New Optimism for Extracting Minerals From Coal Waste as Federal Dollars Flow In

November 8, 2022 - The Biden administration is pouring cash into extracting crucial minerals from coal waste as corporate and academic optimism for the technology grows.

The accelerating energy transition is inflating demand for rare earth minerals used to make things such as batteries for electric vehicles and utility-scale energy storage. However, according to the U.S. Department of Energy, more than 80% of the key minerals the U.S. needs are sourced through imports, and the country is particularly reliant on China.

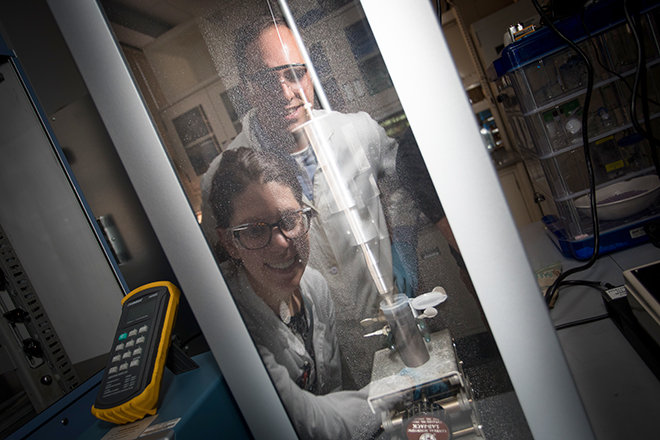

National Energy Technology Laboratory researchers Elliot Roth and Megan Macala sonicate coal-based materials to enhance particle separation and rare earth element extraction.

Source: U.S. Department of Energy

With the backing of the U.S. Congress, and in an effort to placate a key vote in the U.S. Senate, the Biden administration has been supporting several efforts to bolster a domestic supply chain, including extracting the minerals from coal. The black rock, which when burned is a source of the emissions triggering global climate change, is increasingly seen as a domestic source of the ingredients of the energy transition.

"These minerals are essential to our Armed Forces, the technologies that Americans use every day, and technologies of the future," Sen. Joe Manchin, D-W.Va., the swing vote needed for partisan legislation to pass, said in a statement. "Establishing a secure domestic supply chain is crucial to ensuring our energy security and independence while also reducing our reliance on foreign nations, and this swift implementation is a critical first step."

The U.S. has been extracting and burning coal for over a century, and parts of the countryside are littered with coal mining waste sites. Identifying an alternative use could be a boon for the country and for regions where it is mined. And it turns out, coal contains a plethora of key minerals.

"Coal kind of has everything in it," said Brian Anderson, director of the U.S. Department of Energy's National Energy Technology Laboratory. "It has the whole periodic table in it at different concentrations."

The bipartisan infrastructure bill, signed into law in 2021, included $62 billion for DOE to invest in American manufacturing and workers and support a transition to cleaner energy. On Oct. 12, the DOE announced a notice of intent to fund a $32 million program for engineering studies on producing rare earth elements and other critical minerals from coal-based resources.

|

Brian Anderson, director of the U.S. Department of Energy's National Energy Technology Laboratory

Source: U.S. Department of Energy

|

As of the October announcement, DOE said it invested $25 million in 21 projects across the U.S. to encourage the production of rare earth elements and critical minerals. In September, the government offered up $156 million in funding for a first-of-a-kind facility to extract about 10% of the nation's 2019 demand for rare earth elements and critical minerals from unconventional sources such as mining waste. In April, DOE awarded $19 million to 13 rare earth and critical mineral projects in areas traditionally associated with producing fossil fuels.

"It becomes just a technology process to unlock," said Anderson, Biden's pick to lead an interagency working group to revitalize regions whose economies relied on coal or power plants. "The opportunity is to take an environmental burden — acid mine drainage sludge, for example — and turn it into a potential revenue source."

Pleasant surprises on the path to commercialization

A lump of coal contains relatively low concentrations of some of the most valuable minerals, measured in parts per million, which means few companies will mine coal specifically for the materials. However, Anderson said the initial work from the DOE and its academic and commercial partners had exceeded initial expectations for the purity that can be obtained and in the extracted volume from coal waste streams.

Paul Ziemkiewicz, director of the West Virginia Water Research Institute at West Virginia University, said his organization's efforts to pull rare earth elements from acid mine drainage have pleasantly surprised him.

"Anything over 1% rare grade would be considered successful," Ziemkiewicz said. "We've doubled that."

Acid mine drainage also tends to be rich in heavier, more valuable rare earth elements, Ziemkiewicz said. For example, the researcher noted that China's typical mine supply feedstock comprises only a couple of percentage points worth of heavy rare earth elements, but 45% to 50% of rare earth materials in acid mine drainage are in that category.

The Clean Water Act already requires acid mine discharge to be treated, but extracting rare earth materials incentivizes that with a revenue stream. Many sites, including hard rock mining operations, could go into production immediately with modifications to their treatment process, Ziemkiewicz said.

"I'm a lot more optimistic about the resource base than I was maybe six months ago," Ziemkiewicz told S&P Global Commodity Insights.

Broadly, the hope is to tap into a domestic resource and clean up the supply chain for things like electric vehicles by mining the elements in a more environmentally sustainable manner.

|

In addition to rare earth materials, graphene can be extracted from coal. Researchers at the National Energy Technology Lab extracted a liter of graphene quantum dots, valued at about $50,000 commercially, using domestic coal feedstocks.

Source: U.S. Department of Energy

|

"The next step is scaling up," Anderson said. "How can we take what is now bench- or pilot-scale in some forms and move up to more of the demonstration-type scale to continue to refine the process and show commercial availability."

Supplying the base of a growing manufacturing sector could be a substantial opportunity, particularly for regions like West Virginia. The decline of coal used for power generation has been economically devastating for communities in the area.

That sort of opportunity has caught the attention of elected officials.

Companies are also making moves into the space

The private sector has also taken notice.

"The demand looming on the horizon is so large and the geopolitical considerations hanging over these supply chains so alarming, you need to move on multiple fronts to try and build secure, reliable and responsible supply chains," said Conor Bernstein, a spokesman for the National Mining Association.

Through acquisitions over the past several years, American Resources Corp. has built a portfolio of metallurgical coal mines in eastern Kentucky and southern West Virginia, where coal mining volumes have fallen sharply. The company has also been developing patents and technologies to extract valuable materials from sources such as coal mine waste and recycled batteries at the end of their useful life.

Where most researchers in coal country use a solvent extraction process, American Resources pivoted to electrolysis, American Resources Chairman and CEO Mark Jensen told Commodity Insights. While the company is working on tapping into rare earths from coal-based materials, the initial focus is on using end-of-life batteries and magnets from sources such as wind turbines. The materials have a much higher concentration of critical minerals and represent a more significant opportunity than the coal waste streams.

"It'll end up being, in the outer years, 5% to 10% of our overall business," Jensen said regarding extracting critical minerals from coal. "It's not going to be a majority of our revenue stream."

Jensen said the byproducts of the electrolysis process also add value to coal waste streams. One example is precursors to carbon nanostructures used as a concrete additive.

While the government is throwing a lot of support behind extracting rare earth materials, Jensen said the market will ultimately decide the success of such efforts.

Jensen said his company shies away from taking too much government money because of the strings attached. However, given the buzz around growing U.S. critical mineral production, Jensen said he has found it entertaining to watch parties rush into the space.

"You can't just jump into this and try to make money at it," he said. "You're dealing with things that you have to plan. You have to develop a process to make it profitable for the long term and put together a fully integrated plan."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.