EnerSys vs. Anixter Head to Head Analysis

April 2, 2018 - EnerSys (NYSE: ENS) and Anixter (NYSE:AXE) are both mid-cap industrial products companies, but which is the better business? We will compare the two companies based on the strength of their institutional ownership, risk, earnings, profitability, analyst recommendations, dividends and valuation.

Dividends

EnerSys pays an annual dividend of $0.70 per share and has a dividend yield of 1.0%. Anixter does not pay a dividend. EnerSys pays out 14.7% of its earnings in the form of a dividend.

Profitability

This table compares EnerSys and Anixter’s net margins, return on equity and return on assets.

.png)

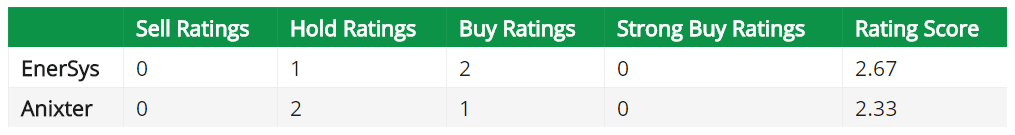

Analyst Recommendations

This is a summary of recent ratings for EnerSys and Anixter, as provided by MarketBeat.com.

EnerSys presently has a consensus target price of $78.00, suggesting a potential upside of 12.44%. Anixter has a consensus target price of $88.00, suggesting a potential upside of 16.17%. Given Anixter’s higher probable upside, analysts plainly believe Anixter is more favorable than EnerSys.

Volatility & Risk

EnerSys has a beta of 1.54, suggesting that its share price is 54% more volatile than the S&P 500. Comparatively, Anixter has a beta of 2.07, suggesting that its share price is 107% more volatile than the S&P 500.

Insider & Institutional Ownership

97.2% of EnerSys shares are held by institutional investors. Comparatively, 92.6% of Anixter shares are held by institutional investors. 1.4% of EnerSys shares are held by insiders. Comparatively, 14.7% of Anixter shares are held by insiders. Strong institutional ownership is an indication that large money managers, hedge funds and endowments believe a stock will outperform the market over the long term.

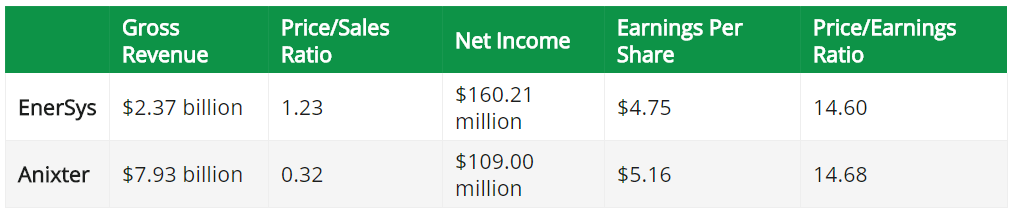

Valuation and Earnings

This table compares EnerSys and Anixter’s revenue, earnings per share (EPS) and valuation.

EnerSys has higher earnings, but lower revenue than Anixter. EnerSys is trading at a lower price-to-earnings ratio than Anixter, indicating that it is currently the more affordable of the two stocks.

Summary

EnerSys beats Anixter on 9 of the 16 factors compared between the two stocks.

EnerSys Company Profile

EnerSys is a manufacturer, marketer and distributor of industrial batteries. The Company manufactures, markets and distributes related products, such as chargers, power equipment, outdoor cabinet enclosures and battery accessories, and provides related after-market and customer-support services for industrial batteries. Its segments based on geographic regions consist of Americas, which consists of North and South America; EMEA, which includes Europe, the Middle East and Africa, and Asia, which includes Asia, Australia and Oceania. The Company’s product lines include reserve power and motive power products. Its Reserve power products also include thermally managed cabinets and enclosures for electronic equipment and batteries. The Company’s motive power products are used to provide power for electric industrial forklifts used in manufacturing, warehousing and other material handling applications. They are used as mining equipment, diesel locomotive starting and other rail equipment.

Anixter Company Profile

Anixter International Inc., through its subsidiary, Anixter Inc., distributes enterprise cabling and security solutions, electrical and electronic wire and cable products, and utility power solutions. Its Network & Security Solutions segment offers copper and fiber optic cable and connectivity, access control, video surveillance, intrusion and fire/life safety, cabinet, power, cable management, wireless, professional audio/video, voice and networking switche, and other ancillary products for technology, finance, telecommunications service provider, transportation, education, government, healthcare, and retail industries. The company's Electrical & Electronic Solutions segment provides electrical and electronic wires and cables, shipboard cables, support and supply products, low-voltage and instrumentation cables, industrial communication and control products, security cables, connectors, industrial Ethernet switches, and voice and data cables to the commercial and industrial, and original equipment manufacturer markets. Its Utility Power Solutions segment supplies electrical transmission and distribution products, power plant maintenance, repair and operations supplies, and smart-grid products, as well as arranges materials management and procurement outsourcing for the power generation and electricity distribution industries. The company serves contractors, installers, system integrators, value-added resellers, architects, engineers, and wholesale distributors in the manufacturing, resource extraction, Internet service provider, and utility industries, as well as defense customers. It distributes its products primarily in North America, Europe, the Middle East, Africa, the Asia Pacific, and Central and Latin America. The company was formerly known as Itel Corporation. Anixter International Inc. was founded in 1957 and is headquartered in Glenview, Illinois.

CoalZoom.com - Your Foremost Source for Coal News