|

Signature Sponsor

January 1, 2021 - The ESG Insider newsletter compiles news and insights on environmental, social and governance developments driving change in business and investment decisions. Subscribe to our ESG Insider newsletter, and listen to the ESG Insider podcast on SoundCloud, Spotify and Apple Podcasts. It's the final ESG Insider newsletter of 2020, a year that brought big change in the sustainability world. Amid the pandemic, companies and investors increasingly emphasized social issues such as worker safety. The death of George Floyd in the U.S. brought heightened focus to racism and systemic inequality. And while climate issues may have been temporarily sidelined by COVID-19, they remained in sharp focus for investors, regulators and companies worldwide. Here's how Carlo Funk, State Street Global Advisors' EMEA Head of ESG Investment Strategy, put it in a recent interview with ESG Insider: "This horrible year when it comes to the pandemic and COVID actually led to a higher prioritization of ESG integration in general, a higher prioritization of social aspects in particular, but did not lead to a de-prioritization of climate whatsoever but has actually pushed climate-related matters higher up on the ESG agenda." You can hear more from Funk and many other big ESG names in our next episode of the "ESG Insider" podcast, where we'll tackle themes to watch in the year ahead. Happy New Year, and we'll see you in 2021. Chart of the Week

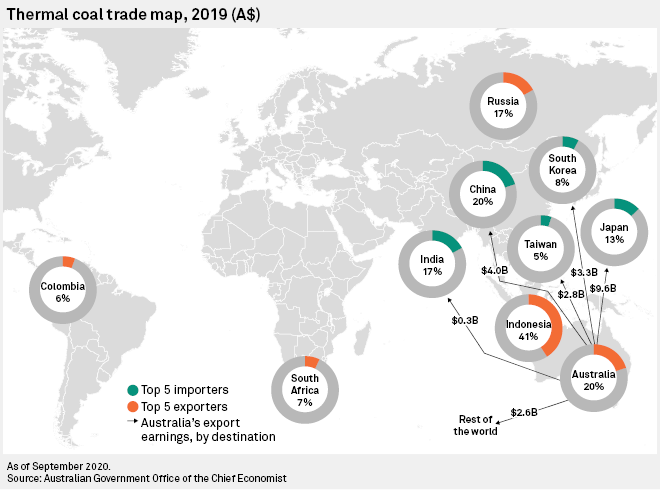

Top Stories Australia's thermal coal financing options thinning out, but hope alive in Asia As Australia's key thermal coal customers adopt carbon neutrality goals, new project financing may be threatened as the Big Four banks in the world's second-largest thermal coal exporter continue to distance themselves from the increasingly contentious commodity. Our Chart of the Week, above, shows the top importers and exporters of thermal coal. 'Nobody willingly pays themselves less': Exec pay reform could be uphill battle The economic crisis brought on by the COVID-19 pandemic has exacerbated the disparity between U.S. shale executives' compensation and shareholders' long-term interests, according to a private equity firm with a history of shareholder activism. Europe's utilities see heavy churn as a dozen CEOs depart in less than 2 years The past few years brought a wave of leadership changes at European power and gas companies as the industry shifted away from fossil fuels and embraced renewable energy. In 2020, 12 of 25 of the largest public and private energy utilities have switched leaders or announced that their CEOs will leave before the end of 2021. Environmental MEA banking stories to watch in 2021: Green financing, Lebanon, Kenya How 'the Tesla' of fund managers is shaking up the renewables industry Bipartisan US House bill would set national clean electricity standard Social Social bond market, healing COVID-19 divisions, set to continue growing Annual US coal fatalities poised to hit record low as industry declines Rio Tinto appointment of Stausholm as CEO receives mixed reviews Governance Activist investor group files climate resolution at 3 European oil majors Challenges ahead for Talen Energy as it retires coal Credit Bank of Moscow raises ESG-linked $20M loan from LBBW ESG Indices

|

|