US Coal Markets Stage Modest Spring Rally

June 20, 2025 - US coal market prices rose slightly in May, despite natural gas prices easing month over month. Natural gas prices remain higher year over year and continue to support firmer steam coal demand.

Higher natural gas prices are expected to improve the economic competitiveness of coal generation through 2027, a welcome prospect for steam coal producers affected by low demand in recent years. Low natural gas storage levels this spring will add to the demand boost, but much of this will go to reducing surplus coal inventories. Beyond 2027, the US coal market is forecast to face pressure from the expansion of zero-carbon electricity incentivized by the Inflation Reduction Act. Overall, the S&P Global Market Indicative Power Forecast projects 44.2 GW of coal plant retirements by 2035, while 797.7 GW of renewable capacity is forecast to come online. Generation from coal plants is forecast to significantly decrease over this period, with US electricity demand for coal declining 46.8%, and coal plants accounting for just 7.1% of total generation by 2035.

Price trends: US coal prices experienced a modest increase in May, with export coal prices rising slightly while domestic coal prices saw minimal changes. Benchmark prices for coal in various regions, including Central Appalachian (CAPP) and Northern Appalachian (NAPP), indicated small increases, with export coal gaining $1.00 per short ton on average.

Natural gas market dynamics: Natural gas prices declined due to mild weather, impacting coal competitiveness. The Henry Hub spot gas price fluctuated but closed lower at $2.97/MMBtu. Regional discounts in gas prices persisted, affecting coal's market positioning.

Coal demand and supply outlook: The US Energy Information Administration (EIA) projected a reduction in coal stockpiles, indicating a potential clearing of surpluses by early summer. Despite a forecasted decline in long-term coal demand, there is an expected increase in coal shipments and production due to higher natural gas prices through 2027.

Regional production forecasts:

– Powder River Basin: Production is expected to grow modestly, reaching 215 million short tons (MMst) in 2025, with a significant decline in demand anticipated by 2030.

– Illinois Basin: Stable production is forecasted through 2027, but demand is expected to decline sharply post-2027 due to wind generation expansion.

– Appalachian Basins: Production is projected to remain stable at approximately 159 MMst, but a decline to 108 MMst is expected by 2030 as domestic demand decreases.

Long-term projections: The S&P Global Market Indicative Power Forecast anticipates significant coal plant retirements and an expansion of renewable energy capacity, leading to a projected decline in coal's share of total electricity generation to just 7.1% by 2035.

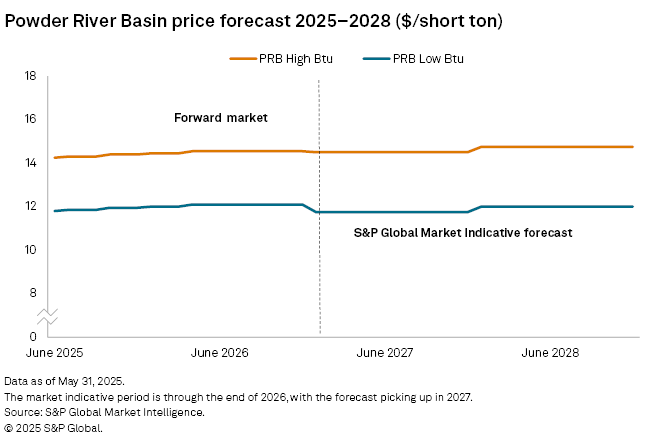

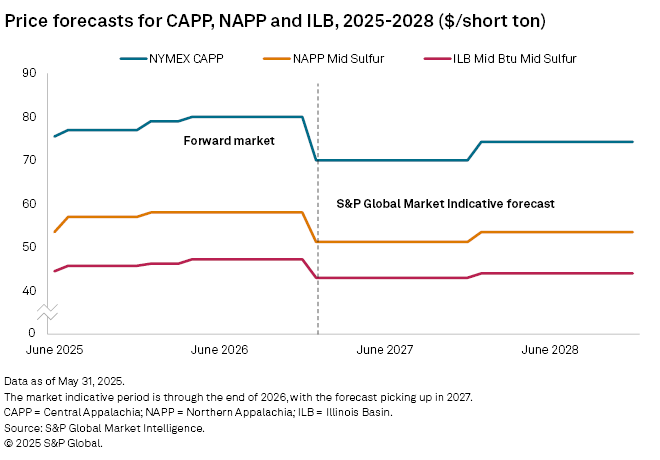

Coal prices saw modest changes in May, with export coal gaining slightly compared to natural gas. Benchmark export coal prices moved $1.00/short ton higher. CAPP region export benchmarks closed May at $79.00/short ton (up 1.3%), NYMEX CAPP at $77.00/short ton (up 1.3%), and NAPP Pittsburgh Seam 13,000 Btu per pound up $2.00/short ton (3.6%) to $57.00/short ton. Domestic coal rose slightly, with Illinois Basin 11,500 mid-sulfur gaining $0.50/short ton, or 1.1%, to $45.75/short ton, while the NYMEX Powder River Basin benchmark held flat at $14.30/short ton.

Natural gas prices fell in May due to mild weather. Henry Hub spot gas opened at $3.12/MMBtu and moved to a mid-month high of $3.31/MMBtu before falling to close the month at $2.97/MMBtu. Spot prices averaged $3.13/MMBtu for the month. Storage refill picked up during the month, with working gas at 2,598 BCF as of May 30. This is 117 BCF above the five-year average, and 288 BCF below the surplus levels of 2024.

Regional gas market discounts continued in May. Chicago Gate averaged $2.88/MMBtu, a $0.25/MMBtu discount to Henry Hub. TCO Pool's discount eased to $0.43/MMBtu at $2.70/MMBtu, while TETCO M3's discount was $0.67/MMBtu at $2.46/MMBtu. SoCal Border's discount was $0.92/MMBtu for an average monthly spot price of $2.21/MMBtu.

The US EIA estimated February 2025 coal stockpiles at 107 MMst, a 7 MMst reduction from January. With another large drawdown expected for February, surpluses that built up during the past year could be cleared by early summer.

Current forward pricing for Powder River Basin coal reflects high inventories this year, with headroom to increase production against natural gas prices in 2026–2027. The inventory overhang may restrain price growth, but inventories may be normal by midyear. After 2027, declining demand will restrain price growth.

Bituminous coal price levels are primarily influenced by export markets, with today's price levels making domestic coal generation less competitive against Northeast natural gas. The recent rally in eastern natural gas prices may nevertheless boost first-half 2025 demand. Seaborne coal demand is expected to decline 6.7% relative to 2024 due to reduced demand from India and Mainland China.

Pricing benchmarks exceeding $65/short ton suggest sustainable returns for eastern bituminous coal. After declining last year, bituminous coal demand for electric generation is expected to remain stable through 2027 on higher electricity demand and more supportive natural gas prices. Declines in steam coal demand are expected to resume after 2027, and overall Eastern US coal demand is forecast to decline 62 MMst from 2025–2030.

Outlook for US coal production, demand

For the four weeks ending May 31, coal shipments averaged 10.4 MMst, 25% higher than this time last year. Continued strong deliveries indicate higher demand this spring and stronger coal shares due to higher natural gas prices.

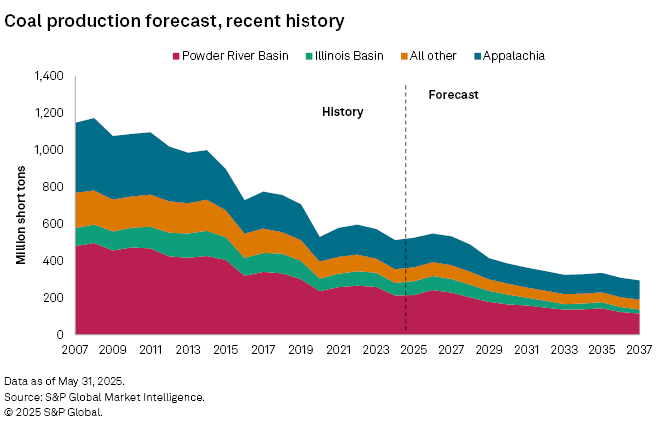

The chart below compares the current production forecast with recent history. We forecast increased coal demand against higher natural gas prices through 2027. Gas to coal switching has already mostly cleared coal inventory surpluses, clearing the way for production growth this year. We now forecast coal production at 524 MMst, an increase of 12 MMst (2.3%) from 2024 levels. Coal generation is forecast to further gain market share from natural gas through 2027, until relative coal and gas pricing normalizes and expanding green energy again puts pressure on coal generation. The overall coal market, including domestic demand and exports, is forecast to decline by 133 MMst between 2025 and 2030, which is a lower rate of decline than previously forecast.

Production outlook — Powder River Basin

First quarter 2025 production reports of the Mine Safety and Health Administration (MSHA) indicate quarter-end production at 54.9 MMst, an annualized rate of 219.4 MMst. Production is now forecast at 215 MMst in 2025, as demand more than offsets 2024 year-end inventory levels. With inventory levels normalized, production is forecast for modest growth through 2027 against higher natural gas prices. By 2030, Commodity Insights projects that coal generation retirements in the Midwest and a substantial expansion of wind generation in Powder River Basin's core markets will shrink coal demand to 164 MMst, further declining to 143 MMst through 2035.

Production outlook — Illinois Basin

We forecast stable annual production through 2027, ranging between 74-76 MMst per year. After 2027, the expansion of wind generation incentivized by the Inflation Reduction Act and announced coal retirements are forecast to erode Illinois Basin coal demand. Coal production in the Illinois Basin is forecast to fall to 54 MMst by 2030, further declining to 33 MMst by 2035.

Production outlook — Appalachian basins

First quarter 2025 production reports of the MSHA indicate quarter-end production at 39.8 MMst, or an annualized rate of 159.2 MMst. With export into seaborne metallurgical markets forming an increasingly larger portion of Appalachian coal demand, the region's aggregate demand is less sensitive to natural gas price competition than in domestic producing regions of the Powder River and Illinois Basins. While the Illinois Basin and Powder River Basin are forecast for improved demand against natural gas generation, gains in Appalachian coal will be more limited. We forecast production at 159 MMst, essentially the same as 2024. As remaining domestic demand erodes with only modest offsets from export growth, Appalachian production is forecast to fall to 108 MMst by 2030.

Further information

Market indicative coal forecasts by Commodity Insights represent forward curves for spot-traded instruments analogous to a strip of contracts. The shorter tenors — current year and prompt year, plus additional years, if available — are driven by the observed/assessed market. The longer tenors — typically forecast years three to 20 for physically assessed markers — are driven by fundamental estimates of cash costs of production, accepted returns to capital, regional productive capacity, and forecast supply and demand. For the long-tenured portion of the curve, Commodity Insights forecasts prices for specific coal markers and defines the remaining markers via historical spreads.