China's Emissions From Power Sector May Peak Around 2024

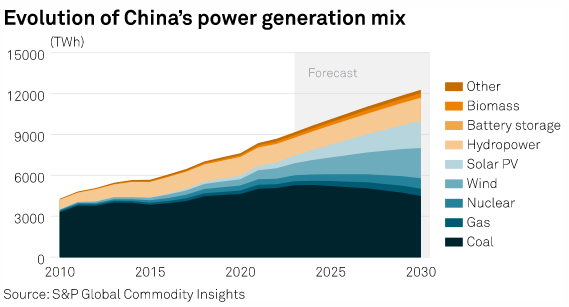

January 14, 2024 - China's carbon emissions from its power sector may peak around 2024, S&P Global Commodity Insights forecasted, but the development is subject to some uncertainties, including the pace of economic recovery and the extent to which rapid growth in renewable generation capacity can translate into reliable power supply.

Although 2023 marked the end of China's battle against COVID-19, the country's weak real estate and export markets were a drag on power demand growth. During the first 11 months of 2023, power demand growth for the entire industrial and services sector was 6.1%, but it was largely due to a low base in 2022, S&P Global data showed.

S&P Global forecasts that China's power demand will grow 5.4% to 9,665.42 TWh in 2024. However, exceeding this moderate level will depend on more pro-growth policies and effective stimulus measures to accelerate economic recovery.

Despite the economic turbulence, China's renewables-based power generation capacity has been soaring in recent years, with S&P Global forecasting solar and wind capacity addition to reach 206 GW in 2024, on par with last year's high.

Whether power sector emissions can peak in 2024 will depend on the development of energy storage systems and transmission infrastructures, which are essential to cope with intermittency and integrate renewables into the grid. Otherwise, growth in renewable capacity will bring simultaneous growth in coal-fired and gas-fired generation capacity.

The coal and gas fleets added 46.5 GW and 6.94 GW of capacity in the first 11 months of 2023. In 2024, China's coal-fired capacity additions are expected to be 44 GW, while gas-fired capacity additions will reach 11 GW, S&P Global forecasts.

With a significant amount of coal-fired generation being under construction, the capacity growth is expected to continue until the latter half of this decade. Nevertheless, a transitioning power grid is expected to see existing fossil-fuel-based generation operate at lower utilization rates as renewables ramp up, driving the shift in the emissions profile.

S&P Global forecasts that the capacity factor of China's coal fleets will drop to 25% by 2050, more than halved from the current level.

Building up Battery Storage

When renewable electricity falls short, the common practice is to count on coal, gas and pumped hydropower to provide baseload supply and ensure grid stability. Over time, utility-scale battery storage should increasingly take on this role and help cut emissions.

China's current battery storage infrastructure falls short of what is needed in the foreseeable future. Looking at global new renewable capacities to be operational by 2028, China alone is expected to account for 60%, the International Energy Agency said in its latest report, calling the country "the world's renewables powerhouse".

S&P Global forecasts that solar and wind electricity supply will grow by 24%, or 245 TWh, to 1,809 TWh in 2024, accounting for 19% of the country's total electricity supply. Comparatively, China's coal-fired electricity supply will grow just 0.2% to 5,287 TWh in 2024, gas-fired supply will grow by 8% to 320 TWh, and pumped hydropower will jump by 17.8% to 73 TWh.

In contrast, battery storage facilities can only provide 6.39 TWh of electricity, which is merely 0.35% of renewable electricity supplies, up from a small base of 3.69 TWh in 2023.

China's battery storage sector is expected to grow at an accelerated pace, with technological advancement and increasing policy support incentivizing more business models, S&P Global said in a December 2023 report.

The government has stressed the need for energy storage systems, or ESS, to participate in power trading to help them generate revenue when discharging electricity into the grid, and in 2024, China's power exchanges are expected to fine-tune rules for ESS.

No Transition Without Tansmission

Another pain point for integrating renewables has been long-distance transmission to connect remote renewables projects in northern and western China with the densely populated eastern and coastal regions where power demand is concentrated.

Most renewables growth in coming years will come from mega-projects in these remote areas. By end-2023, project developers had committed to commissioning 67% of the installed capacity but around 33% was delayed of the total 100 GW, S&P Global data showed. One crucial reason behind the delay was the slow progress in constructing transmission lines.

Currently, the transmission networks with the highest renewable electricity load are the ones carrying hydropower from hydel projects in Southwest Sichuan and Yunnan to eastern and coastal urban regions. Hydro exports through these lines have been unstable in recent years amid increasing droughts and extreme weather conditions.

S&P Global forecasts that China's conventional hydropower electricity supply will increase 3.3% to 1,268 TWh in 2024, much smaller than the 24% increase in solar and wind power supplies.

Constructing these transmission lines is crucial to boost the renewable utilization rate in the mega bases, as well as helping east and southeast regions to acquire renewable electricity from alternative sources at competitive prices.

Additionally, power sector reforms will be key to unlocking more renewables in 2024 and cutting emissions further.

China needs to streamline inter-provincial power trading, enhance dispatchability beyond provincial boundaries, and alter the mindset of "local protectionism," as some provincial governments are reluctant to compromise to import renewable electricity at the cost of shutting local power plants and coal mines.