|

Signature Sponsor

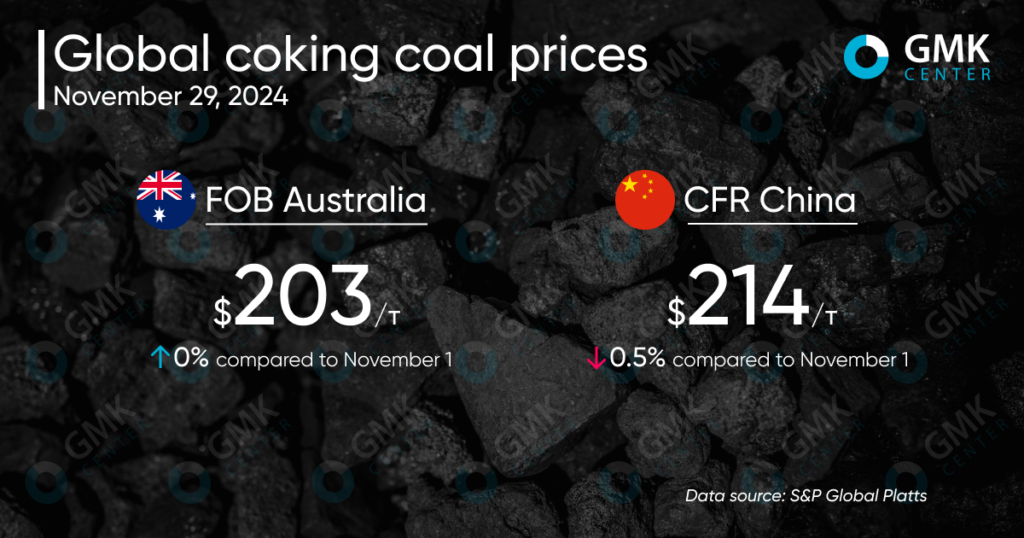

December 4, 2024 - November 2024 was a month of stability for the global coking coal market with little price fluctuation. In Australia (FOB Australia), premium coking coal held the level of $203/t. Meanwhile, on the Chinese CFR China market, prices fell by 0.5% to $214/t by the end of the month. At the same time, in the middle of the month there were fluctuations in the range of $3-4. The main factors affecting the situation were limited market activity, expectations of new economic stimulus in China and weak demand for steel.

The Australian market remained stable amid low buyer activity in the first days of the month. Indian market participants were celebrating holidays, while Chinese buyers limited their purchases to minor ones. Despite talk of economic stimulus in China, there was no real increase in demand. In addition, stable weather conditions in Australia reduced the risk of supply disruptions. Supply remained balanced, and traders kept prices at the current level without having a significant impact on sales. The Chinese market, in turn, showed a moderate decline. Steel mills maintained a low inventory strategy and purchased small volumes at ports, avoiding long-term contracts due to expectations of further price declines. At the same time, the weakness of the domestic steel market increased negative pressure on prices. Trading activity remained limited, with most market participants waiting for winter demand to pick up or for additional incentives from the Chinese government. In the short term, the FOB Australia market is likely to remain stable, unless there are adverse weather events or a sharp increase in Chinese purchases. On CFR China, the price decline may continue, given the excess of supply over demand in the domestic market. At the same time, stimulus measures by the Chinese government may improve the overall economic climate and support demand for coking coal later in the year. November demonstrated the impact of weak fundamentals on the market. Winter and possible economic initiatives in China will be the key factors that will influence the coking coal market dynamics in the coming months. According to S&P Global forecasts, the coking coal market will remain subdued in 2025, with a tendency to lower prices due to limited demand and global economic uncertainty. In the first quarter, prices will be in the range of $190-210/t FOB Australia, with further decline restrained by high production costs. Market participants also point to a possible reduction in production in the US due to low export profitability, which could reduce supply and partially support prices. Additional challenges for the market may arise from changes in US and Chinese tariff policies. China’s reintroduction of a 3% import duty on US coal starting in early 2025, along with the prospect of further trade restrictions, creates uncertainty for exporters. At the same time, U.S. suppliers are likely to refocus on other markets, such as India, which continues to expand its steel capacity. India could become a potential market driver: the launch of new blast furnaces by major producers such as Tata Steel will stimulate demand for coking coal. However, the country has its own coal producers that compete with Australian suppliers. The Chinese coal market remains cautiously optimistic due to weak demand from the steel sector. The economic situation in the country continues to put pressure on prices, and the implementation of new stimulus measures seems insufficient to significantly revive demand. Unless the real estate crisis is resolved, steel consumption in China may remain low, which will have a negative impact on coal imports.

|

|