.gif)

|

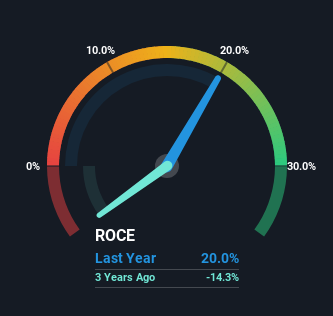

Signature Sponsor

March 18, 2024 - What are the early trends we should look for to identify a stock that could multiply in value over the long term? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. Speaking of which, we noticed some great changes in Corsa Coal's (CVE:CSO) returns on capital, so let's have a look. Return On Capital Employed (ROCE): What Is It?If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Corsa Coal, this is the formula: Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities) 0.20 = US$33m ÷ (US$191m - US$26m) (Based on the trailing twelve months to December 2023). So, Corsa Coal has an ROCE of 20%. In absolute terms that's a great return and it's even better than the Metals and Mining industry average of 2.0%. See our latest analysis for Corsa Coal

Historical performance is a great place to start when researching a stock so above you can see the gauge for Corsa Coal's ROCE against it's prior returns. If you're interested in investigating Corsa Coal's past further, check out this free graph covering Corsa Coal's past earnings, revenue and cash flow. The Trend Of ROCECorsa Coal has not disappointed in regards to ROCE growth. The figures show that over the last five years, returns on capital have grown by 576%. The company is now earning US$0.2 per dollar of capital employed. Speaking of capital employed, the company is actually utilizing 29% less than it was five years ago, which can be indicative of a business that's improving its efficiency. If this trend continues, the business might be getting more efficient but it's shrinking in terms of total assets. The Bottom LineFrom what we've seen above, Corsa Coal has managed to increase it's returns on capital all the while reducing it's capital base. And since the stock has fallen 64% over the last five years, there might be an opportunity here. With that in mind, we believe the promising trends warrant this stock for further investigation. Like most companies, Corsa Coal does come with some risks, and we've found 2 warning signs that you should be aware of. High returns are a key ingredient to strong performance, so check out our free list of stocks earning high returns on equity with solid balance sheets. |

|