an increase in customer demand at our Castle Valley mine.

Cost of operations per ton was $29.17 versus $32.96 in the prior year and $27.48 in the prior quarter. The decrease in the cost of operations per ton was due to allocating the fixed costs of the operation over additional tons.

Northern Appalachia

Sales volume from the Hopedale operations was 130,000 tons versus 91,000 tons in the prior year and 105,000 in the prior quarter. Sales were higher in the current quarter compared to the same period in 2016 due to increased sales volumes from our Hopedale operations as demand increased for coal from this region during the comparative periods.

For the fourth quarter, coal revenues per ton from our Hopedale operation were $40.86 compared to $51.91 in the prior year and $41.38 in the prior quarter. The decrease in revenues per ton was the result of lower contract priced tons sold from our Hopedale complex.

Cost of operations from our Hopedale operation was $6.1 million versus $4.1 million in the prior year and $4.9 million in the prior quarter. The increase in the fourth quarter versus the same period in 2016 was primarily due to increased production to meet contracted sales in the fourth quarter from the Hopedale operation.

Discontinued Operations

On November 7, 2017, the Partnership closed an agreement with a third party to transfer 100% of the membership interests and related assets and liabilities of Sands Hill Mining LLC to the third party in exchange for a future override royalty for any mineral sold, excluding coal, from Sands Hill Mining LLC after the closing date. The Partnership recognized a gain of $3.2 million from the sale of Sands Hill Mining LLC since the third party assumed the reclamation obligations associated with this operation.

Asset Impairment

The Partnership engaged an independent third party to perform a fair market value appraisal on certain parcels of land that it owns in Mesa County, Colorado. The parcels appraised for $6.0 million compared to the carrying value of $6.8 million. The Partnership recorded an impairment loss of $0.8 million during the fourth quarter of 2017.

The Partnership also recorded an impairment charge of $21.8 million related to the call option received from a third party to acquire substantially all of the outstanding common stock of Armstrong Energy, Inc. On October 31, 2017, Armstrong Energy filed Chapter 11 petitions in the Eastern District of Missouri’s United States Bankruptcy Court. Per the Chapter 11 petitions, Armstrong Energy filed a detailed restructuring plan as part of the Chapter 11 proceedings. On February 9, 2018, the U.S. Bankruptcy Court confirmed Armstrong Energy’s Chapter 11 reorganization plan and as such the Partnership concluded that the call option had no carrying value.

Financing Agreement

On December 27, 2017, Rhino Energy LLC (“Rhino Energy”), a wholly-owned subsidiary of Rhino Resource Partners LP (the “Partnership’), certain of Rhino Energy’s subsidiaries identified as Borrowers (together with Rhino Energy, the “Borrowers”), the Partnership and certain other Rhino Energy subsidiaries identified as Guarantors (together with the Partnership, the “Guarantors”), entered into a Financing Agreement (the “Financing Agreement”) Cortland Capital Market Services LLC, as Collateral Agent and Administrative agent, CB Agent Services LLC, as Origination Agent and the parties identified as Lenders therein (the “Lenders”), pursuant to which Lenders have agreed to provide Borrowers with a multi-draw term loan in the aggregate principal amount of $80 million, subject to the terms and conditions set forth in the Financing Agreement. The total principal amount is divided into a $40 million commitment, the conditions of which were satisfied at the execution of the Financing Agreement and an additional $40 million commitment that is contingent upon the satisfaction of certain conditions precedent specified in the Financing Agreement. Loans made pursuant to the Financing Agreement are secured by substantially all of the Borrowers’ and Guarantors’ assets. The Financing Agreement has a three-year term and expires on December 27, 2020.

Capital Expenditures

Maintenance capital expenditures for the fourth quarter were approximately $4.9 million.

Expansion capital expenditures for the fourth quarter were approximately $0.8 million.

Sales Commitments

The table below displays Rhino’s committed coal sales for the periods indicated.

Evaluating Financial Results

Rhino management uses a variety of Non-GAAP financial measurements to analyze the Partnership’s performance, including (1) Adjusted EBITDA, (2) coal revenues per ton and (3) cost of operations per ton.

Adjusted EBITDA. Adjusted EBITDA represents net income before deducting interest expense, income taxes and depreciation, depletion and amortization, while also excluding certain non-cash and/or non-recurring items. Adjusted EBITDA is used by management primarily as a measure of the operating performance of the Partnership’s segments. Adjusted EBITDA should not be considered an alternative to net income, income from operations, cash flows from operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP. Because not all companies calculate Adjusted EBITDA identically, the Partnership’s calculation may not be comparable to similarly titled measures of other companies. (Refer to “Reconciliations of Adjusted EBITDA” included later in this release for reconciliations of Adjusted EBITDA to the most directly comparable GAAP financial measures).

Coal Revenues Per Ton. Coal revenues per ton sold represents coal revenues divided by tons of coal sold. Coal revenues per ton is a key indicator of Rhino’s effectiveness in obtaining favorable prices for the Partnership’s product.

Cost of Operations Per Ton. Cost of operations per ton sold represents the cost of operations (exclusive of depreciation, depletion and amortization) divided by tons of coal sold. Rhino management uses this measurement as a key indicator of the efficiency of operations.

Overview of Financial Results

Results for the three months ended December 31, 2017 included:

Adjusted EBITDA from continuing operations of $7.3 million and net loss from continuing operations of $21.3 million compared to Adjusted EBITDA from continuing operations of $4.6 million and a net loss from continuing operations of $2.8 million in the fourth quarter of 2016. Adjusted EBITDA from continuing operations increased period to period due to an increase in net income from our Central Appalachia operation during the three months ended December 31, 2017 compared the same period in 2016. The increase in net loss from continuing operations for the three months ended December 31, 2017 was primarily the result of $22.6 million in asset impairments recorded in the fourth quarter. Including net income from discontinued operations of approximately $2.6 million, total net loss for the three months ended December 31, 2017 was $18.7 million while Adjusted EBITDA was $6.7 million. Including net loss from discontinued operations of $1.0 million, total net loss for the three months ended December 31, 2016 was $3.8 million and Adjusted EBITDA was $4.6 million.

Basic and diluted net loss per common unit from continuing operations of $1.63 compared to basic and diluted net loss per common unit from continuing operations of $0.30 for the fourth quarter of 2016.

Coal sales were 1.1 million tons, which was an increase of 24.6% compared to the fourth quarter of 2016, primarily due to increased sales from Central Appalachia operations.

Total revenues and coal revenues of $55.8 million and $55.4 million, respectively, compared to $44.4 million and $43.8 million, respectively, for the same period of 2016.

Coal revenues per ton of $49.96 compared to $49.29 for the fourth quarter of 2016, an increase of 1.4%.

Cost of operations from continuing operations of $45.5 million compared to $35.6 million for the same period of 2016 as production increased in the Central Appalachia region to meet the increased demand for met and steam coal during the fourth quarter of 2017.

Cost of operations per ton from continuing operations of $41.09 compared to $39.98 for the fourth quarter of 2016, an increase of 2.8%.

Total coal revenues increased approximately 26.3% period-over-period primarily due to the increase in production in Central Appalachia resulting from increases in demand for met and steam coal from this region. Coal revenues per ton increased primarily due to a higher mix of met coal sold from Central Appalachia compared to the same period of 2016. Total cost of production increased by 28.1% during the fourth quarter of 2017 primarily due to an increase of $5.9 million in total cost of operations in Central Appalachia, which was also the result of increased production in Central Appalachia due to increased demand for met and steam coal from this region.

Results for the year ended December 31, 2017 included:

Adjusted EBITDA from continuing operations of $27.1 million and net loss from continuing operations of $20.6 million compared to Adjusted EBITDA from continuing operations of $16.4 million and a net loss from continuing operations of $15.3 million for the year ended December 31, 2016. Adjusted EBITDA from continuing operations increased period to period due to an increase in net income in our Central Appalachia segment resulting from the increase in production and sales in this region. Including net income from discontinued operations of approximately $1.8 million, total net loss for the year ended December 31, 2017 was $18.8 million while Adjusted EBITDA was $26.3 million. Including net loss from discontinued operations of $115.5 million, total net loss for the year ended December 31, 2016 was $130.8 million and Adjusted EBITDA was $21.3 million.

Basic and diluted net loss per common unit from continuing operations of $1.88 compared to basic and diluted net loss per common unit from continuing operations of $1.96 for the year ended December 31, 2016.

Coal sales were 4.1 million tons, which was an increase of 31.3% compared to the year ended December 31, 2016, primarily due to increased sales from Central Appalachia operations.

Total revenues and coal revenues of $218.7 million and $217.2 million, respectively, compared to $155.4 million and $153.3 million, respectively, for the same period of 2016.

Coal revenues per ton of $52.64 compared to $48.78 for the year ended December 31, 2016, an increase of 7.9%.

Cost of operations from continuing operations of $178.5 million compared to $124.8 million for the same period of 2016 as production was increased in the Central Appalachia region to meet the increase demand for met and steam coal during the year ended December 31, 2017.

Cost of operations per ton from continuing operations of $43.26 compared to $39.73 for the year ended December 31, 2016 an increase of 8.9%.

Total coal revenues increased approximately 41.7% period-over-period primarily due to the increase in production in Central Appalachia resulting from increases in demand for met and steam coal from this region. Coal revenues per ton increased primarily due to a higher mix of met coal sold from Central Appalachia compared to the same period of 2016. Total cost of production increased by 43.0% during the year ended December 31, 2017 primarily due to an increase of $43.8 million in total cost of operations in Central Appalachia. Total cost of operations and cost of operations per ton increased primarily due to higher mix of Central Appalachia tons. The cost of operations for the year ended December 31, 2016 was also impacted by a prior service cost benefit of $3.9 million resulting from the cancellation of the postretirement benefit plan at our Hopedale operation.

Segment Information

The Partnership produces and markets coal from surface and underground mines in Kentucky, West Virginia, Ohio and Utah. For the quarter ended December 31, 2017, the Partnership had four reportable business segments: Central Appalachia, Northern Appalachia, Rhino Western and Illinois Basin. Additionally, the Partnership has an Other category that includes its ancillary businesses.

Rhino Resource Partners LP is a diversified energy limited partnership that is focused on coal and energy related assets and activities, including energy infrastructure investments. Rhino produces metallurgical and steam coal in a variety of basins throughout the United States.

CoalZoom.com - Your Foremost Source for Coal News