Rejection of Peabody-Arch JV Raises Questions About Powder River Basin's Future

October 2, 2020 - The unraveling of a proposed joint venture between two coal mining giants in the Powder River Basin in the U.S. has cast further uncertainty across the beleaguered coal region.

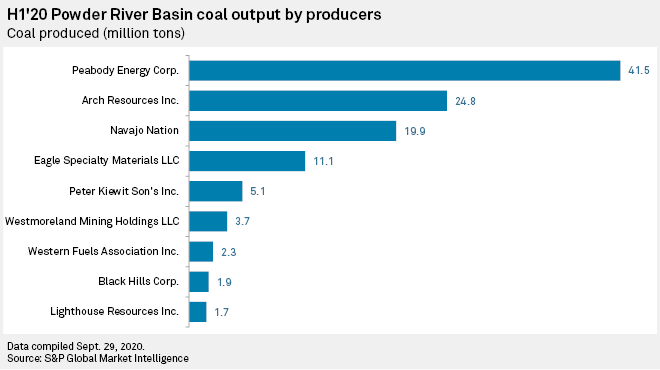

The U.S. District Court for the Eastern District of Missouri recently upheld the Federal Trade Commission's decision to block a Peabody Energy Corp. and Arch Resources Inc. joint venture of certain Powder River Basin and Colorado assets. The FTC said in a Sept. 29 statement that the deal would hurt competition and "likely would have raised the price of coal to the utilities, and ultimately to consumers." The two producers accounted for 59.2% of the coal mined from the Powder River Basin in the first half of 2020, according to S&P Global Market Intelligence data.

Benjamin Nelson, a senior credit officer and lead coal analyst at Moody's Investors Service, called the court decision credit negative for both companies in a recent statement. Nelson predicted in late 2019 that a few coal mines in the Powder River Basin region may close in the early 2020s.

Peabody and Arch were already bracing for declining prospects for the basin. Peabody impaired the value of its North Antelope Rochelle mine by $1.42 billion in the second quarter. Arch President and CEO Paul Lang said on a second-quarter earnings call that he would consider taking steps to "shrink down the operations" at the company's thermal coal mines and possibly begin phased closures.

Larger coal companies worldwide are increasingly ditching thermal coal assets in favor of metallurgical coal or other commodities, said Clark Williams-Derry, an energy finance analyst at the Institute for Energy Economics and Financial Analysis.

"What it looks like now is a race to the exits for thermal coal and sort of an acknowledgment by some of the big players that there's really not a viable financial future for thermal coal in general and probably not in the Powder River Basin either," Williams-Derry said.

A Shrinking Market

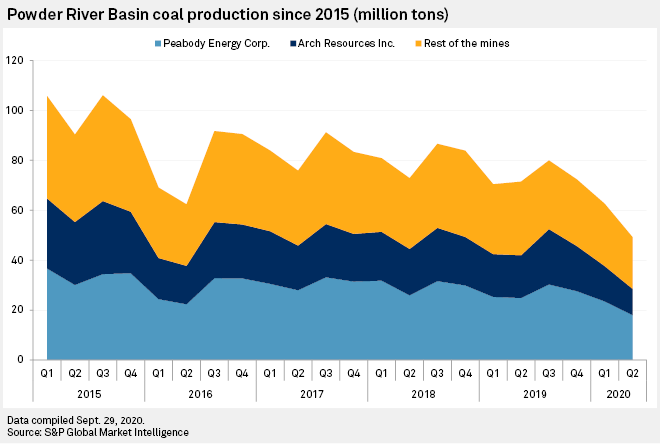

Production from the region is in rapid decline. As recently as the third quarter of 2015, the region produced 106.1 million tons of coal. In the second quarter of 2020, production reached a near-term low of 49.2 million tons, a decline of 53.6% over the period.

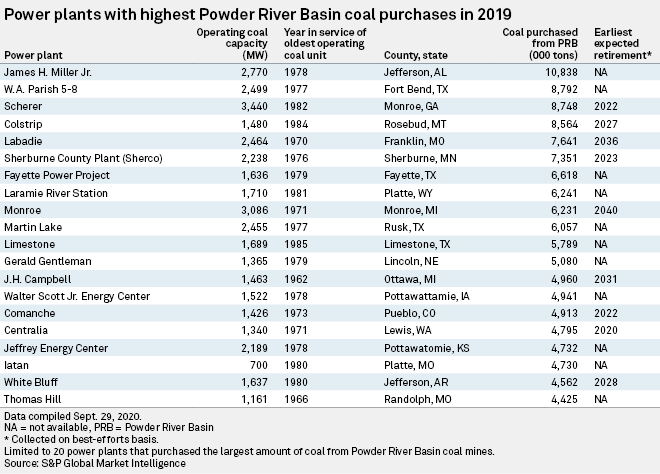

The region's future is increasingly under pressure from a wide-scale retirement of the nation's aging coal generation capacity and a lack of new coal plants.

In a particularly relevant example, the same day the court upheld the FTC's rejection of the coal joint venture, power generator Vistra Corp. announced plans to retire more than 6,800 MW of coal-fired capacity by 2027. According to federal fuel contract data, five of those Vistra units received about 9.1 million tons of coal from Peabody's North Antelope Rochelle mine, equivalent to approximately 10.6% of the mine's reported 2019 coal production.

Adding to the pressure of retirements is lower utilization rates by the power plants that continue to run coal plants, said Robert Godby, director of the Center for Energy Economics and Public Policy and an associate professor at the University of Wyoming.

"That plant that still might be on the books as a customer for the next seven years is really not taking that much coal anyway," Godby said. "That's the real killer in the coal market."

Market Reaction

B. Riley Securities analyst Lucas Pipes called the ruling "disappointing" in a Sept. 29 note to investors.

"There had been some speculative positioning in the shares of [Peabody Energy] and [Arch Resources], but we believe most investors continued to place low probabilities on a successful court ruling," Pipes wrote.

Peabody shares plummeted, with the stock price dropping 20.3% to close at $2.44 after opening at $3.06 on Sept. 29, the same day of the court decision. Arch, which has been in an "ongoing transition into a pure-play metallurgical producer" including plans to dedicate 95% of its 2020 capital budget to its metallurgical coal portfolio, saw its share price decline 7.5% to $43.12 in the same period.

Getting Out of The Powder River Basin

Pipes wrote that Arch's higher exposure to metallurgical coal would make a transition away from thermal coal assets more likely to succeed, and he retained a "buy" recommendation on the stock. In reaction to the court's decision, Arch said it would be open to divesting its thermal coal assets.

"In the current market environment, we believe that divestiture efforts (such as an outright sale of the Powder River Basin assets) are possible, but difficult to accomplish in a value-maximizing manner," Pipes wrote.

Many companies in the basin have gone through bankruptcy reorganizations. Others are owned by smaller or relatively new players in the region that bought coal mines from other companies' bankruptcies, such as the Navajo Nation's Navajo Transitional Energy Co. LLC or Eagle Specialty Materials LLC.

"Paying attention to the end game for some of these thermal coal companies, these smaller thermal coal companies, is going to be really key, because they could leave states and the nearby residents holding a great big bag if they do fail financially," Williams-Derry said.

Still, Godby and Williams-Derry said they could imagine a potential buyer coming forward after Arch's hints at divestitures, particularly if a potential buyer suspects rising natural gas prices could create opportunities for a Powder River Basin coal producer.

"It's hard to imagine a large, well-capitalized miner would show up and bid on their properties," Godby said. "The question is, who really wants to buy a coal mine right now in the United States? Probably the best suitor was just barred in the JV ruling from merging with them."