US Coal Miners Leveraging Demand Spike to Lock in Future Sales

By Taylor Kuykendall

November 5, 2021 - U.S. coal producers are leveraging a recent spike in demand to lock in longer-term commitments that reduce uncertainty around the industry's future.

The boon in sales, coming amid an economic rebound and a bump up in natural gas prices, would seem to run counter to decarbonization efforts by world leaders meeting in Scotland in November to discuss global decarbonization. St. Louis-based Arch Resources Inc. and Peabody Energy Corp., owners of the largest coal mines in the U.S., both reported selling out or nearly selling out planned tonnage through 2022 during third-quarter earnings calls. Other coal producers are also reporting success in capturing multiyear contracts that allow them to confidently ramp up coal production.

"Utilities would love to be restocking right now," Alliance Resource Partners LP President and CEO Joseph Craft told investors Oct. 25. "But they're more focused on ... getting the coal that they got under contract so that they're prepared for the winter without having to run out coal."

'Levels we have never seen before'

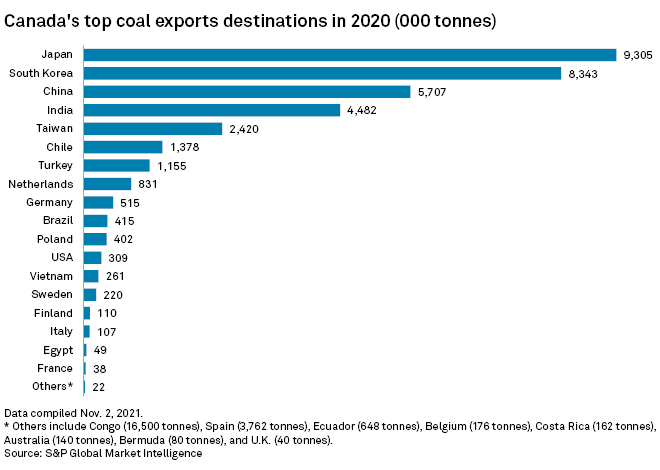

The economy is bouncing off the pandemic-driven lows seen in 2020, and natural gas prices have risen substantially, creating demand for U.S. coal power and making plants more economical to run. Global demand for both thermal and metallurgical coal has also increased at the same time that U.S. coal producers are finding their way into new markets. A trade dispute that has halted the flow of coal from Australia to China has been a boon for U.S. coal miners.

"The combination of solid market fundamentals across the world and ongoing geopolitical tensions between the world's largest met coal consumer and the world's largest met coal producer have elevated pricing for our products to levels we have never seen before," Warrior Met Coal Inc. CEO Walter Scheller said on the company's Nov. 2 earnings call.

While U.S. thermal coal demand is likely to contract again in the coming months, many producers are now locking in sales at favorable prices several years into the future.

"Across the globe, we are seeing record coal index prices in each market segment and demand returning to near pre-pandemic levels," Peabody President and CEO James Grech said.

Several metallurgical coal producers also expressed optimism that even if Australia and China resolve their trade dispute, a lack of new coal supply and interest in ramping up a global build-out of infrastructure will continue to support higher prices.

"Who says Christmas can't come a little early? We are now three quarters through having our best year of financial and operational performance since we went public," Ramaco Resources Inc. founder, Chairman and CEO Randall Atkins said on a Nov. 3 earnings call following the announcement of a newly acquired coal asset, a regular quarterly dividend and nearly completed 2022 coal sales.

Craig Nunez, president and COO of Natural Resource Partners LP, a Texas-headquartered company that leases mineral reserves to multiple coal operators, noted the benefits of higher metallurgical coal prices are also showing up in the partnership's cash flow now and higher thermal pricing is likely to soon benefit the company as well.

Locking in coal purchases

With prices high, the dynamic between coal producers and consumers has become somewhat more favorable for producers, reducing the risk of major investments into new production.

Arch executives said they are not only sold out of thermal coal for 2022 at "highly advantageous pricing" but are also booking substantial sales into the years beyond. Alliance is expecting increased sales volumes in 2022 and booked significant tonnage through 2024. Craft noted the company could lean more heavily on export markets if its domestic customers are unwilling to sign longer-term coal contracts.

Peabody has already sold most of its 2022 Powder River Basin coal production, and the remainder will only be available to customers entering into multiyear contracts, Grech said on the company's earnings call. Peabody also reached agreements that will support its Twentymile mine in Colorado for the next five years and booked Illinois Basin coal sales at higher pricing through 2025.

"At our other U.S. thermal operations [outside of the Powder River Basin], we are ramping up volumes next year by approximately two million tons to meet increased customer demand," Grech said. "We only have a small portion left to be sold for 2022 and for 2023."

Pennsylvania-based coal miner Consol Energy Inc. is also ramping up production based on renewed customer demand and is restarting the development of a fifth longwall machine at its Enlow Fork mine in Pennsylvania.

"Due to the improved market dynamics, the underground operations are generating positive operating cash flows on a consistent basis," Consol President and CEO Jimmy Brock said. "We continue to explore options to further ramp up production."

Underinvestment leads to supply 'scramble'

The obstacles to bringing on new production are part of the reason coal supplies are tight. In addition to uncertainty around the market, many U.S. coal companies struggle to access capital as banks and other financial services are increasingly unwilling to do business with coal producers.

"The reality is there's just been very limited investment in new coal production really everywhere domestically and as well as internationally," said Deck Slone, senior vice president of strategy at Arch Resources. "As a result, there's a bit of a scramble right now as generators look to find additional volumes."

With balance sheets in much better shape and booming share prices, some coal producers might consider steps to consolidate the industry, Grech said. A federal court upheld a Federal Trade Commission decision blocking a proposed joint venture of western coal assets proposed by Arch and Peabody in late 2020.

"Consolidation does need to occur in the market," Grech said. "Even with these strong prices, there's still too many different players out there."

Long-term outlook

Despite recent market improvements, many U.S. coal companies are planning for thermal coal demand to continue its decline domestically. Arch executives said the company's large Powder River Basin thermal coal mines will likely self-fund reclamation costs as the company winds those operations down and pivots to a focus on metallurgical coal markets.

"I think we're very clear-eyed that over the long term — we're going to continue to see pressure as plants close down over time," Arch COO John Drexler said.

Alliance, which already profits from recently acquired assets in the oil and gas sector, said it was committed to providing coal to its customers going forward but also considers opportunities outside the coal space. Nunez mentioned Natural Resource Partners is also looking to continue to diversify into other industries such as carbon dioxide sequestration.

Peabody's interest in future merger or acquisition activity would more likely focus on seaborne coal markets, Grech told investors on the company's Oct. 28 earnings call, but the company remains dedicated to providing thermal coal to U.S. power plants.

"Even though it's in secular decline, we still think there are going to be demand for the producers that are left as reliable producers," Grech said.