Average Annual Prices For Coking Coal in 2025 Fell by 21-27%

December 31, 2025 - Average annual prices for coking coal in 2025 fell significantly compared to the previous year, indicating weak market conditions and weakening consumer demand, which put pressure on suppliers.

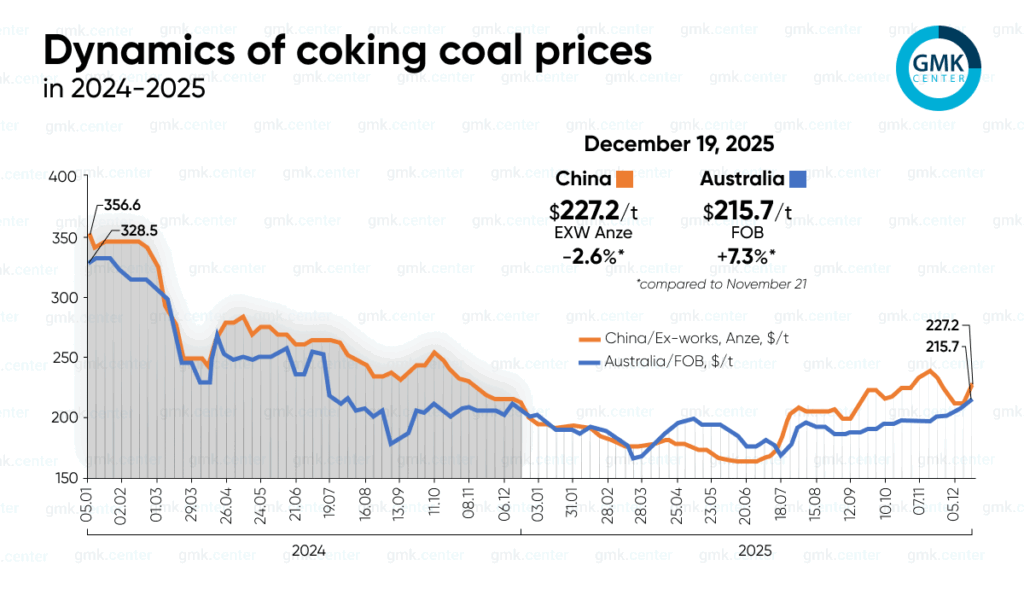

In Australia, coking coal (Australia, FOB) was valued at $215.73/t in mid-December this year, up 5.6% compared to December 2024 and 7.3% compared to the previous month. At the end of the year, the market is recovering, as the current price level is the highest since July 2024. At the same time, the average annual figure for this year was $189.7/t compared to $241.4/t a year ago (-21.4% y/y), reflecting the market’s low levels for most of the period.

Throughout 2025, the Australian coking coal market was under pressure from weak global demand for steel, subdued activity from China, and India’s gradual diversification of import flows. Prices remained low for most of the year, reflecting low margins for steelmakers and the absence of sustainable growth drivers. At the same time, restrictions on domestic production in China and periodic supply disruptions prevented the market from undergoing a deeper correction.

In November 2025, the market remained sluggish due to the off-season, weak trading activity, and deteriorating sentiment in China amid falling futures. However, by the end of the month, the situation began to change: improved macroeconomic signals from China and growing interest from India provided support for prices. In December, the key factor was a supply shortage linked to the rainy season in Australia, as well as increased activity among Indian steelmakers ahead of the end of the financial year. At the same time, the potential for further growth was held back by weak profitability at steel mills and limited end demand in China.

In 2026, limited supply and Indian demand are expected to support the market, while China’s economic slowdown, increased competition among suppliers, and the long-term transition to less carbon-intensive technologies will remain key risks.

In the Chinese market (China, Ex-works Anze), average annual prices for coking coal fell more sharply, by 26.9% y/y, to $194.5/t compared to $266/t in 2024. At the same time, at the end of the year, the market also entered a recovery phase – as of December 19, offers stood at $227.2/t, up 7% compared to December last year, but down 2.6% compared to the previous month.

In China, coking coal prices have been under significant pressure this year due to weak steel production profitability, unstable demand for metal products, and the active use of administrative regulatory tools by the state. Fluctuations in DCE futures, periodic recovery in domestic production, and growth in imports, particularly from Mongolia, have led to high volatility and a sharp decline in average annual prices.

In November, the market showed mixed dynamics. On the one hand, a series of price increases for coke and active purchases amid expectations of a reduction in supply supported quotations, while on the other hand, falling futures, growing stocks at mines, and signals of increased energy security during the heating season sharply worsened sentiment. At the end of November and beginning of December, the correction intensified due to a decline in pig iron output, weak metallurgical profits, and expectations of new rounds of coke price reductions. At the same time, local mine shutdowns in Shanxi and environmental restrictions limited the decline, and in mid-December, the market received a boost from a sharp rebound in futures and fears of a shortage of high-quality coal.

In 2026, the Chinese market is likely to remain volatile. A potential recovery in domestic production and imports will hold back growth, while stricter environmental requirements, safety regulations, and the need to replenish stocks will create periodic price impulses.