|

Signature Sponsor

November 4, 2025 - Ramaco Resources (METC) has signed a major research agreement with the U.S. Department of Energy’s National Energy Technology Laboratory. The partnership aims to advance rare earth element and critical mineral development at its Brook Mine in Wyoming. It has been a whirlwind year for Ramaco Resources, with momentum firmly on the company’s side thanks to a string of major initiatives, most notably the pivotal new federal partnership and Brook Mine facility launch. While there’s been a recent pullback in the share price, with a 1-month share price return of -26.2%, that comes after a massive run: year-to-date share price return stands at 160%, and the total shareholder return over the past year is an impressive 184%. Over a longer horizon, the company’s transformation into a critical minerals leader is clear, as the 5-year total shareholder return has soared more than twelvefold. If you’re curious to see how other fast-growing companies with strong insider ownership are capitalizing on major industry shifts, the best place to start is with our fast growing stocks with high insider ownership. With so much momentum and a robust pipeline of announced projects, does Ramaco’s recent share price drop signal a compelling entry point? Or are markets already factoring in the company’s ambitious growth trajectory? Most Popular Narrative: 35% UndervaluedRamaco Resources is trading at $27.87, while the most widely followed narrative sets its fair value at $43 per share. This significant gap invites a closer look at what is driving the company’s valuation outlook and what could be fueling expectations of further upside.

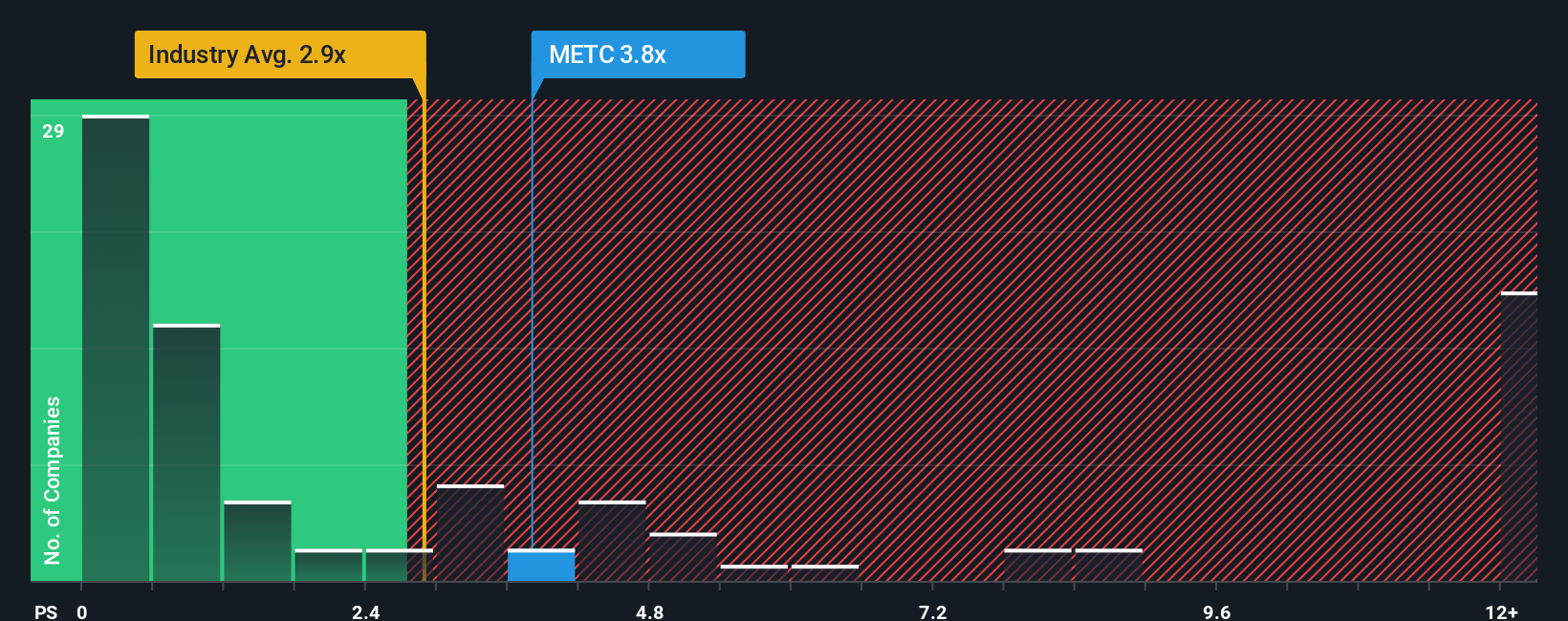

Curious about the bold numbers and breakthrough milestones behind this eye-catching valuation? Dive into the details to discover which extraordinary growth assumptions and profitability forecasts might power Ramaco’s potential to reshape the critical minerals landscape. Don’t miss what the narrative reveals about the future earnings picture. Result: Fair Value of $43 (UNDERVALUED) Have a read of the narrative in full and understand what's behind the forecasts. However, persistent reliance on government support and volatile commodity pricing could quickly undermine Ramaco’s ambitious diversification and growth narrative. Find out about the key risks to this Ramaco Resources narrative. Another View: What Do the Multiples Say?While the narrative and analyst targets suggest upside, valuation by the price-to-sales ratio takes a different approach. Ramaco’s current ratio of 3.2x looks steep not only against its industry average (2.8x), but especially versus the peer average of just 1.2x. The fair ratio, which the market could revert to over time, is 1.1x. This premium suggests that the market is pricing in a lot of future success, leaving limited margin for error. See what the numbers say about this price — find out in our valuation breakdown.

|

|