|

Signature Sponsor

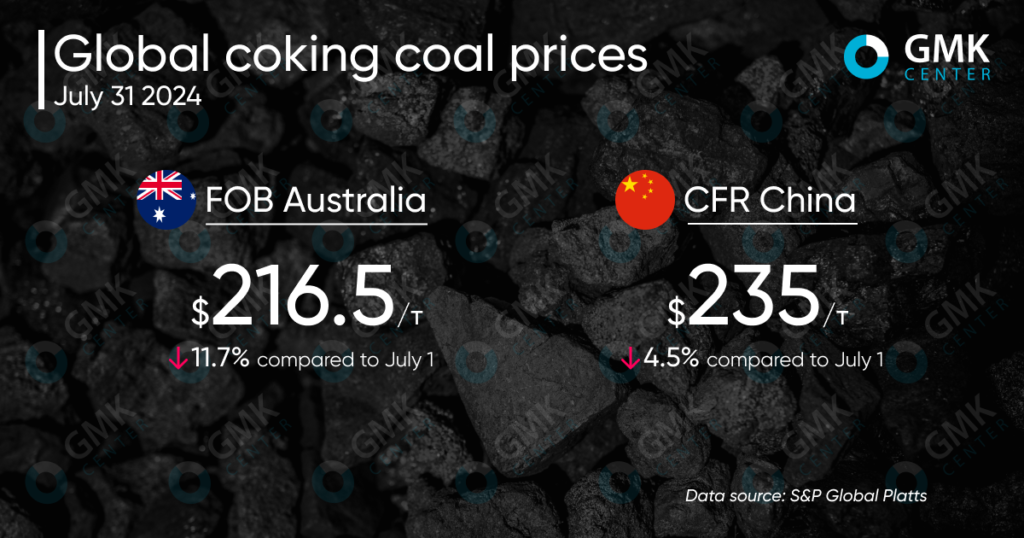

August 4, 2024 - Indian consumers will return to the market at the end of August, stocks of raw materials in Chinese ports are sufficient According to S&P Global, Australian coking coal prices (FOB Australia) decreased by 11.7% – to $216.5/t in July 2024. Prices for coking coal in China (CFR China) fell by 4.5% last month – to $235/t.

In late June and early July, the market reacted to possible supply problems following a fire at an Anglo American coal mine. On June 30, the company announced that it had suspended production at the Grosvenor mine in Queensland after an underground coal gas fire a day earlier. The miner said it was working with the relevant authorities to extinguish the fire before being able to assess steps to safely return to the site. These procedures are expected to take several months. Anglo American expected to produce approximately 8 million tons of coking coal in the first half of 2024, with Grosvenor’s contribution of approximately 2.3 million tons. In total, Anglo American’s estimated coking coal production for 2024 is 15-17 million tons, with Grosvenor’s share of about 3.5 million tons. At the time, traders noted that speculation on this topic had pushed up market sentiment somewhat, raising Australian coking coal prices. However, they predicted that the price would eventually return to normal. In addition, market participants expected that this force majeure would have a limited impact on supply in the third quarter, or only on the company’s supplies in the fourth quarter. According to S&P Global’s forecast, the seaborne coking coal market is likely to remain limited in price range in the third quarter, as significant supply volumes offset concerns about supply shortages following the Anglo American mine incident. India is also expected to return to purchases after the monsoon. Indian buyers will return to the market in late August and early September after the rainy season. The third quarter is traditionally the worst in the country in terms of steel demand. However, they are unlikely to agree to a high price. Indian consumers are currently taking a wait-and-see attitude. According to BigMint, at the end of August, prices for premium Australian hard coking coal on the Indian market amounted to $216.5/t FOB. They fell due to additional supply entering the market, and buyers are confident in the availability of September bulk cargoes. The country is currently seeking to diversify its supply of this key raw material. As reported, India will start importing coking coal from Mongolia on a trial basis from the end of July. It was expected that JSW Steel would receive about 30 thousand tons, while SAIL would probably receive 3 to 5 thousand tons. This will be the second such supply for JSW Steel after 2021. In addition, India plans to increase the share of local coking coal used in metallurgical mixtures from the current 10-12% to 35%. The government has also launched a mission to increase domestic production to 140 million tons by 2030. At the end of July, prices for Australian coking coal on the Asian market rose slightly due to interest from Chinese steelmakers in August cargoes, as sea-based raw materials are attractive. FOB prices in the country approached CFR China prices during the second quarter, and the situation was similar at the end of the month. Some steel mills preferred forward deliveries, as prices for port stocks were higher and sellers were reluctant to reduce them. There remains a sufficient supply of premium products from Australia and Canada in ports. Chinese end-users maintain ultra-low stocks of coking coal, buying it from ports as needed. As GMK Center reported earlier, global coking coal prices rose in early June. The positive trend was driven by increased demand and expectations of a supply decline in July and August. |

|