Coronavirus Puts More Than a Third of Seaborne Coal Supply at Risk

May 11, 2020 - The full impact of the coronavirus outbreak on the global economy is yet unclear. However, the demand destruction is already becoming evident, with seaborne thermal and metallurgical prices in near-freefall. So, what does this mean for global seaborne supply? And how will different regions be affected?

This article is an excerpt from our insight ‘Spot prices put 36% of seaborne production at risk’. .

Quantifying the Impact on Seaborne Supply

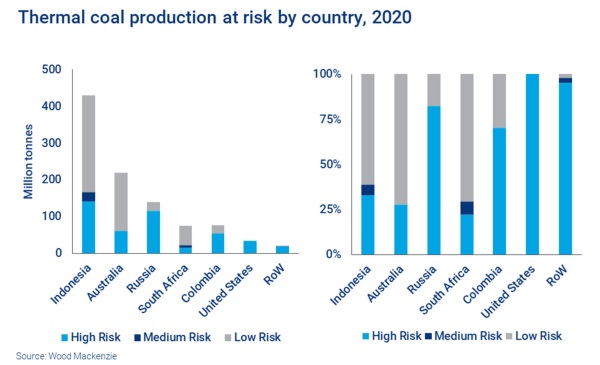

Our research analysed the relative risk of production curtailment, identifying three risk categories:

High risk – operations with a negative spot margin and either a positive or negative valuation.

Medium risk – operations with a positive margin but a negative valuation.

Low risk – operations with a positive margin and a positive valuation.

The results are stark. More than a third of the seaborne coal market is currently at high risk of production curtailment.

Thermal Coal: Collapsing Prices Take Margins With Them

It may come as no surprise that the hard-hit thermal coal market accounts for 93%, or more than 440 million tonnes, of high-risk production. As it stands, nearly 45% of production would have a negative cash margin if sold at spot prices.

All producing countries have some thermal coal at risk. Indonesia has the most high-risk tonnage, though the entire Atlantic basin is struggling.

In Indonesia, weak demand from China and domestic oversupply are creating significant pressure, and a high likelihood of production cuts. The low oil price, and resultant fall in diesel, is in its favour – but exchange rate movements offer little help as the majority of costs are in US dollars.

Australia is best positioned to weather the storm. Costs versus quality of coal were already amongst the best in the world and exchange rate movements have only strengthened that position. As a result, we expect Australia to remain a core global supplier of coal regardless of weakening demand. Some curtailments may happen but will be limited due to high fixed costs around take-or-pay contracts.

Seaborne Metallurgical Coal Spared the Collapse – For Now

The metallurgical sector – with prices falling but not yet at record lows – represents just 7% of high-risk production, or around 33 million tonnes. Around 10% of metallurgical production has a negative cash margin.

The US is struggling at current spot prices, and the high costs of its producers mean that production cuts are coming. Small producers are likely to fall quickly and quietly, with larger operations announcing cuts.

In Canada, on the other hand, production is at low risk of curtailment. Canadian producers are positioned nearly as well as high-quality Australian operations. Lower quality and smaller operations are more at risk than large, flagship operations – however, while there is potential for some production curtailment if prices continue to fall, the tonnage is likely to be smaller than other countries.