|

Signature Sponsor

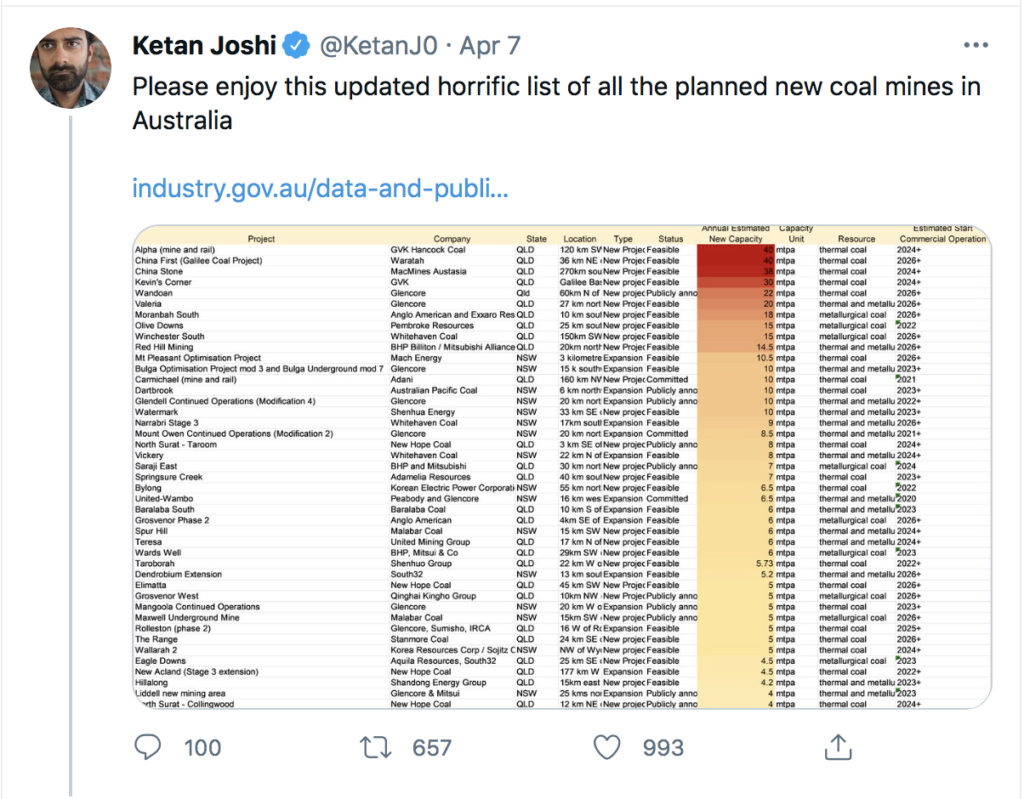

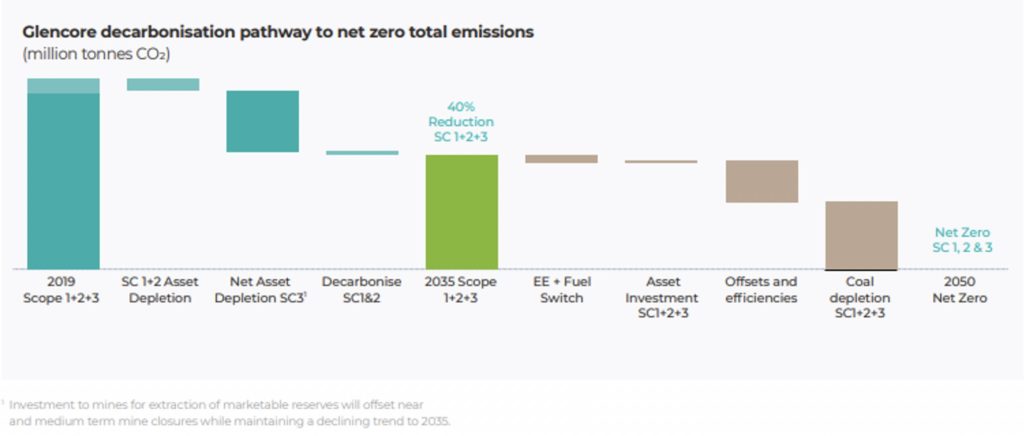

April 27, 2021 - Later this week, shareholders in Glencore will vote on the company’s climate transition plan, otherwise known as a ‘Say on Climate’. Glencore joins just a handful of other companies, including oil majors Royal Dutch Shell and Total, in giving its shareholders a vote this year. In all likelihood, shareholders will vote in favour of Glencore’s climate strategy. It is an awkward situation: the first Say on Climate vote for a globally material emitter will likely rubber stamp plans for at least nine new or expanded coal mines in NSW and Queensland. Glencore’s Coal ExpansionismGlencore, the world’s largest coal producer, placated climate-conscious investors in early 2019 by announcing a “cap” on coal production. It committed to limiting coal production to its 2019 production levels of 145 million tonnes per annum. The cap, however, did not rule out any new or expanded coal mines, as Glencore shuffles production from Colombia and South Africa to Australia. Yesterday, the NSW Independent Planning Commission approved Glencore’s application to continue its Mangoola Coal mine near Wybong in the Hunter Valley. The approval will allow Glencore to extract a further 52 million tonnes of thermal coal through to 2030. Notably, the Muswellbrook Shire Council opposed the Mangoola extension, the first time it has opposed a coal mine since 2010, declaring “enough is enough”. According to the Department of Industry’s list of major projects, Glencore is involved in another eight new or expanded coal mines, in addition to Mangoola, which combined will produce a total of 91 million tonnes of coal per annum at full production. All of these mines will produce mostly thermal coal used in electricity generation. One of those mines is the enormous Valeria project near Emerald in Queensland, which Glencore acquired from Rio Tinto in 2018. Valeria is expected to produce 20 million tonnes of thermal and metallurgical coal per annum for 35 years. A start date planned for 2026 would see the mine’s anticipated operational life stretch out until 2061, despite Glencore’s commitment to net zero emissions by 2050. Glencore’s CommitmentsGlencore’s operational emissions (Scopes 1 and 2) were more than 24 million tonnes CO2e in 2020. If Glencore were listed on the ASX, it would be our third largest emitter, behind AGL Energy and Rio Tinto. Glencore’s Scope 3 emissions, predominantly from the combustion of the coal it sells, were 271 million tonnes CO2e in 2020, equivalent to half of Australia’s annual emissions. In late 2020, Glencore updated its climate commitments, announcing an absolute reduction target (including Scopes 1, 2 and 3) of 40% by 2035 (on 2019 levels). Unlike BHP and Rio Tinto, Glencore has accepted complete responsibility for its Scope 3 emissions. It is one of the few resources companies to admit that reducing its Scope 3 emissions will be met through the “managed decline” of its coal business, in other words by cutting production. Glencore has previously criticised its peers for setting “wishy washy” emissions reduction targets for 2050, without a credible plan or interim targets along the way. It’s hard to disagree. According to the Australian Council of Superannuation Investors (ACSI), 18 ASX-listed companies have committed to net-zero emissions, but 13 of those companies have not laid out a plan to get there. Glencore has also criticised its competitors for selling or spinning off their coal assets rather than managing their decline. CEO Ivan Glasenberg rightly criticised South32 and others for selling assets to “other players who have no intention of reducing emissions”. Rio Tinto’s sale of its coal assets in 2018 may have been good for shareholders, but if anything, emissions from its former mines have continued to rise. Will Climate-Aware Investors Endorse Coal Mine Expansion?The Say on Climate initiative, pioneered by hedge fund investor Chris Hohn, gives shareholders a vote on companies’ climate transition plans, and their performance against those plans. Glencore’s lack of a short term target (pre-2035) may allow it to actually increase emissions in the critical decade to 2030. While its emissions declined in 2020, that had more to do with the pandemic rather than a deliberate effort to act in the best interests of the planet. Glencore’s planned coal mine expansions are not insignificant, and cannot be easily explained away. As others have previously noted, many of the largest coal mines in the Hunter Valley are already operating well below capacity and global coal demand is flat. So why is Glencore persevering with so many new and expanded coal projects? If Glencore is to be taken seriously on climate, these must be abandoned. Policy InfluenceWhat is not mentioned in Glencore’s climate plan is the role of its lobbyists. Glencore has long fanned the flames of the climate wars in Australia and elsewhere. From 2017 to 2019, Glencore funded Project Caesar—a secretive pro-coal Facebook campaign, administered by Crosby Textor. Glencore remains one of the largest members of some of Australia’s biggest blockers of climate action: the Minerals Council of Australia, the NSW Minerals Council and the Queensland Resources Council (QRC). Last year, BHP and Origin Energy exited the QRC after it ran an anti-Greens advertising campaign during the Queensland state election. Glencore said nothing. Just this week, the NSW Minerals Council organised a live broadcast from a coal mine on behalf of Sky News, and its CEO Stephen Galilee penned an opinion piece boasting that “everybody loves coal when the votes depend on it”. Earlier this month, Glencore hosted the campaign launch for the Nationals candidate for the Upper Hunter by-election at its Ravensworth coal mine. This Week’s VoteGlencore shareholders have the opportunity this week to send a message to outgoing CEO Ivan Glasenberg: if he wants climate action to be his legacy rather than one of denial and delay, he must abandon coal expansionism and rein in the lobbyists. It is likely that this opportunity will be squandered. Shareholders will almost certainly reward Glencore’s decision to be one of the first companies to provide a Say on Climate vote with endorsement of the company’s plan. At the very least, this should cause some introspection about climate-aware investors’ voting strategy, or lack thereof. History will not look back kindly at institutional investors’ endorsement of Glencore’s coal expansionism in 2021. Shareholders must think carefully about wasting future Say on Climate votes by rubber stamping incrementalism. Dan Gocher is director of climate and environment at the Australian Centre for Corporate Responsibility (ACCR). |

|